Bank Holding Companies Shoveled Billions Of Dollars At Shareholders And For Stock Repurchasing Right Up To The Start Of Their Taxpayer-Funded Bailouts And Guarantees

Bank holding companies continued to pay shareholder dividends and engage in stock repurchasing programs in the quarters leading up to the last economic recession, well after it was apparent there was something seriously wrong in the banking sector that would require taxpayer funding to keep the system afloat.

“Academics, industry analysts and policymakers have noted that these payments reduced capital at these firms at a time when there was considerable uncertainty about the full extent of losses facing individual banks and the banking industry,” said a report posted Wednesday by Beverly Hirtle, Federal Reserve Bank of New York senior vice president for research.

In other words, shareholders considerations were put to the front of the line while banks ended up going to the U.S. taxpayer for preferential treatment and guarantee to keep them from going under. Some of the country’s largest bank holding companies, including Citigroup Inc (NYSE:C), Bank of America Corp (NYSE:BAC), American International Group Inc (NYSE:AIG) and JPMorgan Chase & Co. (NYSE:JPM) received TARP funds and were given asset guarantees.

These large banks have since returned the bailout money to the government, including profit, though many small banks are still in the red, and the “too big to fail” problem -- where banks might continue to engage in risky behavior if the government is there to provide them a unique safety net -- persists. In many cases, banks also used money they were supposed to lend to small businesses to repay the federal government, which led to a credit crunch in vital commercial paper that small companies rely on. (For a thorough list of TARP recipients and who still owe money to Uncle Sam, check out Propublica’s Bailout Recipients page.)

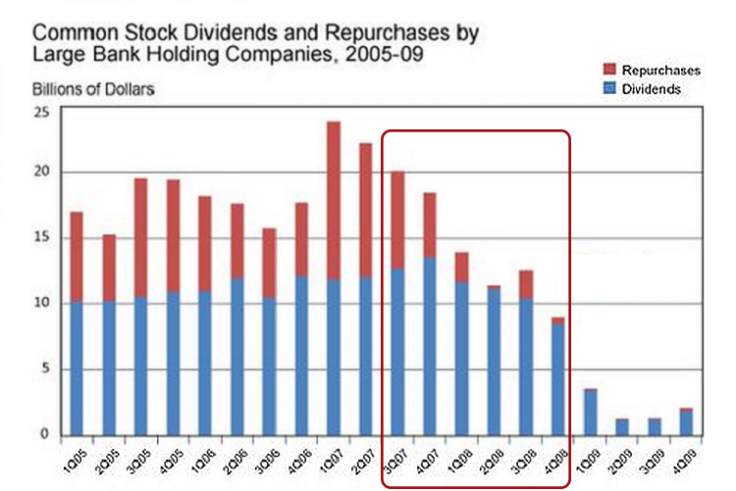

Bank capitalization was undercut by these dividends payments and stock repurchases even as it was becoming increasingly apparent that banks would require capital through the Troubled Asset Relief Program (TARP). President George W. Bush signed TARP into law on Oct. 3, 2008, in the same quarter that bank holding companies paid out more than $8 billion in dividends and were still buying back significant amounts of shares, depleting their ability to contribute to the capitalization needs.

Between the middle of 2007 and the end of 2008, bank holding companies with more than $10 billion in assets continued to shovel billions of dollars at shareholders. In fact, dividend payments increased in the third and fourth quarters of 2007 and remained above $10 billion per quarter until the end of 2008.

Stock repurchasing -- when banks spend money to raise the value of shares (and the wealth of their shareholders) by buying back equity from the markets -- averaged $7.5 billion per quarter in the period leading up to the financial crisis, representing about two thirds the amounts these banks were giving to shareholders in quarterly dividend payments.

It wasn’t until after the TARP fund started to be divvied out that the nation’s largest banks significantly curtailed dividend payments and stock repurchasing. But from the third quarter of 2007 until the end of 2008, it was business as usual.

© Copyright IBTimes 2024. All rights reserved.