American Workers Have A New Set Of Financial Goals. How Can Employers Respond?

Every household in America has been affected by the Covid pandemic in one way or another. Health and well-being aside, many lost their primary source of income, spent their life savings, or even lost their home. According to the Census Bureau, the initial economic impact of Covid was more widespread than mortality. More Americans lost their jobs due to Covid than during the great depression.

Now with the country adjusting to a new normal and pushing forward after a year and a half, many Americans are finding their footing again when it comes to employment and they aren’t settling. With so many signing bonuses, competitive salary packages and innovative new benefits in the marketplace, employers are having a hard time attracting and retaining top talent.

American workers have a whole new set of financial goals in 2021, and these goals could provide some insight to employers who are looking for ways to stand out, attract new talent, and hold on to their valued employees. The latest FinFit assessment survey of more than 85,000 employed Americans gives an updated look at the financial well-being of the average worker, and what their financial goals are for the year ahead.

Financial health status of the American worker

The financial assessment data calculates and defines how financially stable the average American worker is. Are they healthy, coping, or vulnerable when it comes to their financial position? Only a quarter (26.5%) of respondents fell into the healthy category while 6 in 10 (61.1%) said they were coping and 12.3% of respondents classified as vulnerable. So what exactly do these classifications mean?

Those who identify as financially healthy convey that they could make ends meet for over six months if they lost their primary source of income, while those identifying as vulnerable say they would last between one week and one month. Those who are coping land somewhere in the middle with enough funds to last between three and six months without employment.

With over three quarters of respondents reporting that they fall into either the coping or vulnerable category, this is an overall indication that the average working American is not currently in a healthy financial situation.

Looking to the future

Now that many workers are establishing and normalizing their new work-life routines – and spending habits - some of them have stabilized their budgets and will have the opportunity to start saving money again. So, what are Americans saving for over the next 12 months?

The most common answer shows that workers are looking forward to their hard-earned paid time off. The number one goal for the next year is to take a vacation (38.1%). Participants wanting to file their own taxes (33.3%) came in second, and setting up an emergency fund (31.5%) was third. Those who identified themselves as financially healthy ranked saving for a vacation the highest, while those who are in the vulnerable category are looking to pay off their credit card debt before spending money on a trip.

Low on the list of priorities are buying an engagement ring, paying for a wedding, and saving for retirement. Why are Americans not focused on these historically popular savings goals? The answer may vary depending on generation.

Demographic differences

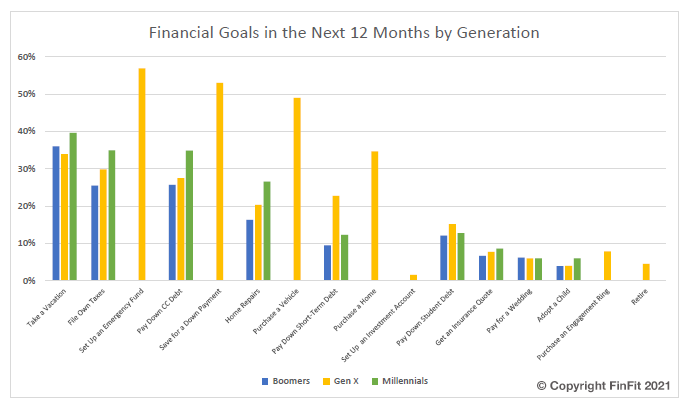

Financial priorities vary greatly by age group. According to our assessment data, Boomers are the most financially healthy group, followed by Gen X, with Millennials in last place. Members of all three generations stated that saving for major life events and retirement are low on the list of priorities.

As Millennials are the least financially healthy age group, they are tending to delay major life events, such as marriage and buying a home, whereas Baby Boomers and Gen X are more likely to already own a home or be married, meaning those types of expenses are off of their radars.

Out of the participating age demographics, Millennials are prioritizing vacations and filing their own taxes the highest, while over half of Gen X plans to build up their emergency savings fund. Much like Millennials, Boomers also want to take a vacation, but unlike Gen X, they’d rather pay off their credit card debt than save for an emergency.

Takeaways for employers

Nearly three quarters of those surveyed (73%) are in a coping or vulnerable financial situation, with Gen X and Millennials encompassing a majority of that group. As employers begin to re-evaluate their benefits offerings heading into the new year, ensuring employees feel financially supported could go a long way in retaining and attracting talent. Based on our findings, the following programs should be primary considerations: savings initiatives, 401(k) matching and savings account contributions, funding HSA accounts, making IRA contributions, programs and workshops to allow employees to enhance their financial literacy, and access to financial wellness resources and services.

With 55% of workers planning to leave their current role within the next year, employees need to feel that they are being supported and that their financial well-being is a priority to their employer. It could be the difference that keeps valued employees from testing whether or not the grass is greener on the other side.

A year and a half of living through a global pandemic has affected every American in multiple ways, forcing them to re-evaluate their current situations. Financially, households are making forward-thinking plans and temporarily holding off on purchasing luxury products and major life events. If all generations can agree on anything after the pandemic, it’s that they’re burnt out and need a break.

(Dave Kilby is the CEO of FinFit)

© Copyright IBTimes 2024. All rights reserved.