AT&T Lays Out 3-Year Plan

Telecom giant AT&T (NYSE:T) reported mixed third-quarter results Monday morning, with total revenue down slightly, partly due to weakness in the WarnerMedia segment. But the stock jumped higher when the market opened as investors reacted positively to the company's 2020 outlook and its three-year guidance and capital allocation plan.

A mixed bag

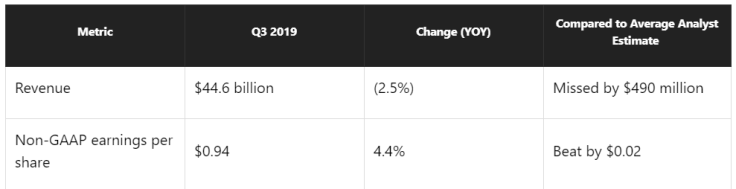

AT&T missed estimates for revenue in the third quarter, although its adjusted earnings per share came in a bit better than expected.

Total communications revenue was down 1.7% to $35.4 billion, with a slight increase in mobility sales more than offset by lower revenue in the entertainment group and business wireline.

In the mobility business, the company recorded 255,000 phone net adds, helping to drive service revenue up 0.7%. In the entertainment group, AT&T lost more than 1.1 million premium TV subscribers.

The WarnerMedia segment saw sales slump 4.4%, although HBO was a bright spot. HBO revenue was up 10.6%, and HBO operating income jumped 13.7%. The company is planning to unveil its upcoming HBO Max streaming service during its Oct. 29 WarnerMedia Day event.

Along with its results, AT&T laid out its expectations for 2020. The company sees revenue growth of 1% to 2%, adjusted EPS of $3.60 to $3.70, free cash flow around $28 billion, and a total monetization of assets between $5 billion and $10 billion.

AT&T's three-year plan

Under pressure from activist shareholder Elliot Management, which criticized the company for its massive acquisitions over the past few years, AT&T has laid out a plan that will carry it though 2022.

On the capital allocation front, AT&T expects to make no more major acquisitions over the next three years. The company will continue to review its portfolio of businesses and assets, although there was no mention of any specific plans. Elliot suggested a possible divestiture of DIRECTV as part of its plan for the company.

AT&T plans to continue to grow its dividend at a "modest" pace, and it expects to be paying out less than 50% of its free cash flow in dividends by 2022. Between 50% and 70% of post-dividend free cash flow will be used to retire roughly 70% of the shares issued in the acquisition of Time Warner. The rest will go toward eliminating all the debt from that acquisition, with a goal of bringing down the net-debt-to-adjusted-EBITDA ratio to a range of 2.0 to 2.25 by 2022.

The board of directors will also get a refresh, with two directors set to retire over the next 18 months. An additional director will be added at the next board meeting, followed by a second new director next year. CEO Randall Stephenson will remain in his position "through at least 2020."

On the financial front, AT&T expects to grow revenue by 1% to 2% annually over the next three years, delivering adjusted EPS between $4.50 and $4.80 in 2022. Free cash flow is expected to rise to a range of $30 billion to $32 billion in that year.

AT&T's plan to deleverage over the next few years is good news, given that total debt topped $160 billion at the end of the third quarter. Selling DIRECTV would help the cause, although the company may end up taking a loss if it does sell that business.

If AT&T can successfully hit its 2022 target for adjusted earnings, the stock has plenty of room to rise. At just shy of $39 per share following the rally on Monday morning, the stock trades for just 8.4 times the midpoint of AT&T's three-year earnings goal.

This article originally appeared in the Motley Fool.

Timothy Green owns shares of AT&T. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.