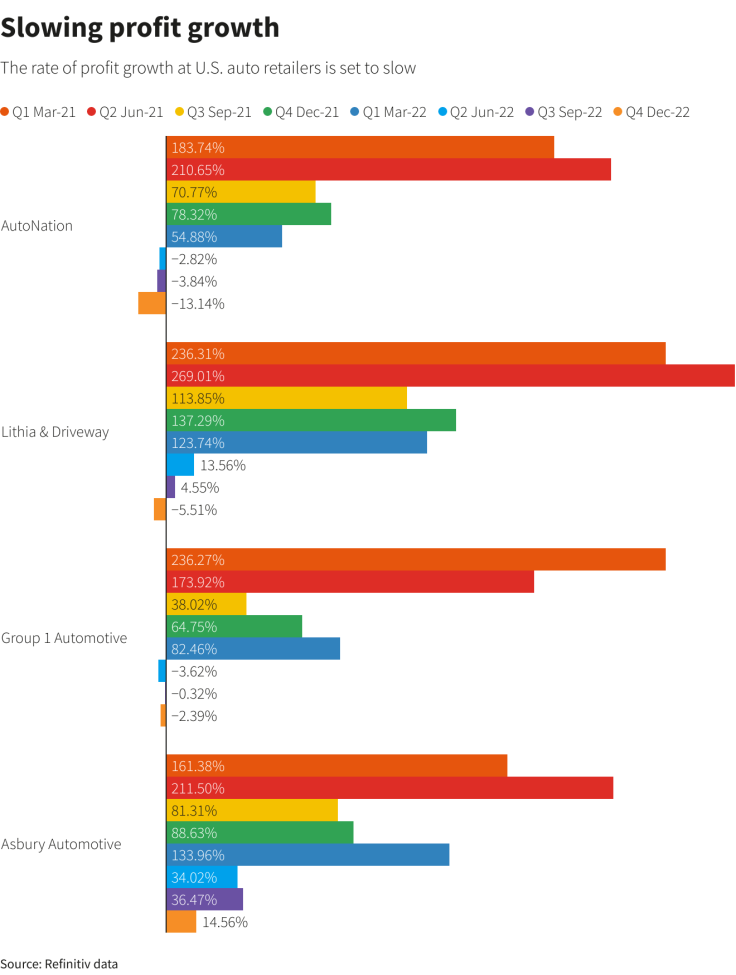

For Auto Retailers, Pandemic-era Profit Boost In Rear-view Mirror

Profit growth at U.S. car dealers is likely to lose momentum in the second quarter, as the auto industry struggles to ramp up production due to parts shortage, while inflation-fueled price hikes keep buyers out of the market.

Preference for personal transport from cash-flushed Americans during the pandemic turbo-charged auto sales last year, despite price hikes, helping retailers such as AutoNation Inc, Lithia & Driveway, Group 1 Automotive Inc and Asbury Automotive Group Inc.

However, with inflation posing a threat to overall consumer spending, auto dealers will find it tough to match their performance in the comparable period as vehicle prices are set to fall from record highs.

"Prices are still hitting record highs but there's concern that there could be a decline in the second half of the year with a recession looking more and more likely," CFRA analyst Garrett Nelson said.

Retailer margins are set to moderate "pretty materially" in the second half, Nelson added.

American's affordability of new vehicles slipped in June from a year earlier, when prices were lower and incentives higher, according to the Cox Automotive/Moody's Analytics Vehicle Affordability Index.

The industry's struggles with chip shortage and supply chain disruptions have also led to a 25% drop in inventory at the start of June, which is a third of the pre-pandemic level, according to analytics firm Wards Intelligence.

Investors will be watching for comments from industry executives for warning signs on consumer behavior in a hyper-inflationary environment. (https://reut.rs/3INok32)

AutoNation Inc, the largest U.S. retailer, is expected to report its slowest quarterly profit growth since 2020 when it reports results on Thursday.

Other dealers such as Lithia & Driveway, Group 1 Automotive Inc and Asbury Automotive Inc are also expected to report weak earnings over the next few weeks.

(Graphic: Slowing profit growth:

)

THE CONTEXT

Industry executives and analysts say demand for vehicles has been strong so far, despite price hikes, which have also protected profits at retailers and automakers such as General Motors Co and Ford Motor Co.

However, recent data and industry analysis show that inflation is slowly eating into sales.

"Channel checks suggest demand has softened, particularly in mid- to low-priced vehicles, and we are assuming some step-down in GPUs and unit sales," Stephens analyst Daniel Imbro said.

Retail sales of new vehicles in June fell 18.2%, a report from auto industry consultants J.D. Power and LMC Automotive showed.

However, demand for high-end cars is strong, J.P. Morgan analysts say, and should cushion falling sales of lower- and mid-range cars.

FUNDAMENTALS

AutoNation:

* Analysts estimate Q2 revenue to grow 0.3% to $7 billion when it reports results on July 21

* Earnings per share (EPS) estimated at $6.22

* The stock has gained about 0.3% of its value this year

Lithia & Driveway:

* Analysts estimate Q2 revenue to grow 21.1% to $7.279 billion

* EPS estimated at $12.05

* The stock has lost about 4.4% of its value this year

Group 1 Automotive:

* Q2 revenue is expected to grow 10.8% to $4.1 billion

* EPS estimated at $10.74

* The stock has lost about 13% of its value this year

Asbury Automotive:

* Asbury Automotive Q2 revenue is expected to grow 51% to $3.9 billion

* EPS estimated at $8.82

* The stock has lost about 3.9% of its value this year

WALL STREET SENTIMENT

* For AN, 6 out of 11 analysts rate the stock "buy" or higher, while 5 have a "hold" rating

* The median price target is $147

* For LAD, 11 out of 13 analysts rate the stock "buy" or higher, while one has a "hold" rating and one "sell" rating

* The median price target is $450

* For GPI, 5 out of 8 analysts rate the stock "buy" or higher, while 2 have a "hold" rating and one "sell" rating

* The median price target is $300

* For ABG, 4 out of 8 analysts rate the stock "buy" or higher, while 3 have a "hold" rating and one "sell" rating

* The median price target is $232.5

© Copyright Thomson Reuters 2024. All rights reserved.