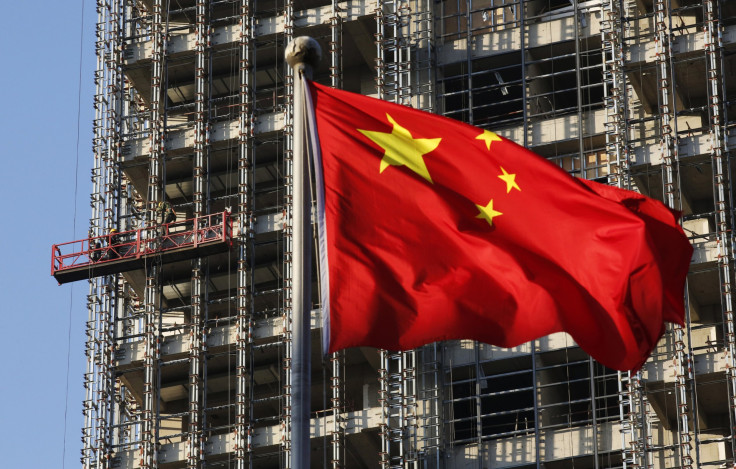

Analysts Expect Short-Term Boost To China's Slumping Real Estate As Central Bank Eases Loan Requirements

Stock markets rose Tuesday morning to hit fresh seven-year highs following Monday’s announcement by China’s central bank that it was reducing the minimum down payment on loans for second homes to 40 percent from 60 percent, and cutting the minimum down payment for first-home buyers using public housing funds to 20 percent from 30 percent.

The move is being seen as part of efforts to stimulate China’s sagging property market, which last month saw a record drop in prices, following six months of falling prices. China’s finance ministry also announced Monday that it was removing a 5.6 percent sales tax on homes that had been owned for more than two years; the move reversed a policy introduced in 2011 to cool an overheating market, which imposed tax on all property sales within five years of the purchase date.

News of the plans, apparently leaked to the market before the central bank announcement meeting, sent China’s already rebounding stock market to its highest close in seven years on Monday. The Shanghai Composite Index finished at 3786.57, while real estate stocks saw their biggest rise in six years, with many companies’ shares rising by their daily limit of 10 percent. On Tuesday, shares rose in early trading, with the Shanghai Stock Exchange breaking through the 3,800 mark, before falling back and losing about 1 percent on Tuesday afternoon while the CSI 300 index rose 1.9 percent early before losing ground and falling 0.9 percent.

China’s big commercial banks said they would seek to respond soon to the announcement. Some smaller banks have already cut their minimum loan requirements and interest rates too: A Shanghai website reported that Zhejiang Commercial Bank announced during the night that it would lower its deposit requirement to 40 percent, in line with the central bank’s announcement, and would also give a 30 percent discount on interest rates. Other banks reportedly said they would follow suit.

The paper.cn also reported that at least one real estate developer said it would raise prices by around 3 percent on anticipation of growing demand, following the announcement. Some individual vendors are also reported to have raised prices by a similar amount, while others have decided to delay sales to see how the market develops. Some buyers reportedly rushed to real estate agents’ offices to make down payments on Monday night, fearing price rises, though one agent told the website that major price hikes by big developers were unlikely.

The policy moves follow several steps to boost the real estate market -- which provides some 15 percent of China’s GDP, not including related infrastructure - over the past half year. In late September Chinese banks relaxed rules on loans for people purchasing their first home.

Analysts say the government is caught between a fear of the property market overheating -- amid public concern about house prices, which remain far higher compared to average income than in many countries -- and fear of a crash, which could hit both real estate developers and the hundreds of millions of citizens who have already bought homes.

Many Chinese developers have been struggling to sell their inventory over the past year. The pressure on real estate companies was highlighted on Monday when Kaisa Group, a troubled property developer from the southern city of Shenzhen, which has already defaulted on loans, announced it would miss the deadline for filing its 2014 earnings, according to the South China Morning Post. Vanke, China’ s largest listed developer, meanwhile, reported a slowdown in profit growth in 2014, to 4.2 percent, on total sales of 15.75 billion yuan (about $2.53 billion], the paper said.

Concern about deflation, which Chinese leaders have warned about in recent days, and falling commodity prices, may also have inspired the policy relaxation, analysts say. But, speaking on Chinese state radio, Gao Sheng, an analyst at Guantong Futures in Beijing, said that while the moves might provide a short-term boost to demand, particularly for larger homes, some banks might still be unenthusiastic about offering loans to home buyers, as they can charge higher interest rates for other types of loans.

And Li-gang Liu, chief economist for Greater China at ANZ Bank, told the South China Morning Post that a further easing of monetary policy, including further cuts in lending rates, would be needed to prevent slowing GDP growth.

© Copyright IBTimes 2024. All rights reserved.