Asian Stocks Gain On US Manufacturing Data; Chinese Shares Rally After Fee Cut

Asian stock markets ended higher on Wednesday as upbeat U.S. manufacturing data eased worries that the world's biggest economy had lost momentum at the start of the second quarter.

The Institute for Supply Management (ISM) said that U.S. factory activity grew in April at the strongest pace since June 2011. ISM's manufacturing purchasing managers Index (PMI) improved to 54.8 percent in April from 53.4 percent in March. The data also beats Reuters' expectation for a decline to 53.0 percent and pushed the Dow Jones Industrial Average to close at its highest level in more than four years.

The ISM report was in contrast to a recent string of disappointing regional manufacturing measures, particularly the Chicago PMI, a gauge of business activity in the Midwest, which had showed that the rate of growth slowed last month.

The effect of the solid U.S. manufacturing activity will be felt in Asia in about six months, supporting my view that Asian exporters will gradually recover towards the end of the year, Hirokazu Yuihama, a senior strategist at Daiwa Securities in Tokyo, told Reuters.

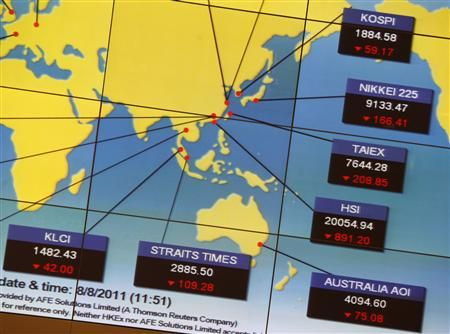

The Japanese Nikkei gained 0.31 percent or 29.30 points to 9,380.25, and the South Korean Kospi advanced 0.86 percent. The Indian benchmark BSE Sensex slipped 0.10 percent.

Toyota Motor Corp. gained 0.47 percent and Honda Motor Co. advanced 0.68 percent, while Sony Corp. rose 0.4 percent in Tokyo.

Chinese shares rallied after official data released on Tuesday showed that manufacturing activity in the world's second biggest economy improved in April for the fifth straight month as the country's economic condition continued to strengthen. Its Purchasing Managers' Index (PMI) rose to 53.3 in April from 53.1 in March, signaling that the economy in the second quarter may be more stable.

The Chinese Shanghai insex climbed 1.76 percent or 42.12 points to 2,438.44, and Hong Kong's Hang Seng index surged 1.02 percent or 214.87 points to 21,309.08.

Brokerage firm shares rallied after the China Securities Regulatory Commission said Monday that the Shanghai and Shenzhen stock exchanges would lower fees charged for trading yuan-denominated shares by 25 percent, which will go into effect beginning June 1.

The cut in transaction fees signifies the government is putting emphasis on the capital markets, and this signal is very important, Li Jun, a strategist at Central ChinaSecurities Co, told Bloomberg News.

Citic Securities Co. gained 1.31 percent, and Haitong Securities Co. surged 2.33 percent in Shanghai.

Among the material companies, Yunnan Aluminium Corp. gained 3.14 percent and Jiangxi Copper surged 6.14 percent, while Yunnan Copper Industry climbed 10.02 percent.

© Copyright IBTimes 2024. All rights reserved.