ASEAN Economic Outlook: Are Southeast Asian Countries Set To Reap The Demographic Dividend?

Home to 600 million people and located next to the growth engines of China and India, countries comprising the Association of Southeast Asian Nations (ASEAN) economies face the challenge of creating enough jobs to absorb their domestic growing labor forces and building infrastructure to boost productivity, according to an HSBC economist.

“We believe the future, at least from a demographic and natural resource perspective, belongs to ASEAN,” HSBC economist Trinh Nguyen said in a research note. “But whether this will be realized will be dependent on the will of the countries’ leaders.”

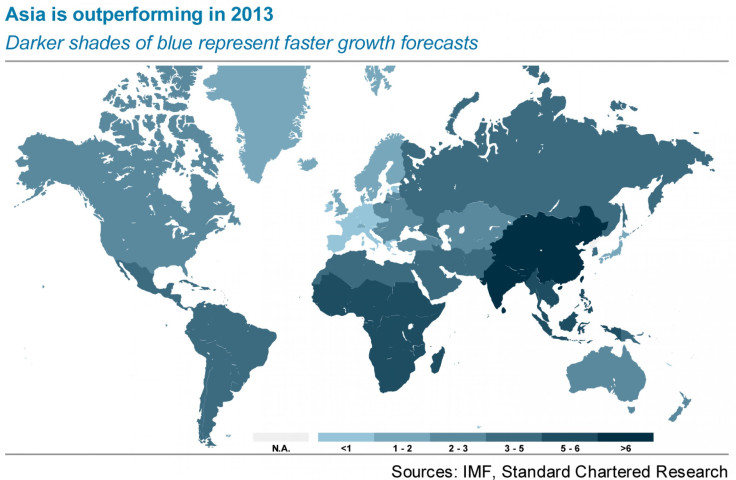

Although seen as the new frontier for growth, these Southeast Asian countries still performed below their potential, averaging just 5 percent growth in the past decade. The region attracted $111.4 billion in foreign investment last year -- almost equal to China’s $121.1 billion. But Nguyen thinks ASEAN countries can and should do better.

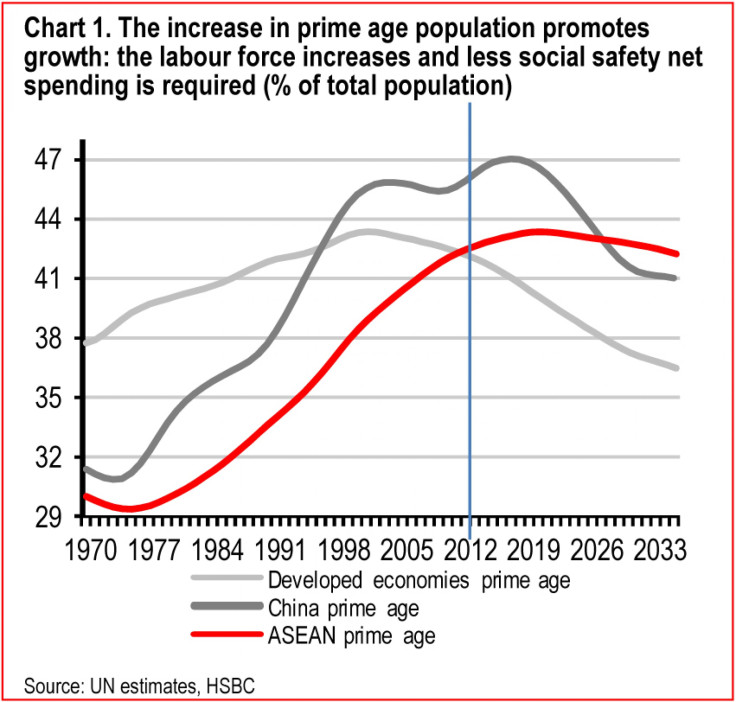

In the coming decades, ASEAN nations will have more prime-age adults (age 25-54) than ever before, and their dependency ratio (the proportion of the young and aged to working age adults) will drop significantly, freeing up resources for other investment opportunities, according to HSBC. Economic behavior varies at different stages of life -- while the young require investment in education and health, and the aged require health care and pensions, prime-age working adults supply labor and savings.

