Apple Card: Everything To Know About The iPhone Credit Card

Apple Inc. on Monday launched “Apple Card,” a credit card designed for the iPhone, to be used with the Apple Pay contactless payment system. The launch of Apple Card also represents a significant move by Apple to protect user privacy in ways not seen before.

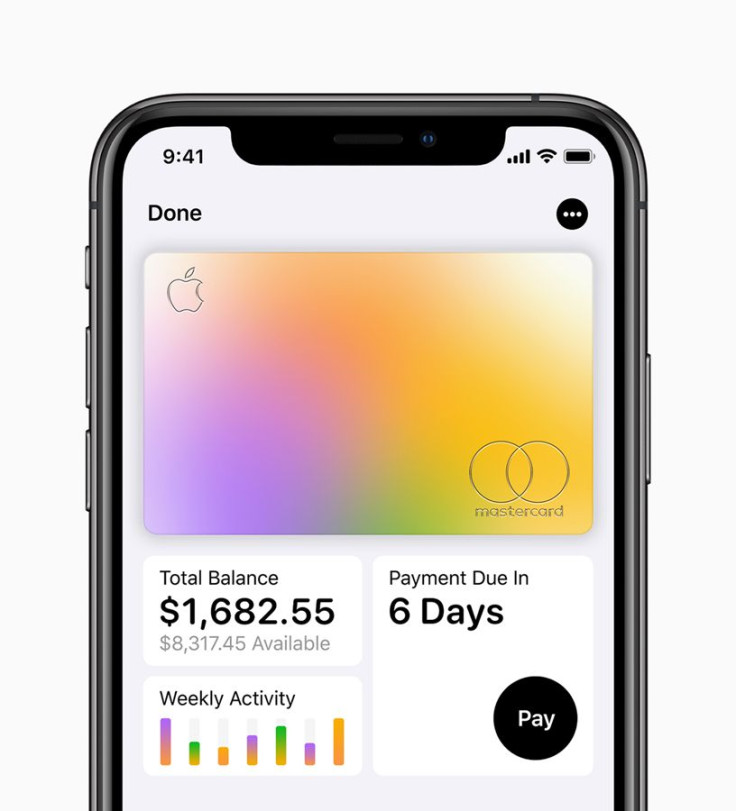

Apple Card is built into the Apple Wallet app on the iPhone. Apple said its new card offers customers a familiar experience with Apple Pay, and the ability to manage their card on their iPhones.

Apple Card transforms the entire credit card experience by simplifying the application process, eliminating fees and encouraging customers to pay less interest. The card also provides a new level of privacy and security.

Apple also claims Apple Card doesn’t store any user transaction information.

"We created a unique architecture for Apple Card where Apple doesn't know what you bought, where you bought it or how much you paid for it," said Jennifer Bailey, Vice-Presidentfor Apple Pay.

She said Apple Card partner Goldman Sachs will neither share nor sell user data to third parties for marketing or advertising. In addition, the Apple credit card gives customers easy-to-understand, real-time views of their latest transactions and balance right in Wallet.

Apple has partnered with Goldman Sachs and Mastercard to provide the support of an issuing bank and global payments network.

In terms of security, Apple Card's unique card number will be stored in the iPhone's Secure Element security chip. Purchases will be authenticated through Touch ID or Face ID.

Apple card offers a rewards program with Daily Cash, which gives back a percentage of every purchase as cash on customers’ Apple Cash card each day. Daily Cash is added to customers’ Apple Cash card each day, said Apple.

It can be used right away for purchases using Apple Pay. Users can view their Apple Card balance or send to friends and family in Messages. Apple Card support is available 24/7 by sending a text from Messages.

There are no fees associated with Apple Card. There are also no annual, late, international or over-the-limit fees. Apple says its card’s goal is to provide interest rates that are among the lowest in the industry and if a customer misses a payment, they will not be charged a penalty rate.

Apple Card is both a digital service stored in Apple Wallet and an actual physical card for use where Apple Pay isn't accepted. Apple designed a titanium Apple Card for shopping at locations where Apple Pay isn’t yet accepted.

The physical Apple Cards has no visible card number, CVV security code, expiration date, or signature. This information is available on Wallet, however.

Apple Card will be available this summer. Customers can sign up for Apple Card in the Wallet app on their iPhones in minutes. They can begin using Apple Card with Apple Pay right away.

Bailey said Apple Card will give people more insights into their finances. For example, a user will know how much she’s spent in a certain category, or when the next bill is due.

© Copyright IBTimes 2024. All rights reserved.