Analysis-Spirit Airlines Winning Bidder May Need Years To Recoup Price Tag

The bidding war for Spirit Airlines Inc between Frontier Group Holdings Inc and JetBlue Airways Corp may leave the acquirer taking years to earn back their investment.

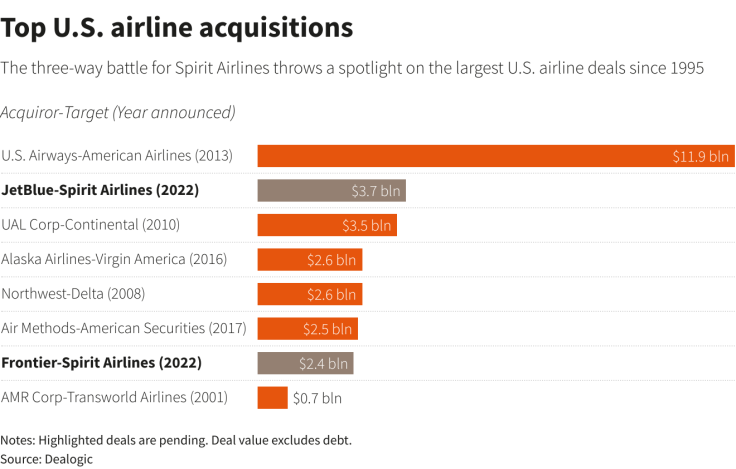

JetBlue's latest cash-and-stock bid values Spirit at $3.7 billion, while Frontier's latest cash-and-stock bid, which Spirit recommends its shareholders should back, is worth $2.4 billion. Spirit has delayed its shareholder vote on the deal for a third time to July 15 to negotiate further with both suitors.

JetBlue and Frontier may have to wait anywhere from three to five years or even longer to recoup their investment if they are successful, according to a dozen investment bankers and analysts interviewed by Reuters.

Frontier expects the combined company to deliver annual synergies of roughly $500 million, most of which will start kicking in roughly three or four years after the deal is completed. JetBlue says a tie-up with Spirit will deliver synergies of $600 million to $700 million the first year after integration is complete.

Airline experts said the long-term synergies cited by both JetBlue and Frontier make it worth the price the companies are willing to pay for Spirit, although some analysts cautioned that the bidding war might strain their finances in the near term.

"We are probably heading into a recession. This is not the right time to borrow a lot of money to buy a competitor," said Israel Shaked, professor emeritus of finance at Boston University.

Spirit, JetBlue and Frontier declined to comment.

Graphic: Top U.S. airline acquisitions Top U.S. airline acquisitions-

EXPENSIVE BET

The bidding war began in February this year, when Frontier offered to buy Spirit. Two months later, JetBlue swooped in with an all-cash, unsolicited bid worth $3.6 billion for Spirit that was higher than the price Frontier had offered.

Since then, both sides have engaged in a game of one-upmanship and made competing offers for Spirit that have included sweeteners such as higher break-up fees and route divestitures, which were aimed at easing regulatory concerns.

Frontier, which has so far been unable to garner enough shareholder support for its proposal, earlier on Monday urged Spirit to extend the shareholder voting deadline to July 27, saying its last proposal was its "best and final offer" and that it was waiving its right to match JetBlue's most recent offer.

The airline industry is grappling with high fuel prices, pilot shortages and flight cancellations as it tackles a rebound in travel demand more than two years after the onset of the COVID-19 pandemic. A tie-up with Spirit would give the winning suitor more scale and resources to deal with these challenges.

Raymond James & Associates airlines analyst Savanthi Syth said the deal made sense long-term even though it was expensive.

"This is a more expensive deal, at 17 times price-to-earnings, than the deal for Virgin America at 15.5 times," Syth said, referring to the bidding war in 2016 between Alaska Air Group Inc and JetBlue that ended with Alaska buying Virgin America in a $2.6 billion deal.

Alaska made its deal work. Since taking over Virgin America, it has won market share against low-cost competitors and paid down debt it raised to finance the acquisition, analysts said.

JetBlue is making the same gamble. It will be assuming $3.5 billion of new debt to finance its bid for Spirit. Analysts and management experts pointed out that in the event of a global recession, a highly levered balance sheet could weigh heavily on JetBlue's financial performance, diminishing its earnings power.

"Recessions are always very tricky environments for airlines," said Florian Ederer, associate professor of economics at the Yale School of Management. "We went through a whole range of bankruptcies in previous recessions for airlines."

Frontier will not be stretching itself as much. It had $727 million in cash and long-term debt of roughly $207 million as of March 31.

It is possible the bidding war reaches price levels that would cause one suitor to bow out, said Helane Becker, managing director and senior research analyst at Cowen.

"At some point, one or the other (Frontier or JetBlue) will drop out because Spirit might become overvalued. We don't believe it is there yet, but we'll have to see what happens," Becker said.

Frontier has an advantage in that its bid is seen by Spirit as more likely to be cleared by antitrust regulators than a tie-up with JetBlue. JetBlue's current Northeast Alliance with American Airlines is already in the crosshairs of the regulators - in June, a U.S. judge said the Justice Department's antitrust lawsuit against American Airlines Group Inc and JetBlue would move forward.

Spirit has, so far, said that a deal is not possible unless JetBlue drops that partnership.

© Copyright Thomson Reuters 2024. All rights reserved.