Bank of England’s New Governor Mark Carney To Unveil ‘Forward Guidance’ For Interest Rates

The big day is almost upon us.

The Bank of England’s new governor, Mark Carney, is expected to unveil new guidance for setting interest rates on Wednesday -- a day that could mark another important step in the evolution of unconventional monetary policy.

Back in March, U.K. Chancellor George Osborne asked the BoE to assess the merits of “forward guidance,” a policy which involves giving a clearer indication of how interest rates might evolve in the short to medium term, in the August Inflation Report. The review will be published on Wednesday, Aug. 7 by Carney at a press conference in London at 5:30 a.m. EDT.

The U.S. Federal Reserve adopted the forward guidance in December and the European Central Bank began giving forward guidance in July. Economists have said they expect Carney, a pioneer of forward guidance during his recent tenure at the Bank of Canada, will persuade BoE officials to follow suit.

The Fed has tied the possibility of higher interest rates to a fall in unemployment to 6.5 percent, while maintaining the fight to keep inflation below 2.5 percent. The BoE could also choose to link low interest rates to a threshold for the unemployment rate.

“We are convinced that the Bank of England will formally adopt a policy of forward guidance on interest rates,” said Howard Archer, chief U.K. and European economist at IHS Global Insight, adding that the BoE will most likely adopt economic thresholds relating to unemployment levels to support this policy.

“The Bank of England will hope that by making it abundantly clear that interest rates will not be rising for some considerable time this will keep gilt yields down and will also encourage businesses and consumers to invest and spend more through providing greater certainty that their borrowing costs will not be increasing any time soon,” Archer said.

Last week, the BoE’s Monetary Policy Committee voted to keep its target for bond purchases at 375 billion pounds ($575 billion) and left its key rate at 0.5 percent, a record low.

While case for a lowering of interest rates has been diluted by the recent improvement in the British economy, Archer thinks that growth is still likely to be limited overall for some time to come and with prolonged tight fiscal policy, he believes that the central bank will be in no hurry to raise interest rates. Archer expects interest rates to stay at 0.50 percent until at least late-2015.

After several years of near-stagnation, the economy expanded 0.6 percent in the second quarter. Furthermore, the economy appears to have enjoyed a decent start to the third quarter, with CBI surveys pointing to improved manufacturing activity in July and relatively healthy retail sales. In addition, consumer confidence jumped to a 39-month high in July.

Many market participants have started to wonder whether the recent run of very strong activity and survey data will persuade the MPC that it is no longer necessary to introduce forward guidance.

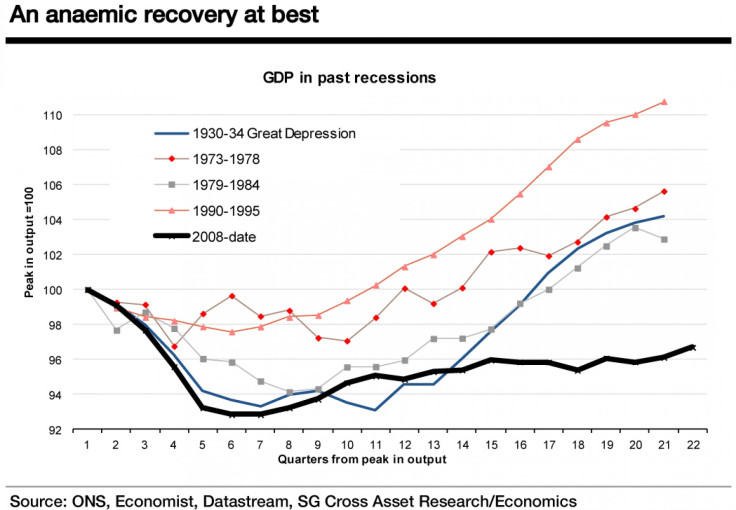

“We disagree with that view,” said Brian Hilliard of Societe Generale. “The current recovery still stands out as being extremely anemic. The current recovery is the only one, after over five years from the peak of output, in which the economy is far from regaining that peak.”

© Copyright IBTimes 2024. All rights reserved.