Apple’s Cash Pile: Making You Pay More for ‘Insanity’

Apple now may have more cash and securities available than any other company, at least $81.5 billion at the end of its fourth quarter ended Sept. 24. How come?

The company, which reported annual revenue of $108.25 billion, entered a technology club with only one other current member, Hewlett-Packard, although IBM appears well on target to pass the $100 billion annual revenue mark this year.

Apple is also highly profitable: full-year net income soared more than 85 percent to $25.9 billion, making it one of the world's most profitable companies. That's unusual because Cupertino, Calif.-based Apple sells hardware, software and services.

Here's why: Apple's gross margin keeps growing and growing. For the year ended Sept. 24, the company's gross margin rose to 42.8 percent from 39.37 percent a year ago because customers were willing to pay more for an Apple product that cost less from a competitor.

Gross margin is Apple's sales less the cost of sales.

In the fourth quarter, for example, Apple's gross margin swelled to 40.3 percent from 36.9 percent in 2010; the result of selling more iPhone 4s, iPad2s and MacBooks that sell for more than non-Apple products.

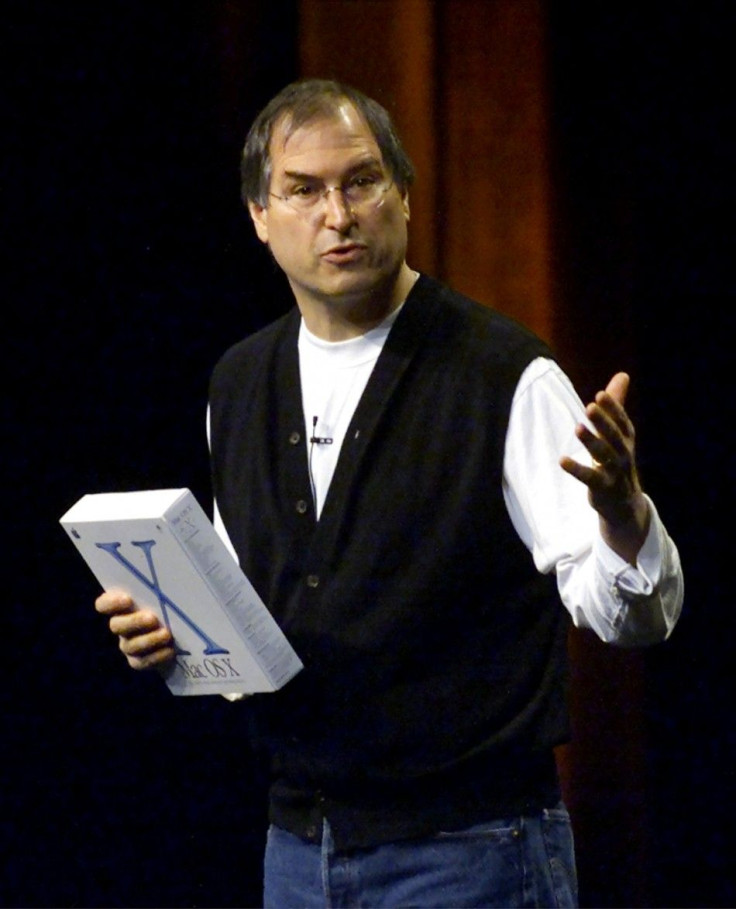

That was part of co-founder Steve Jobs' insanely great strategy of devising products consumers may not know they wanted, then selling millions of elegantly designed units.

Although it hasn't analyzed fourth-quarter data, market researcher IHSiSuppli now has shed some light on Apple's fat gross margins.

Not surprisingly, Apple's gross margin for the iPhone 4 was 72.6 percent, compared with 70.7 percent in the fourth quarter of 2010. This may suggest the iPhone is overpriced. It also may explain why new CEO Tim Cook, for the first time, has begun tiered pricing for the iPhone 4S, old iPhone 4s and made the old iPhone 3 free.

Meanwhile, gross margin on the iPad 2 is 42.2 percent, down from 47.1 percent last year, perhaps reflecting new entrants into the tablet sector from Samsung Electronics, Motorola Mobility, HP and others.

Other gross margins: for the iPod, 59.6 percent, Mac desktop, 59.6 percent, Mac portables, 47.7 percent.

By contrast, the overall gross margin for Dell, the No. 2 PC maker, is 22.5 percent.

Apple shares traded at $399.10, down $6.67 in late Tuesday trading, giving the company a market value of $370.3 billion, about $16 billion below the value of Exxon Mobil.

© Copyright IBTimes 2024. All rights reserved.