Are Interest Rates Going Up Or Down? Trump Pushing Fed To Cut To Zero

Now that the U.S. Federal Reserve is in its quiet period ahead of next week’s monetary policy meeting, President Trump criticized the central bank Thursday as “derelict” for its conservative approach to interest rates.

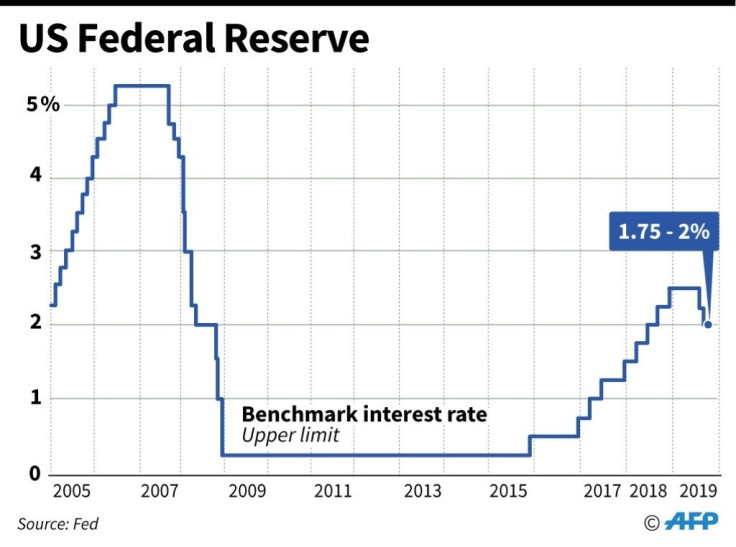

The Federal Open Markets Committee meets next Tuesday and Wednesday to consider a cut in the federal funds rate. The central bankers have cut the rate by 25 basis points in each of their last two meetings, putting the current rate at 1.75% to 2%.

Trump has been pushing for a rate of zero or less, and Thursday said the Fed would be “derelict in its duties if it doesn’t lower the rate.”

He urged the bankers to take a page from the European Central Bank, which has initiated a new round of quantitative easing. Interest rates are in negative territory in the eurozone.

“Germany and others are actually getting paid to borrow money,” Trump tweeted.

In the last round of comments, Fed Vice Chairman Richard Clarida left the door open for a third consecutive rate cut but tempered predictions by noting the economy is in a “good place” and may not need the stimulation.

Thursday’s weekly initial unemployment claims numbers indicate the labor market remains strong with initial claims falling to 212,000, down 6,000 from the preceding week. Other economic reports have indicated the U.S. economy is softening.

Fed economist Jens H.E. Christiansen said in a recent research paper that negative interest rates “could become an important policy tool for fighting future economic downturns.” Christiansen looked at the countries where negative rates have been implemented and found the rates push government bond yields lower, something that could have helped speed the recovery from the 2008 recession.

Christiansen noted, however, rates set at zero could prompt some investors to hold on to physical currency despite the dangers of theft and fire and the cost of transporting and storage.

Diane Swonk, chief economist for Grant Thorton, urged caution.

“Worry about the economy, but [there’s a] need to balance that concern with the efficacy of each cut,” she tweeted. “A later cut may have more bang for the dollar.”

A pregnant pause, with the Fed holding on a rate cut next week and delivering later, may be more strategic and advantageous to at this phase of the cycle. Allows Fed more leeway to deal with risks - Brexit, trade war, weaker growth - as they flare. https://t.co/4x1lWAiBmo

— Diane Swonk (@DianeSwonk) October 23, 2019

She noted if the FOMC decides to keep rates where they are, it will disappoint the markets, which already have factored in a cut.

Swonk also said she’s surprised at how split the Fed is on the issue, especially given delays in Brexit and developments in the trade war with China.

© Copyright IBTimes 2024. All rights reserved.