Apple's Main Investor Concern This Quarter: Demand

Apple Inc investors have for years cheered investments to expand its supply chain to meet feverish global demand for iPhone and MacBooks. Now, the question is whether the company can sell everything it made.

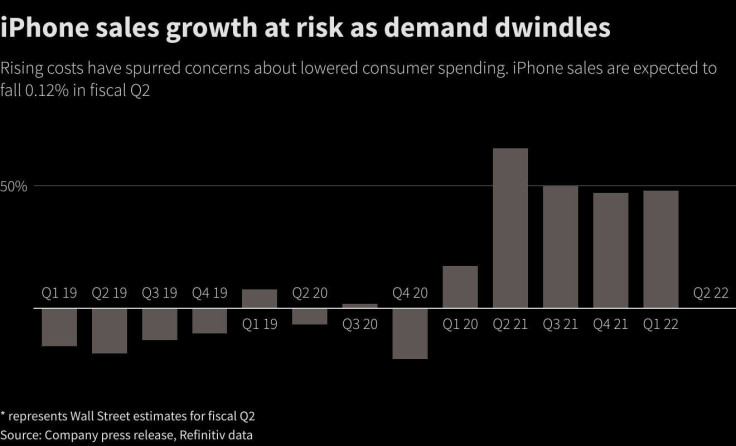

Rising costs for fuel, groceries and other essentials in the U.S., Europe and Asia has spurred concerns about lower consumer spending on tech gadgets, and Wall Street now is uncertain whether Apple can sell as many iPhones as it did last year.

Apple reports fiscal second-quarter results on Thursday.

"Demand is the focus, given the inflation pressure in United States, global and China's economy uncertainties... Supply issue is important too, but it is more short term," said Jeff Pu, an analyst at Haitong International Tech Research.

In China, the world's largest smartphone consumer market, total industry phone shipments this year are expected to be 300 million units from about 325 million units last year, according to research provider Trendforce, which expects more deterioration as China's economy takes a hit from strict COVID-19 curbs and the Ukraine war.

To grow its footprint elsewhere in China, which generates at least a fifth of Apple's revenue, the company in March launched a low-cost 5G iPhone SE to woo consumers looking to upgrade on a budget. But that plan might not succeed as fewer consumers plan upgrades, according to Counterpoint Research's Jeff Fieldhack.

Demand for 5G phones is expected to dwindle in China, too, as consumers limit spending to everyday essentials amid slowing economic growth.

"When we sit here half a year from now, we'll probably say that this was the quarter where there's this new wave of headwinds that came in and shifted the market around," Canalys analyst Runar Bj?rhovde said. "It's commencing a lot of challenges that will come up in the next few quarters."

To be sure, Apple, a pandemic winner as demand for its iPhones, MacBooks and services surged, still grew market share last year due to the popularity of its iPhone 13 series.

Apple is expected to report revenue of $93.89 billion for its fiscal second quarter, a 4.8% rise, but its slowest growth rate in six quarters. Sales of iPhones, where Apple gets most of its revenue, are expected to fall slightly to $47.88 billion, according to Refinitiv data.

GRAPHIC: iPhone sales growth at risk

Click here for an interactive graphic: https://tmsnrt.rs/3ERUGHX

Though Apple lost out on billions of dollars in sales last year due to product shortages, it escaped much of the supply issues that plagued other tech companies, thanks to its buying power, and the company's ability to place custom orders for components used in its products.

It also prioritized manufacturing more expensive, high-margin products. Apple forecast that those supply issues would continue to decrease in its second quarter, another reason why analysts have shifted focus to the demand side.

© Copyright Thomson Reuters 2024. All rights reserved.