Asian Stocks Fall After Spanish Downgrade, Japan Data

Asian stock markets declined Thursday as weak machine orders data from Japan and the Spanish debt downgrade by Standard & Poor’s weighed on the sentiment.

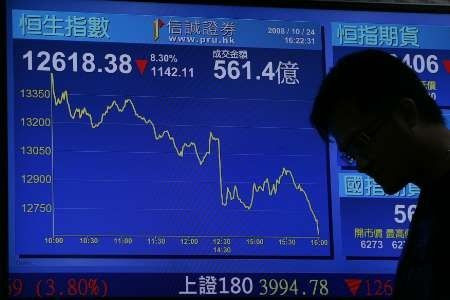

Japanese benchmark Nikkei declined 0.58 percent or 49.45 points to 8546.78, Chinese Shanghai Composite fell 0.81 percent or 17.07 points to 2102.87 and South Korea’s KOSPI Composite plunged 0.78 percent while Hong Kong's Hang Seng gained 0.35 percent or 73.52 points to 20993.12 and Indian benchmark BSE Sensex rose 0.29 percent.

Markets sentiment deteriorated as the euro zone debt crisis once again took the center stage after S&P downgraded its rating on Spain’s debt to just one notch above junk at BBB- from BBB-plus, citing significant risks to Spain’s economic growth and budgetary performance, and the lack of a clear direction in euro zone policy. S&P also lowered the short-term sovereign credit rating to "A-3" from "A-2" and gave a negative outlook to the country.

“The slow progress towards a sovereign bailout for Spain will have likely played a role in the decision, a factor that is also weighing on general market sentiment. The debt downgrade may on the margin increase the pressure on the Spanish government to request a formal bailout,” said a note from Credit Agricole.

The weaker-than-expected machine orders data from Japan also added to the downside. Official data Thursday showed that machinery orders declined 3.3 percent on a monthly basis in August following two straight months of increase. The fall was bigger than Reuters’ estimate of 2.6 percent monthly decline and suggests that there is an urgent need to take additional measures for enhancing the growth potential of the economy.

“The global economy’s in a tough place. If you look at what’s going in the euro zone, you look at what’s going on in the United States, you look at what’s going on in Japan and you even look into China today, you’ve got a lot of anxiety in the system,” Goldman Sachs Group Inc.’s president and chief operating officer Gary D. Cohn was reported as saying by Bloomberg Television.

Meanwhile, the Bank of Korea (BoK) cut its key policy rate by 25bp to 2.75 percent Thursday in a measure to loosen the policy to boost the country’s economic growth. The move was widely expected by analysts as the inflation remained at the bottom end of the BoK’s target range of 2 to 4 percent this year.

Japanese stocks ended lower as declines from the industrial firms and exporters weighed. The shares of industrial companies plunged following the weaker-than-expected machine orders. Mitsubishi Materials Corp. plunged 3.90 percent and Fanuc Corp. fell 2.65 percent while Nissan Motor Co Ltd. fell 1.20 percent.

Gains in the financial and infrastructure sector shares supported Hang Seng. Bank of China Ltd. surged 2.70 percent and China Construction Bank Corp. advanced 2.55 percent while China Railway Construction Corp Ltd. climbed 6.84 percent.

In Seoul, Samsung Electronics Co Ltd. declined 1.58 percent and LG Electronics Inc slipped 0.59 percent while Hyundai Motor fell 1.69 percent.

© Copyright IBTimes 2024. All rights reserved.