Consumers are borrowing again: is that a good thing?

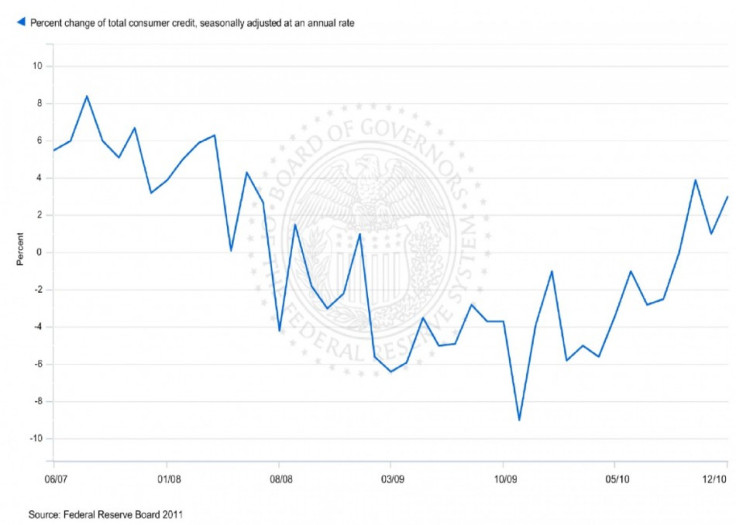

Beginning in February 2009, outstanding consumer credit has contracted for nineteen consecutive months, with November 2009 recording the largest single monthly drop over that period (of 9 percent at an annualized rate).

However, in September 2010, outstanding consumer credit stayed flat, increased at a rate of 3.9 percent in October, grew by 1 percent in November 2010, and expanded at 3 percent in December 2010.

Trends in consumer leveraging (borrowing) tend to last a long time. For example, before the global financial crisis induced the first contraction in August 2008, outstanding consumer credit had expanded for 126 consecutive months.

Assuming this trend continues, what does it mean for the US economy?

The Good

1. Consumers now have the confidence to borrow and have more money to spend. Their spending will boost revenues of businesses and may spark a virtuous cycle of accelerated business hiring that leads to even more consumer confidence and spending.

2. It's an indication that loose monetary policy is finally working on consumers as they are induced to borrow. This perhaps marks the end of the 'liquidity trap' for consumers.

3. Interestingly, nonrevolving credit growth far outpaces revolving credit growth. An example of consumer revolving credit is credit cards. An example of nonrevolving consumer credit is student loans.

Arguably, growth in nonrevolving consumer credit is better for the economy because these loans are spent for more long term and strategic purposes compared to revolving credit loans.

The Bad

1. Consumers arguably still need to deleverage, or pay down their debt. The fact that they're borrowing again delays the solution to their current balance sheet problem and possibly sows the seeds for future crises.

Moreover, for the broad economy, borrowing just kicks the can down the road and delays reforms that would address the structural imbalances that led to the financial crisis in the first place.

However, a counterpoint is that the best solution for repaying consumer debt is economic growth (and a little bit of inflation). So if current borrowing achieves those ends, it may actually be the best solution to reducing old debt.

2. Leverage increases risks because debt (versus equity, for example) represents money that's owed. If not paid, debt causes bankruptcy. Even before that, though, debt servicing and repayment takes away money from potentially profitable investments.

So as consumers borrow more, they put themselves at risk in the event of personal financial misfortunes or a downturn in the general economy.

© Copyright IBTimes 2024. All rights reserved.