Asian Stocks Decline Despite Rate Cuts; Focus Turns To US Data

Asian stock markets declined Friday as investors remained cautious ahead of the U.S. employment data later in the day while major central bank's actions to stimulate the global economy failed to calm market jitters.

Japanese shares ended lower, led by declines from exporter companies' shares, as the yen strengthened against the euro. Benchmark Nikkei fell 0.65 percent or 59.05 points to 9,020.75. Canon Inc. declined 2.50 percent and Fujitsu Ltd. plunged 3.14 percent while NEC Corp. slumped 4.92 percent.

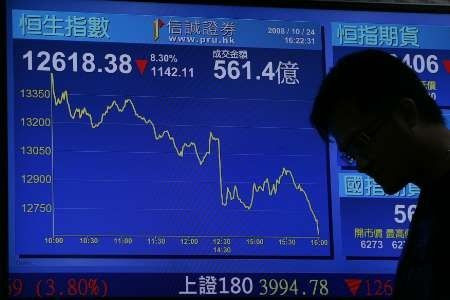

Hong Kong's Hang Seng fell 0.04 percent or 8.49 points to 19800.64 as declines from Chinese banking shares weighed after the People's Bank of China (PBoC) cut its key policy rates for the second time in less than a month. China Construction Bank Corp. declined 2.46 percent and Bank of Communications Co Ltd. declined 2.48 percent while CNOOC Ltd. fell 1.02 percent.

South Korean KOSPI declined 0.92 percent and the Indian benchmark BSE Sensex was trading flat while Chinese Shanghai Composite gained 1.01 percent, led by gains from property developers and industrial companies' shares after rate cut.

The European Central Bank Thursday cut its main interest rate to a record low of 0.75 percent and overnight deposit and lending rates to 0 percent and 1.5 percent respectively in an attempt to rejuvenate the economic growth momentum. But investors were disappointed with the central bank's move to not pursue any bolder stimulus measures for now.

In a surprising move Thursday, the People's Bank of China (PBoC) cut its key policy rates for the second time in less than a month. The central bank lowered the benchmark one-year lending rate by 0.31 percentage point and one-year deposit rate by 0.25 percentage point. The unexpected move intensified concerns about the economic growth in the world's second largest economy and raised speculation that key economic data next week would be weak.

I think the ECB is priced in. It's been a case of buy the rumor all week and now probably some profit taking on the announcement. The market would really need something big like a Fed move not the ECB or Bank of England which is a bit more of a minor consideration, Societe Generale analyst Robin Bhar was quoted as saying by Reuters.

Investors are eagerly waiting for the U.S. government's monthly nonfarm payrolls report, which is the most closely-watched economic data pertaining to the jobs market and is a key gauge for the direction and pace of the economic recovery.

Jobs growth in the U.S. declined for the third straight month in May and raised concerns that labor market conditions were deteriorating again. The latest jobs data will offer clues about the impact of the intensifying euro zone crisis on U.S economy and chances of further monetary stimulus from the Federal Reserve to support the sputtering recovery.

However, Thursday's private sector payrolls data showed that companies added more jobs in June and dampened hopes of additional quantitative easing by the Fed ahead of Friday jobs report.

© Copyright IBTimes 2024. All rights reserved.