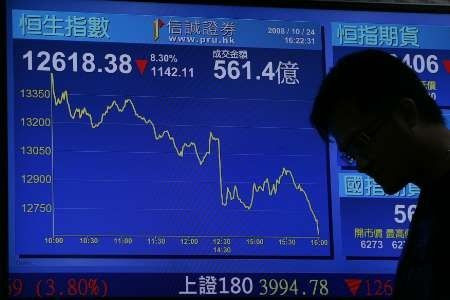

Asian Stocks Mostly Down As Google, Microsoft Earnings Disappoint

Asian stock markets mostly declined Friday as the disappointing quarterly earnings from the U.S. blue chips and an unexpected jump in initial jobless claims weighed on the sentiment.

Chinese Shanghai Composite declined 0.16 percent or 3.39 points to 2128.30, South Korea’s KOSPI Composite plunged 0.78 percent or 15.28 points to 1943.84 and Indian benchmark BSE Sensex slipped 0.47 percent while Japanese benchmark Nikkei gained 0.22 percent or 19.82 points to 9002.68 and Hong Kong's Hang Seng advanced 0.20 percent.

Markets opened on a negative note, following declines on the Wall Street overnight as the number of Americans lining up for new jobless benefits unexpectedly jumped last week, erasing a sharp decline to the lowest level in four years in the prior week, and earnings from technology majors disappointed.

The Labor Department said Thursday that initial claims for state unemployment benefits gained sharply by 46,000 last week to a seasonally adjusted 388,000 in the week ending Oct. 13, worse than the economists' estimate of 365,000.

Sentiment was further weighed down by weaker-than-expected quarterly earnings from blue chip companies, Google and Microsoft. Search engine giant Google’s third quarter earnings fell short of expectations as its Motorola business continued to incur operating loss, including severance and restructuring expenses. Its third quarter adjusted net profit declined to $3 billion or $9.03 per share from $3.18 billion or $9.72 per share in the same period last year and missed Reuters estimate of $10.65 per share.

Microsoft’s first quarter net profit plunged to $4.47 billion or $0.53 per share from $5.74 billion or $0.68 per share in the same period a year-earlier. Revenue declined 8 percent to $16.01 billion from $17.37 billion last year.

“You end up in a standoff in the share market between focus on economic data, which is more forward-looking, and focus on earnings, which are not as good. Earnings reflect the economic weakness we saw a few months ago, and therefore you could argue it’s somewhat outdated,” Shane Oliver, Sydney-based head of investment strategy at AMP Capital Investors Ltd., told Bloomberg.

Meanwhile, PBoC adviser Song Guoqing said that China will not provide a big economic stimulus and a strong growth rebound was unlikely. A slew of economic reports from China on Thursday showed clear signs of a turnaround. Reports on retail sales, industrial production and fixed asset investment came in above the consensus while economic activity data met expectations.

“The better the numbers, the less the government will do to stimulate growth, and it now seems that chances of additional aggregate demand coming to the global economy from China are very low,” said a note from Credit Agricole.

Japanese shares ended higher, led by gains from exporter companies on weaker yen. Canon Inc. gained 1.15 percent and Honda Motor Co Ltd. advanced 1.10 percent while NEC Corp. climbed 10.48 percent.

In Hong Kong, GOME Electrical Appliances Holding surged 5.81 percent and Bank of China Ltd. advanced 0.32 percent while BYD Co Ltd. rose 1.30 percent.

In Seoul, Samsung Electronics Co Ltd. plunged 2.62 percent and Hyundai Motor Co fell 0.87 percent while Korea Gas Corp. surged 5.39 percent.

© Copyright IBTimes 2024. All rights reserved.