Analysis-European Firms Strike High-stakes Bond Deals As Interest Rates Rise

European firms are selling debt that can be converted into their own shares at an unrelenting pace, as they seek shelter from the fastest escalation in interest rates by major central banks since the 1980s.

After borrowing heavily during years of rock-bottom interest rates, businesses are feeling the pinch of rising debt costs and some are turning to convertible bonds - a form of junior debt that can be converted into a company's equity.

Convertibles can offer corporations cheaper funding but risk diluting earnings and tilting the balance of power among shareholders if investors invoke their conversion rights.

These "bonds with a twist", as fund manager Schroders once put it, have historically been associated with companies that may lack other sources of funding and were perceived by some as an "admission of weakness".

But in the current environment, this kind of cheaper financing is increasingly popular among traditional bond issuers too.

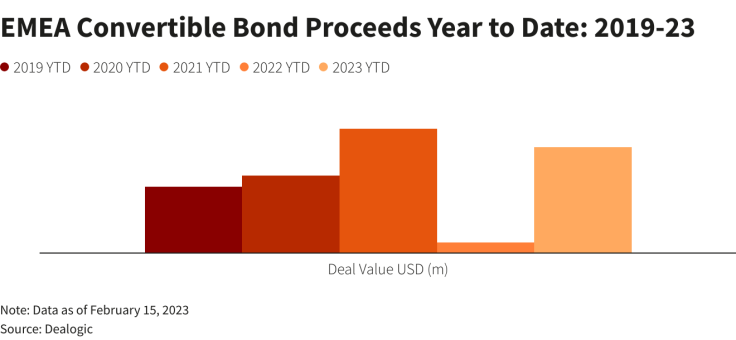

Since January, companies in Europe, the Middle East and Africa (EMEA) have raised $2.9 billion through seven convertible deals, significantly above this time last year and higher than levels seen before the COVID-19 pandemic, according to Dealogic data.

The region is also slightly ahead of the United States in terms of capital raised via convertible bonds, something that market participants describe as rare, illustrating the strong appetite from companies on this side of the Atlantic.

"Issuance in Europe was extremely low last year. But a lot of issuers are now looking at convertible bonds to reduce their financing costs, as they face upcoming debt maturities," said Stephanie Zwick, Head of Convertible Bonds at Fisch Asset Management, which oversees more than 4 billion Swiss francs ($4.34 billion) in convertible debt.

Graphic: EMEA Convertible Bond Proceeds Year to Date: 2019-23

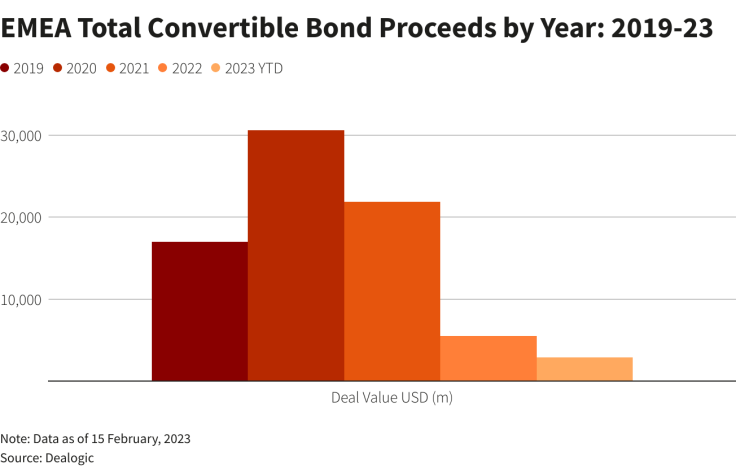

Corporate debt issuance dried up in the market turmoil following Russia's invasion of Ukraine, but momentum for equity-linked deals - as the asset class is also known - started to pick up in the latter part of 2022 and has carried into the new year.

Repeat issuers like Germany-based food delivery group Delivery Hero have come to market to refinance maturing deals, but there are also new names, like French industrials company Spie.

While tighter central bank policy has forced companies to bump up interest payments on new convertibles, the average coupon is still about half that paid in the junk, or sub-investment grade, bond market, according to market participants.

The asset class has also caught the eye of higher-rated issuers, said Ismail Iraqi, Head of Equity-Linked in EMEA at JPMorgan.

"Both investment grade and high yield issuers are currently looking at convertible bonds to fund growth, diversify their funding or refinance outstanding debt at lower cash coupons than traditional debt," Iraqi said. This includes financing for mergers and acquisitions, he added.

In January, German arms manufacturer Rheinmetall, which sits at the bottom of Moody's investment grade rating scale, raised 1 billion euros ($1.07 billion) through two convertible bonds to fund its acquisition of Expal Systems.

The bonds were sold with a coupon of 1.88% and 2.25%, respectively, and a conversion premium of 45%, representing the extra cost over the company's share price that investors paid for their conversion privileges.

Last year's equity market slump meant many convertible bonds lost value by wiping out the possibility of converting them profitably into shares, but the recent rebound in stocks could further incentivise debt issuers and investors to return.

"For us, it's interesting to look at new deals with more balanced terms, and we've invested in some of the latest issues," Fisch's Zwick said.

Graphic: EMEA Total Convertible Bond Proceeds by Year: 2019-23

This week, Delivery Hero placed a 1 billion euro deal to replace existing convertible notes nearing maturity, which were effectively trading like regular debt securities after a drop in the company's share price depleted their equity value.

However, the company, which is not yet profitable, offered investors an annual coupon of 3.25%, higher than on past issues.

Despite the prevalence of industrial names coming to market in recent weeks, more deals may come from the tech and healthcare sectors, which are recurrent issuers of convertible debt, said Sriram Reddy, Managing Director of Credit at Man GLG, part of investment manager Man Group.

"The zero-rate environment of the past decade induced businesses to issue straight debt almost at will," Reddy said. "Now that we have a material cost of capital again, we expect new convertible issuance to become a more popular option."

($1 = 0.9214 Swiss francs)

($1 = 0.9338 euros)

© Copyright Thomson Reuters {{Year}}. All rights reserved.