Analysis-With War Risk, Unclear How Much U.S. Real-yield Collapse Will Benefit Stocks

Real yields in the U.S. Treasury market have gone even more negative as inflation surged, which is typically viewed as a positive factor for stocks, but Russia's invasion of Ukraine has placed more emphasis on shedding risk than on the possibility of getting higher returns on Wall Street.

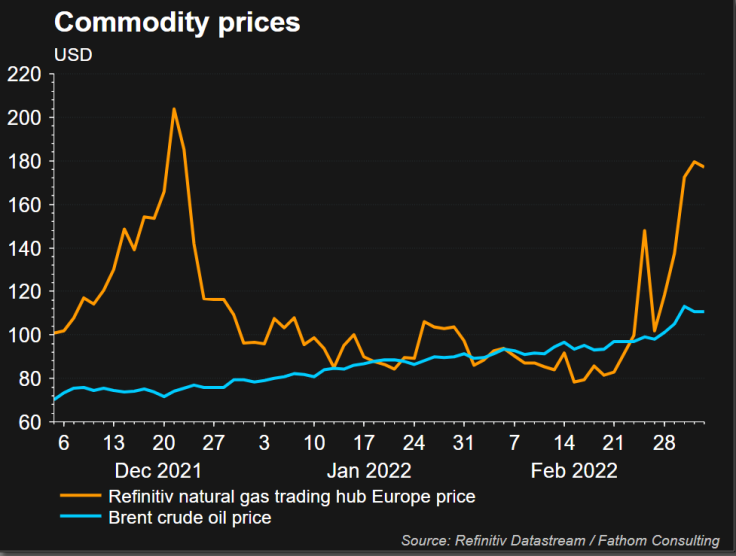

The decline in benchmark U.S. real yields, which have been mainly below zero since 2019, suggested that investors are piling into TIPS because of concerns about high inflation. Indeed, the war has propelled global benchmark Brent crude futures to a roughly 14-year high of just under $140 per barrel.

U.S. stocks, even with a strong earnings outlook and backed by a robust economy, may not be the best asset to hold during this geopolitical crisis, analysts said, though there was some divide in views.

"If all else equal and you sat there and saw that one of the largest countries in the world is attacking a country one-third its size and it has aspirations to reconstitute the old Russian empire, is that really a good backdrop for stocks?" said David Petrosinelli, managing director and senior trader at broker-dealer InspereX in New York.

Russian President Vladimir Putin, brushing aside worldwide condemnation of the invasion, which Russia calls a "special operation" vowed to press ahead with his offensive, which he said was going to plan, unless Kyiv surrendered.

Since Russia launched the invasion on Feb. 24, the yield on U.S. 10-year Treasury Inflation Protected Securities (TIPS), also called the real yield because it strips out inflation, has fallen about 45 basis points.

The 10-year TIPS yield has collapsed by roughly 64 basis points, since the release on Feb. 10 of U.S. consumer price data showing the annual U.S. inflation for January hitting a 40-year high. On Monday, the 10-year real yield dropped to a two-month low of -1.027%.

Graphic: U.S. TIPS and stocks,

Real yields are an important input to broader financial conditions, and when they are low, that typically underpins U.S. equities.

"Equities like many financial assets are evaluated on the present value of their expected future cash flows," said Tim Wessler, macro strategist, at Deutsche Bank in New York.

"When real yields are falling, that means the expected value of a stock's future cash flow is going to be higher. If you look at the sector breakdown of equities, if you look at the S&P 500 and compare its returns to big tech stocks or FANG stocks, they outperform the S&P on days when real yields fall," he added, referring to the growth-stock grouping of Facebook, now known as Meta, Amazon, Netflix and Google-parent Alphabet.

After a sharp fall to start the year accelerated with Russia-Ukraine tensions, the benchmark S&P 500 has bounced back about 4% from its Feb 24 intraday low. But Wall Street's fear index, the VIX, has climbed and the market sold off late last week and opened down on Monday.

The S&P 500 technology index did slip slightly last week, mainly due to selling on Thursday and Friday. Since its intra-day trough on Feb. 24, that index has actually gained 4.2%.

Analysts said aside from the tumble in real yields, U.S. stocks have benefited from the view that the latest geopolitical turmoil means the Federal Reserve would take a gradual approach to tightening monetary policy, starting next week.

Fed Chair Jerome Powell said last week he would back an initial quarter percentage-point increase in the Fed's benchmark rate at the March 15-16 meeting, but held out the prospect of hiking more aggressively this year if inflation does not ease.

"This uncertainty is going to cause the Fed to move more slowly, to tighten more slowly and as a result fall behind the curve on inflation, which is positive for risk assets and a support for them," said Ryan Swift, bond strategist, at BCA Research in Montreal.

InspereX's Petrosinelli thinks though that the risk in equities is in the medium to long term.

"The expectations component is really the wild card here," Petrosinelli said. "We could be sitting at oil of $150 per barrel very, very easily here in the coming days and I'm not saying it's going to happen. But that can't be good for stocks." Graphic: Commodity prices,

© Copyright Thomson Reuters 2024. All rights reserved.