AstraZeneca, Gilead Merger Would Be Biggest Pharma Deal In History

KEY POINTS

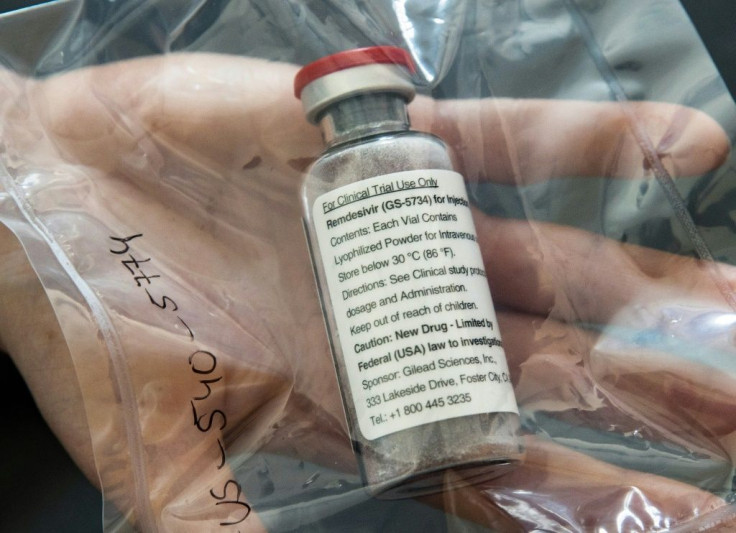

- AstraZeneca is showing an intent to merge with Gilead Sciences, the maker of remdesivir

- Gilead Sciences, however, seems uninterested in any merger this time

- It's grown by relentlessly acquiring other pharma firms and seems bent on continuing to do so

There's a better than even chance Gilead Sciences Inc., maker of the COVID-19 treatment "remdesivir," will rebuff a merger offer set to be tabled by AstraZeneca plc. The United Kingdom's largest pharma company has made preliminary moves to acquire Gilead Sciences as part of its push for market dominance in COVID-19 therapies, Bloomberg reported.

AstraZeneca will manufacture a COVID-19 vaccine currently being developed by the University of Oxford. The U.S. government has pledged as much as $1.2 billion to support the rapid development of this vaccine.

A vaccine plus ownership rights to remdesivir, which still remains the only approved treatment for COVID-19 worldwide, will transform AstraZeneca into a more formidable power in the global healthcare industry and a leader in antivirals.

On May 1, remdesivir received an emergency use authorization (EUA) from the U.S. Food and Drug Administration (FDA) due to studies showing it shortened hospital time for people with COVID-19. Sales of remdesivir could hit $7.7 billion by 2022, according to Boston-based investment bank, SVB Leerink.

Indications are Gilead might not share the same vision with AstraZeneca, however. Gilead has grown over the past 33 years from a wee California startup to a multinational company with revenues of $24.5 billion in 2019 by relentlessly eating-up other pharmaceutical companies.

Gilead has bought about a dozen pharma firms since 2010, which amounts to buying at least one firm per year, as part if its growth-by-acquisition strategy. Analysts affirm Gilead right now isn't interested in selling to or merging with another pharma multinational. Instead, Gilead seems intent on sticking to its strategy focusing on partnerships and smaller acquisitions.

“First and foremost, we’re focused on M&A (mergers & acquisitions),” said Robin Washington, Gilead’s former chief financial officer, in 2019. “We remain optimistic and very engaged at looking at a lot of different opportunities.”

A Gilead spokesperson declined to comment on the AstraZeneca takeover attempt. On the other hand, a spokesman for AstraZeneca said the company doesn’t comment on “rumors or speculation.”

To be clear, there are no formal and ongoing merger discussions. But if a deal does somehow occur, the merger between AstraZeneca (valued at $140 billion at Friday's stock market close) and Gilead (valued at $96 billion) will be the biggest yet in the pharmaceutical industry.

Despite the initial merger denials by both firms, there is the undeniable fact Gilead CEO Daniel O'Day and AstraZeneca CEO Pascal Soriot used to work together as executives for Switzerland’s Roche Holding AG. In addition, several managers currently at Gilead used to work for AstraZeneca.

© Copyright IBTimes 2024. All rights reserved.