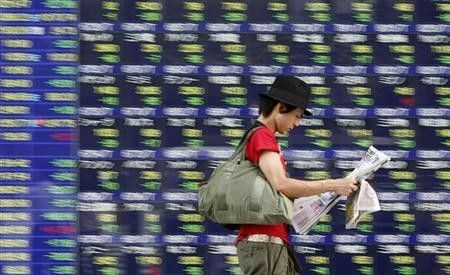

Asian Stock Markets Fall Amid Greek Exit Fears

Asian stock markets declined Wednesday as renewed concerns of Greece's probable exit from the euro zone dampened sentiment.

All the major Asian indices were trading in the red with the Japanese Nikkei plunging to 1.93 percent, China's Shanghai index falling by 1.46 percent and South Korea's Kospi down by 1.32 percent while the Indian benchmark BSE Sensex and Chinese Shanghai declined 0.87 and 0.74 percent respectively.

Concerns over a messy Greek exit from the euro zone intensified after former Greek prime minister Papademos said during an interview with the Dow Jones Newswires Tuesday that the debt-ridden country was making preparations to leave the 17-member currency bloc.

The comments out of Greece outweighed a report showing an improvement in US home sales in April. Sales of previously owned homes rose 3.4 percent in April, reversing three months of decline and suggesting that housing market recovery was gaining some traction amid a moderate elevation in economic growth early in the second quarter.

European leaders are slated to meet Wednesday in Brussels for an informal summit where new pro-growth solutions will be discussed.

The informal summit of EU leaders will likely focus on the situation in Greece but it is also likely to lay the ground for an agreement on pro-growth measures to be announced at the next formal EU summit on 28-29 June, said a note from Credit Agricole.

News from Japan also weighed the sentiment. The world's third largest economy reported a rise in trade deficit in April compared to a year earlier as the nuclear energy crisis has resulted in an increase of oil and gas imports. Japan reported a trade deficit of 520.3 billion yen ($6.5 billion) compared to a deficit of 477.7 billion yen a year ago.

Meanwhile, the rating agency Fitch downgraded Japan's long-term foreign currency rating by a notch to A+ from AA, citing the country's rising debt-to-GDP ratio.

In Japan, the shares of major exporter companies declined after the trade deficit and Fitch's ratings downgrade. Sony Corp declined 2.23 percent and Canon Inc fell 2.71 percent while Nintendo slipped 2.58 percent.

© Copyright IBTimes 2024. All rights reserved.