The Philippines, Malaysia, Vietnam, Indonesia, Myanmar and Cambodia are among the countries with positive working population growth rates and declining dependency ratios, conditions that are favorable to growth, according to HSBC.

However, as the divergent experience of Latin America and East Asia showed, the demographic dividend is wasted if the absorptive capacity of labor and capital -- the capability of an economy to deploy them efficiently -- is low.

Western Europe, the U.S. and East Asia managed to capitalize on their respective demographic dividends, Nguyen said. Coupled with trade liberalization and improved mobility of capital and labor, developed economies’ gross domestic product (GDP) per capita rose from $2,800 in 1970 to $42,000 in 2011. China, which had a strong demographic profile in the 1970s and 1980s, only benefited from the favorable prime-age structure after it created higher productivity jobs.

But not all ASEAN countries have been proactive in preparing for this demographic transition.

The Philippines. The Philippines had the third highest income per capita in Southeast Asia in 1970 (behind Singapore and Malaysia), but by 2011 it was eclipsed by Thailand and Indonesia. Recent improvements in fiscal and monetary management have raised hopes that the Philippines can reverse its fortunes with reforms that are able to capitalize on its increasingly favorable demographics.

In the next several decades, the Philippines should have one of the most favorable demographic transitions amoung the ASEAN countries. This means the country needs to increase capital expenditure to make up for its high population growth rates and capital depreciation. Currently, the investment to GDP ratio is around 20 percent.

“Raising the investment level in the Philippines is necessary to capitalize on its demographic dividend,” Nguyen said. He calculates that should investment jump to 30 percent of GDP by 2020 and stay at that rate until 2030, GDP would expand on average by 6.9 percent from 2013 to 2030.

Indonesia. Indonesia is the largest ASEAN nation both in terms of population (245 million) and GDP ($878 billion). The country capitalized on its demographic transition well and was able to raise its output level significantly, thanks largely to a multitude of policy reforms, including the development in the 1970s of institutions coupled with an emphasis on an export-oriented manufacturing sector that absorbed excess labor. The improvement of the banking sector after the Asian financial crisis also facilitated more efficient investment.

Should Indonesia’s investment (assuming it is efficiently allocated) rise from its current 25 percent to 30 percent of GDP, then by 2030, GDP per capita would triple from the current level, Nguyen projects.

Thailand. In contrast, Thailand should begin to see its working age population decline in 2022. “While that is still almost a decade from now, Thailand will have to prepare for this demographic transition,” Nguyen said.

Approximately 67 percent of the Thai population is still rural, which means that there is plenty of room for Thailand to lift earnings per worker, provided that investment is available to boost productivity. Thailand’s cabinet in March approved a bill to borrow 2 trillion baht ($68 billion) to fund long-term infrastructure projects, including high-speed railways, highways and mass-transit networks. If these are implemented efficiently, they could offer more job opportunities for still-poor rural workers.

Should Thailand’s investment rate rise from the current level of 22 percent to 30 percent by 2020, real GDP growth rates would expand on average by 5 percent, according to Nguyen.

Vietnam. The opening of the Vietnamese economy in the 1980s, coupled with a demographic boom, created higher productivity jobs and boosted decades of rapid economic growth. GDP expanded on average 7 percent in the past decade.

Investment as a share of GDP rose from an average of 12 percent in the 1980s to 35 percent in the 2000s. Given Vietnam’s low level of development (from a GDP perspective), an increase of investment was necessary to build up infrastructure, Nguyen said. Vietnam will continue to have a large working age population in the next two decades.

In 2011, the government embarked on rigorous reforms aimed at fixing the debt-ridden state banks and rein in inefficient state enterprises (SOEs). “Should Vietnam continue to carry out reforms to restructure its financial system, total factor productivity would turn from negative to positive,” Nguyen said. With both reforms and a gradual rise of investment to 40 percent of GDP, annualized economic growth would exceed 8 percent by 2030.

Malaysia. Malaysia’s GDP per capita is poised to be the second-highest in Southeast Asia behind Singapore at $11,000 by year-end 2013, based on HSBC’s estimate. Although Malaysia only has a population of 29 million, the country’s working age population is expected to continue to grow.

Should the investment to GDP ratio rise to 30 percent from 25 percent, average GDP growth would expand by 5.8 percent, according to Nguyen.

© Copyright IBTimes 2024. All rights reserved.