Are Social Media Users Abandoning Facebook And Instagram?

Facebook (NASDAQ:FB) and its subsidiary Instagram are among the most widely used social networking apps in the world, but a recent Bank of America report claims that mobile downloads of both apps are declining.

The report, which cites data from research firm Sensor Tower, claims that combined downloads of Facebook and Instagram fell 13% year-over-year in the third quarter so far. Facebook's downloads declined 15%, while Instagram's downloads dropped 9%.

Bank of America also notes that downloads of Snap's (NYSE:SNAP) Snapchat, Twitter (NYSE:TWTR), and Pinterest (NYSE:PINS) all rose year-over-year during the same period. Let's take a closer look at Facebook and see why the tech giant might be losing its momentum.

Facebook's user growth only comes from certain markets

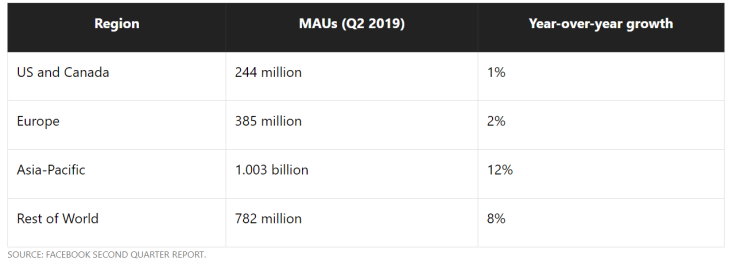

Facebook's total monthly active users (MAUs) rose 8% annually to 2.41 billion last quarter. However, most of that growth came from overseas markets.

That's a big problem for Facebook, since its users in the U.S. and Canada generated 48% of its revenue last quarter despite only accounting for 10% of its total MAUs. Its users in Europe generated 24% of its revenue but only accounted for 16% of its MAUs. Simply put, Facebook generates most of its revenue from slower-growth developed markets, but most its user growth comes from lower-revenue developing markets.

Facebook doesn't regularly update its number of Instagram users, but it announced that the platform's total MAUs doubled from 500 million to 1 billion between June 2016 and June 2018. The tech giant is increasingly depending on Instagram's growth -- especially in developed markets -- to offset Facebook's slower growth.

Saturation, alienation, and competition

Facebook faces three main problems in developed markets like the U.S. First, the market is heavily saturated. Pew Research claims that 69% of American adults currently use Facebook, and that percentage has remained unchanged since 2016.

Second, Facebook alienated its users with a seemingly endless streak of privacy, security, and PR debacles, which included the Cambridge Analytica data breach, data leaks from linked third-party apps, severe security problems in WhatsApp, and the proliferation of fake news campaigns at home and abroad.

Earlier this year, a poll by NBC News and The Wall Street Journal found that 60% of Americans no longer trusted Facebook with their personal data, compared to the 37% and 28% who didn't trust Alphabet's Google and Amazon, respectively.

Lastly, Facebook still faces tough competition from niche rivals like Snapchat, Twitter, and Pinterest. 41% of U.S. teens ranked Snapchat as their favorite social network, according to Piper Jaffray, compared to 35% for Instagram and just 6% for Facebook. Facebook repeatedly tried to stomp out Snapchat by cloning its most popular features in Instagram, yet Snapchat's daily active user growth still accelerated last quarter.

Twitter remains the top platform for following celebrities, brands, real-time news, and debates, while Pinterest's platform of interest-based pins remains refreshingly detached from a user's personal life. A recent Cowen & Co. study also found that 48% of Pinterest's users use the platform to find and shop for products -- compared to just 10% of Instagram users.

Sensor Tower's numbers indicate that more social media users are gravitating toward these platforms as Facebook's growth peaks. Facebook previously offered users an illusion of choice with Instagram -- but that illusion is fading as Facebook tethers Instagram more tightly to its core app with cross-platform features.

Should Facebook investors be concerned?

Bank of America's report is noteworthy, but it should be taken with a grain of salt. Mobile downloads aren't directly comparable to active users, Facebook's apps are already pre-installed on many new phones (which reduces recorded downloads), and it's unclear if Sensor Tower's numbers cover all of Facebook and Instagram's higher-growth overseas markets.

Nonetheless, it supports the bearish claims that Facebook is running out of room to grow and that its recent missteps are alienating users. Therefore, investors should see if that case has merit when Facebook releases its third-quarter report next month.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Leo Sun owns shares of Amazon, Facebook, and Snap Inc. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Facebook, and Twitter. The Motley Fool owns shares of Pinterest. The Motley Fool has a disclosure policy.

This article originally appeared in The Motley Fool.