Bank Of America To Fed: Weakening Dollar Signals Coming Inflation

The steady weakening of the U.S. dollar against other major world currencies could push inflation up faster than investors have expected, providing the Federal Reserve additional justification to raise interest rates in the months ahead.

That’s the conclusion of analysts at Bank of America Merrill Lynch, who examined the impact of currency prices on domestic inflation. If correct, the analysis would vindicate Fed Chair Janet Yellen, whose repeated assertion that the forces holding back inflation are merely “transitory” has been challenged by skeptics.

The question, however, is just how much the strengthening of the dollar against a basket of other world currencies affected prices of goods in the U.S. When the dollar gains strength — as it did throughout 2015 amid mounting fears over the course of global growth — goods from abroad become effectively cheaper, putting a drag on U.S. inflation. But those effects aren’t felt evenly throughout the economy.

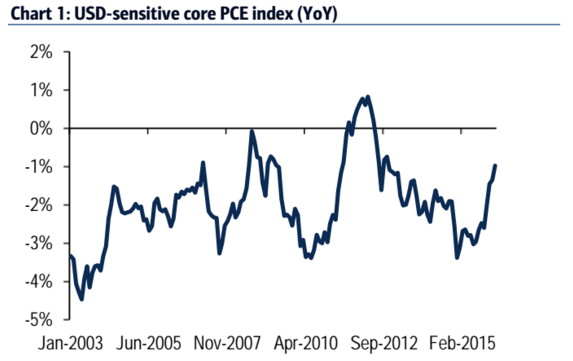

Breaking apart the various sectors that make up core personal consumption expenditures (PCE), the Fed’s preferred inflation measure, Bank of America isolated those goods that have a high import content and close correlation with the dollar, including jewelry, motor parts and appliances. An index of just those items showed a steep increase in the past several months.

Overall, the analysts found that lower import costs put a 0.3 percent damper on year-over-year inflation. That might not sound like much, but 0.3 percent is a large margin relative to the Fed’s target of 2 percent annual gains in core PCE, a metric that excludes food and energy prices. In February, prices accelerated at a clip of 1.67 percent year over year.

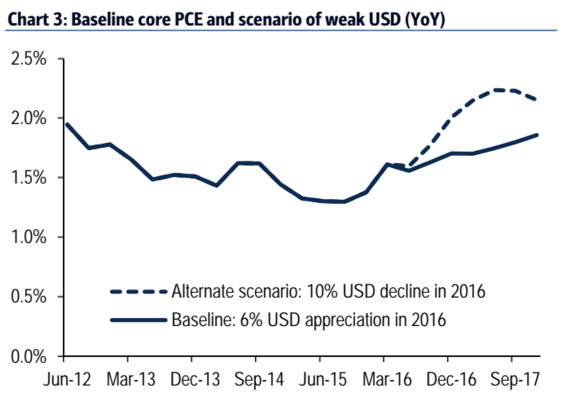

The course of inflation over the rest of 2016 depends in part on the path the dollar takes. After appreciating nearly 10 percent over the course of 2015, the dollar has eased more than 3 percent in 2016. If Bank of America’s current projections hold, core inflation is likely to merely inch toward 2 percent over the next 18 months. But a 10 percent decline in the dollar, totally erasing last year’s gains, would push inflation back to the Fed’s target much quicker, the analysts said.

But all this depends on whether the Bank of America analysts' thesis holds — that import prices really are appreciably raising inflation. Inflation measures rose in the first two months of the year, concurrent with the easing of the dollar. Though the Fed ascribed the pop in inflation to “transitory factors,” Bank of America argued the effect on the dollar wouldn’t be so brief.

“The shift is broad, brisk, and suggests the dollar’s disinflationary drag is fading,” the analysts wrote. In short, that means the Fed may have to take a harder look at the dollar in coming months as policymakers grapple with the decision of when to hike interest rates next.

The Fed's rate-setting committee meets again next Tuesday and Wednesday.

© Copyright IBTimes 2024. All rights reserved.