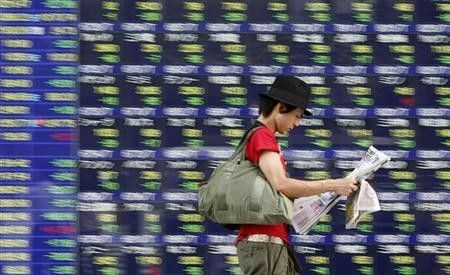

Asian Stock Markets Fall On Weak US Service Sector, Retail Sales Data

Asian stock markets declined Friday as weaker-than-expected data on the U.S. services sector and disappointing April retail sales fueled concerns that the recovery in the world's largest economy is slowing.

The Institute for Supply Management (ISM) said Thursday that the U.S. nonmanufacturing sector expanded at a slower pace than expected in April. ISM's nonmanufacturing purchasing managers' index declined to 53.5 in April from 56.0 in March and also widely missed economists' estimation of 55.3. The employment index declined to 54.2 in April from 56.7 in the previous month.

Meanwhile, weakness in retail sales data also weighed on the sentiment. Of the 15 companies that reported sales, seven missed expectations, according to Thomson Reuters data.

The downturn in the ISM services' jobs component, combined with the recent ADP employment report, which showed a slowdown in private sector hiring, point to a sluggish April employment report.

As concern over U.S. growth's robustness is intensifying, the jobs number will provide further clues for assessing the U.S. outlook and the Fed's stance, said a note from Credit Agricole.

Hong Kong's Hang Seng index declined 0.77 percent, or 163.53 points, to 21,086.00 and South Korea's KOSPI index fell 0.30 percent, or 5.96 points, to 1,989.15 while the Shanghai index gained 0.49 percent.

In Hong Kong, Chinese property developers led the decline after China Vanke reported Thursday that its April sales fell 5.8 percent compared to the same period last year.

China Overseas Land & Investment Ltd. declined 2.41 percent, while China Resources Land Ltd. plunged 4.08 percent in Hong Kong.

Energy and raw material companies' shares also declined on weak commodity prices. Jiangxi Copper fell Corp. 1.66 percent CNOOC Ltd. declined 1.31 percent while China Shenhua Energy Co. declined 1.45 percent in Hong Kong.

In Seoul, Samsung Electronics Co. declined 2.93 percent, Hyundai Motor Co. plunged 3.2 percent and LG Electronics gained 0.96 percent.

Indian stock markets plunged Friday, led by declines from banking and realty shares. Benchmark BSE Sensex plunged 1.74 percent, or 298.46 points, to 16,852.73.

ICICI Bank plunged 3.96 percent, the State Bank of India declined 3.75 percent and Reliance Industries Ltd. fell 2.08 percent.

© Copyright IBTimes 2025. All rights reserved.