The Banker Catcher: Head Of Tarp Gets Tough On Bankers And Send Dozens To Jail

"Some bankers cultivated a culture of self-dealing, criminally concealing that the bank was funding their luxury lifestyles, believing they were entitled to the finest money could buy ...”

These are the forthright words of the special inspector general of the Troubled Asset Relief Program, Christy L. Romero.

Romero's congressional report was released this week and featured a number of other strong comments, but it also contained a great deal of data that supports the notion that U.S. regulators do have teeth and are not afraid to use them.

Summary of findings:

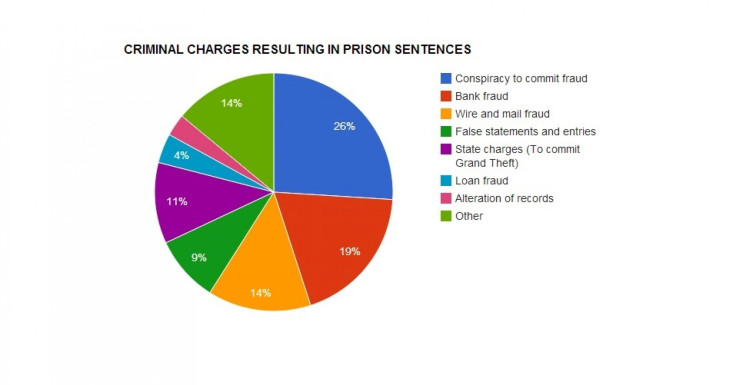

According to the report, criminal charges have been brought against 154 individuals, including 98 senior officers (CEOs, owners, founders, or senior executives) of their organizations. Of those, 112 defendants now have criminal convictions of which 65 were given prison sentences (others are still awaiting sentencing).

Civil cases and other actions against 63 individuals (including 49 senior officers) and 51 entities, some of which will face criminal and civil charges.

Sixty individuals have been temporarily suspended or permanently banned from working in the banking or financial industry, working as a contractor for the federal government, or as a licensed attorney.

Combined, they have lost a total of $4.68 billion in restitution and forfeiture, civil judgments and other orders. This includes $4.2 billion for restitution, forfeiture of $233.1 million and civil judgements and other orders for $288 million.

© Copyright IBTimes 2024. All rights reserved.