Barrick Gold (ABX) Suspends Construction Of Massive Pascua Lama Mine In Chile

Barrick Gold Corp. (TSE:ABX), the Canadian company that produces the most gold in the world, said in its third-quarter earnings report Thursday that it will temporarily suspend construction at its massive Pascua-Lama mine in Chile to save cash in the short term.

The Pascua-Lama mine, which is also partly situated in Argentina, contains almost 17.9 million ounces of gold reserves, and is one of the world’s largest gold and silver resources.

Barrick took a severe $5.1 billion impairment charge because of Pascua-Lama in the second quarter, which prompted adjusted profits to fall by 22 percent.

The company said Thursday that Pascua-Lama construction required for environmental protection and regulatory reasons would continue. The Chilean Supreme Court ruled in late September that Barrick needed to expand its work on water management systems before it could resume construction, the latest in a string of environmental and regulatory hurdles thrown up before the project.

Barrick executives said previously that Pascua-Lama could be operational by mid-2016. The suspension makes that previous timeline far more uncertain.

“This decision will postpone and reduce near-term cash outlays, and allows the company to proceed with development at the appropriate time under a more effective, phased approach,” read a Barrick statement. “The decision to re-start will depend on improved project economics such as go-forward costs, the outlook for metal prices, and reduced uncertainty associated with legal and other regulatory requirements.”

“This is the right course of action for the company,” said Barrick CEO Jamie Sokalsky, in an earnings conference call on Thursday morning. He described the mine as the one of his top priorities, but also Barrick’s “biggest challenge.”

“Metal prices have continued to remain at lower levels for a longer period of time, and other risks and uncertainties related to regulatory and other legal matters persist,” he continued. “Accordingly, capital costs estimates for the project have continued to come under pressure.”

Only clarity in regulatory and legal matters can guarantee that the mine will move forward to completion, continued Sokalsky on the call.

Barrick has struggled with soaring costs, especially in light of gold price declines this year, and has reacted by closing and consolidating several mines.

The company cut its capital cost guidance for fiscal 2014 by an extra $1 billion on Thursday.

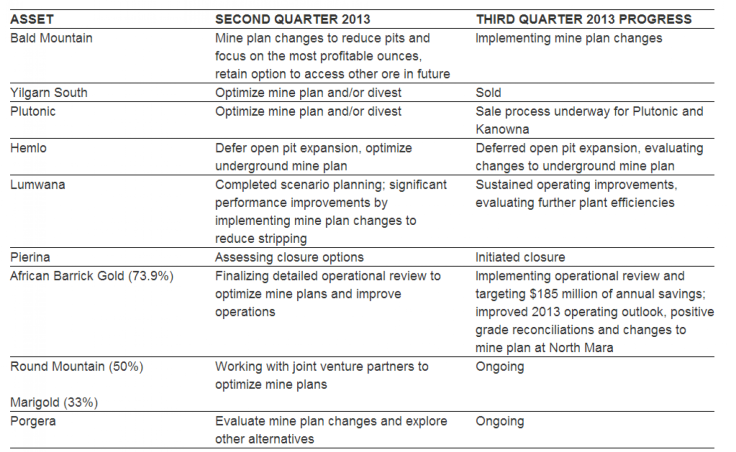

The company included a list of its assets, mostly mines, charting their divestments in the past year.

Barrick earned a profit of $172 million in the third quarter, though that’s in light of a $7.5 billion loss for the year to date. Revenues fell by about $400 million from the same quarter a year before. Barrick has $1.3 billion of debt maturing by the end of 2015.

© Copyright IBTimes 2024. All rights reserved.