Analysis: Hot Inflation Builds Case For 'Big-bang' Fed Rate Hike In March

The unexpectedly large surge in U.S. consumer prices last month has bolstered the view that the Federal Reserve is late to the fight against the strongest inflation since the early 1980s and needs to take quick action to begin to make up the lost ground.

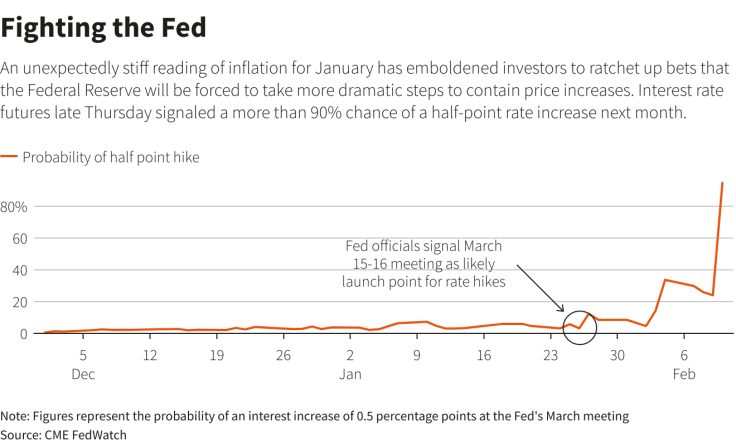

With investors sharply upping their bets that the U.S. central bank will have to start with a "big bang" 50-basis-point interest rate hike at its March 15-16 meeting, debate within the Fed is sure to intensify in the coming weeks as market pressure builds despite officials' public resistance to such a large liftoff in borrowing costs.

"I don't think there's any compelling case to start with a 50-basis-point" rate increase, Cleveland Fed President Loretta Mester said on Wednesday.

Fast forward a day, and investors feel the latest U.S. inflation reading tips that on its head - household prices were up 7.5% in the 12 months through January - with market participants seeing significantly better-than-even odds of just such a large rate hike next month, up from a one-in-four probability when Mester spoke.

Fed policymakers have already flagged they will begin raising the central bank's benchmark overnight interest rate from near zero at the March meeting, just days after it stops its two-year spree of buying billions in government bonds each month to keep financial conditions loose and spur borrowing amid the COVID-19 pandemic.

By many measures they are already late to the party, with inflation at its highest level in 40 years and a super-tight labor market at odds with a Fed only just getting ready to remove crisis-era policy support.

"All this logically supports a 50-basis-point move in March," says Karim Basta, chief economist at III Capital Management. "Whether the Fed ditches its gradualist approach remains the most relevant question."

To Mark Cabana, head of U.S. interest rates strategy at Bank of America Global Research, the case only gets stronger as market bets on a bigger rate hike in March continue to build.

"The logic for them to go is compelling," he said, noting that doing so would get Fed policy faster to where it needs to be in the face of inflation while keeping borrowing costs still far below the level where they would put the brakes on economic growth.

"Are you going to tell the market that it's wrong and you need to go slower?" Cabana said. "If the market gives the Fed the option, we do not believe that the Fed will tell the market that it's wrong."

His view contrasts with that of many economists, including those at his own bank, who say the U.S. central bank is now stuck on quarter-percentage-point increments for future rate increases.

Instead of going bigger to start, they say, the Fed will just speed up the pace of rate hikes quicker than the one-per-quarter pace it has stuck to in recent memory or begin to reduce its balance sheet sooner than expected. With one more big inflation reading and more jobs data due before the March meeting, the jury is out on whether that trend will hold should the numbers continue to come in hotter than expected.

GRAPHIC: Fighting the Fed,

BOXED IN?

The Fed is leery of spooking financial markets, which have required diligent handholding in recent years to avoid a knee-jerk tightening of financial conditions and repeats of episodes like the 2013 "taper tantrum," which was widely seen as a communications misstep.

A half-percentage-point hike in March wouldn't itself hurt the economy, economists say, but the signal it sends about the future path of policy could if traders expect similar-sized increases in rates at future meetings.

"The market goes from pricing five (quarter-percentage-point rate hikes) to pricing eight, 10 and then you are potentially causing some real sharpening in financial conditions," said Aneta Markowska, chief financial economist at Jefferies.

"They are way behind the curve, and I think they have a lot of catching up to do," Markowska added, "but I think it makes sense to move, not slowly, but not too aggressively."

Keeping rate hikes to 25-basis-point increments allows the Fed to better tailor policy to the data if inflation soon cools on its own, as Atlanta Fed President Raphael Bostic said this week he thinks is likely.

In fact, Fed officials are betting much of the inflation spike will ebb on its own in the second half of this year as supply chains get untangled and an easing COVID-19 pandemic allows more people to return to work, making the need for a bigger rate hike less important.

And already, the relative tightening in financial conditions that has occurred in just a few months means there is less catch-up for the Fed to do, despite the apparent disconnect between keeping its policy rate near zero and inflation running at more than twice its 2% target.

One way to quantify that tightening is the Wu-Xia "shadow" rate, which uses bond yields and other market clues to show how loose monetary policy really is when the actual policy rate is stuck near zero.

After the pandemic-triggered recession, the Fed's monthly purchases of $120 billion in Treasuries and mortgage-backed securities pushed that rate as low as negative 2%. Since November, when Fed Chair Jerome Powell began signaling a quicker end to the bond-buying program and an earlier start to rate hikes, the rate has risen by about 1.65 percentage points.

That has policymakers like St. Louis Fed President James Bullard arguing that there's not much need for the Fed to go big now, at least for starters.

Narayana Kocherlakota, an economics professor at the University of Rochester who was known for his dovish views after the 2007-2009 recession when he was the Minneapolis Fed's president, sees it differently, and even expects dissents, including perhaps from Fed Governor Christopher Waller, should the central bank not go harder in March.

"I think going 50 now also puts it on the table in every meeting going forward ... so it expands optionality in a big and useful way," he said. Much-higher-than-expected inflation, he said, "deserves an aggressive response."

© Copyright Thomson Reuters 2024. All rights reserved.