Apple Earnings Highlight Strength Beyond iPhone

After reporting preliminary data on some key fiscal first-quarter financial metrics earlier this month, investors knew Apple's (NASDAQ:AAPL) iPhone segment was up against some headwinds and would drag on the tech giant's overall revenue for the period. CEO Tim Cook said Apple's revenue for its fiscal first quarter would come in at about $84 billion -- a whopping $7 billion below management's previous guidance for the metric.

"Lower than anticipated iPhone revenue, primarily in Greater China, accounts for all of our revenue shortfall to our guidance and for much more than our entire year-over-year revenue decline," Cook explained in a Jan. 2 letter to shareholders.

But now Apple's just-posted earnings release for its first quarter gives investors more insight into the company's results, including a closer look at the iPhone segment, earnings per share for the period, guidance, and more.

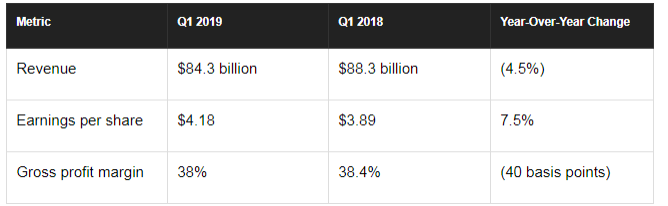

Apple first-quarter earnings: The raw numbers

Apple's revenue for its fiscal first quarter -- $84.3 billion -- came in slightly higher than the preliminary figure Cook provided on Jan. 2. But it highlights the company's contracting revenue as a result of a decline in iPhone sales. Overall revenue for the period was down 4.5% from the record revenue it posted in the year-ago period.

Earnings per share, however, came in at a record high of $4.18 -- up 7.5% from $3.89 in the year-ago quarter. The rise in earnings per share despite a decline in revenue is attributable to the company's aggressive share repurchase program, which has helped reduce its share count from 5.2 billion shares in the year-ago quarter to 4.8 billion in the recently ended fiscal first quarter.

Segment results

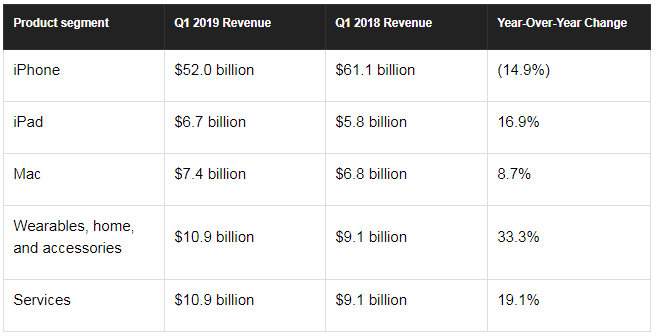

"While it was disappointing to miss our revenue guidance, we manage Apple for the long term, and this quarter's results demonstrate that the underlying strength of our business runs deep and wide," Cook said in the fiscal first-quarter update -- and the CEO wasn't kidding. While iPhone revenue fell 15% year over year, all of the other segments saw their combined revenue rise 19% year over year. More importantly, Apple revealed the gross profit margin of its second-largest segment -- services -- for the first time. At 63%, the metric didn't disappoint. With services revenue growing rapidly, the segment's lucrative gross profit margin bodes well for the growth potential of Apple's earnings per share over the long haul.

Looking ahead, Apple said it expects its fiscal second-quarter revenue to come in between $55 billion and $59 billion, down from $61.1 billion in the year-ago quarter. This forecast likely reflects further expected declines in iPhone revenue as this year's iPhone product cycle has a tough time living up to year-ago sales.

This article originally appeared in the Motley Fool.

Daniel Sparks owns shares of Apple. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.