Is Apple Really Worth $1 Trillion? Carl Icahn Thinks So, Some Have Their Doubts

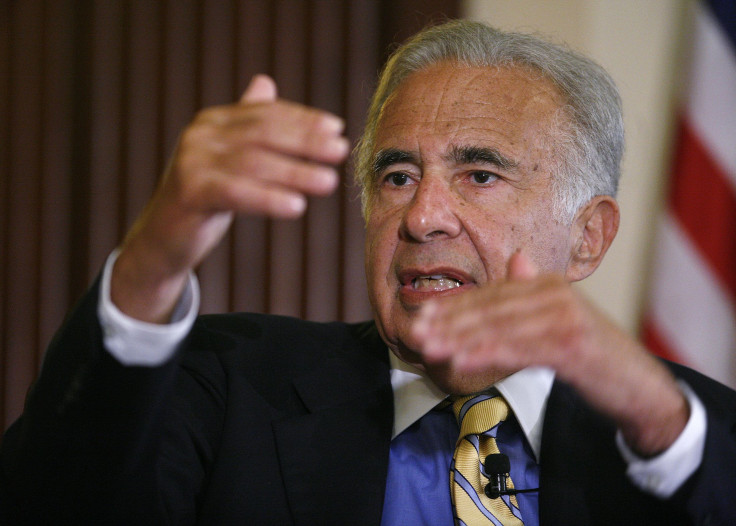

Apple became the first American company to surpass $700 billion in market capitalization earlier this week. But apparently that wasn’t enough. The next day, famed activist investor Carl Icahn issued a letter to his Twitter followers arguing the iPhone maker should actually be trading $90 higher than it is, at a price that would value Apple at more than $1.2 trillion. For that reason, he wrote, Apple should give investors their due by repurchasing more of its own shares.

Icahn’s bullish letter is characteristically blunt. On paper, the numbers support an Apple worth more than its current $126 share price. But is Icahn’s headline-ready pronouncement reasonable in reality?

“I think his gross expectation is too high,” says Andy Hargreaves, a senior research analyst at Pacific Crest Securities. “The practical reality is that to trade at a trillion dollars you have to find another $300 billion. That’s a lot of money.”

Icahn doesn’t waste too much ink on iPhone sales or future product lines. He focuses instead on pure numbers. Predictions of Apple’s 2015 earnings per share fall far short, Icahn argues, partly due to the way analysts compute Apple’s effective tax rate. What’s more, Apple is trading at a discount given its price-to-earnings ratio relative to that of the market. Few disagree with this point, but Icahn feels Apple should be trading significantly higher than others project, given its earnings.

But these arguments may not account for real-world sales projections. “Icahn’s expectation for continued iPhone growth is aggressive,” Hargreaves says. “Especially to get to the targets he’s looking for.”

Analysts like Morningstar’s Brian Colello have expressed tempered outlooks for Apple’s unproven new products, such as credit card alternative Apple Pay and the forthcoming Apple Watch. Moreover, as Colello pointed out in October, investors may run the risk of double-counting sales: customers who otherwise might have bought a new iPad could opt for the large-screen iPhone 6.

Given these doubts, it's unclear whether Apple's future sales could warrant another half-trillion in its market capitalization. "That's a lot of money," Hargreaves says.

Of course, Icahn isn’t simply wishing the price up – the former corporate raider has long pushed Apple to boost its share price through stock buybacks. Apple already has lavished more than $100 billion on shareholders through a reward program initiated in 2012, including $73 billion in buybacks. Last April, the company announced it was expanding its buyback program by 50 percent. But Icahn thinks Apple could go further.

Companies flush with cash often repurchase shares of their own stock in an effort to boost demand, and thus share price. Short-term gains often result, potentially due to reduced supply. But as Jeffrey Snider of Alhambra Investment Partners argues, “We don’t know exactly what causes the outperformance.” Part of the gain, he says, might lie in a simple fact: “Investors seem to have a preference for companies with repurchase programs.” Apple is no outlier here.

Snider says few in the investment field are willing to criticize buybacks, and for Apple specifically, he thinks the repurchase program makes sense: “What else are they going to do with the cash?” Some have estimated that between 5 percent and 10 percent of Apple’s price gain in recent years stems from buybacks. But Snider questions whether stock buybacks are the best use of resources in the long run. “Companies buy back shares rather than investing in the growth of their businesses,” he says. “I think that’s a waste.”

Then there's the issue of actually buying the stock. Projections such as Icahn’s create the impression that oceans of cash are sloshing around Apple’s Cupertino, California, headquarters, but the reality is more complicated. Apple’s cash reserves are indeed colossal – in its latest SEC filing the company reported $178 billion in cash. The catch is that $158 billion, or 89 percent, is overseas.

“All the cash is offshore,” Hargreaves says. “To bring it back you have to pay the taxes.” Apple keeps the cash in foreign accounts to avoid paying a repatriation tax, but it can borrow cheaply against its far-flung reserves. “If you’re not going to pay the taxes, you have to borrow against it. There’s a little transactional cost there.”

That explains why, despite its overflowing coffers, Apple has to go into debt to orchestrate stock buybacks. Its most recent such bond deal amounted to $5 billion.

Regardless of whether one agrees with Icahn’s prescription, most analysts share his rosy outlook. “It’s not totally insane to argue that a business growing that fast should trade proportionally to market,” Hargreaves says. “It’s a fantastic business.”

In the end, as some observers have noted, Icahn’s missive might amount to simple promotion. Sure enough, Apple rose 1.2 percent by midday Thursday, evidencing the so-called Icahn Lift in action. With $6.5 billion of Apple stock in his portfolio, that little one-day bump earned Icahn around $80 million.

© Copyright IBTimes 2025. All rights reserved.