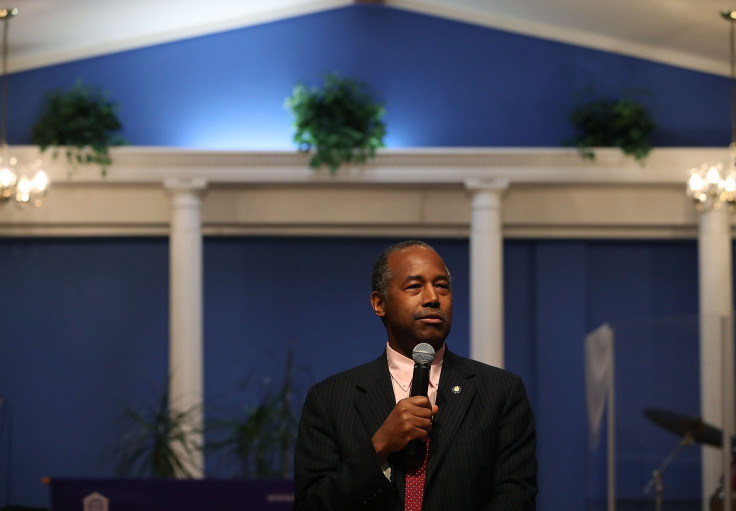

Ben Carson Mistakes Real Estate Owned By Banks For Oreo, The Sandwich Cookie, In Congressional Hearing

Secretary of Housing and Urban Development Ben Carson on Tuesday confused the lending industry term, REO, for real estate taken back by banks or government, with the iconic chocolate sandwich cookie that has white filling.

Rep. Katie Porter, D-Calif., in questioning the secretary regarding the higher rates of foreclosures and home losses by FHA borrowers than borrowers in Government-Sponsored Enterprise programs, asked the secretary if he knew what an REO was.

“An Oreo?” he asked.

OH, REO! Thanks, @RepKatiePorter. Enjoying a few post-hearing snacks. Sending some your way! pic.twitter.com/q4MMTBWVUI

— Ben Carson (@SecretaryCarson) May 21, 2019

“Not an Oreo, an R-E-O,” the freshman representative corrected. She went on to explain that REO stood for real estate owned usually by the government or returned to banks after a borrower has defaulted and the property has not sold at auction.

The Federal Housing Administration (FHA) is a government agency partially created by the National Housing Act of 1934. One of the purposes of the FHA is to provide a financing system through the federal government that insures home mortgages, in an attempt to stabilize the housing market.

Government-Sponsored Enterprise programs are quasi-government entities that target specific sectors of the economy for funding, such as agriculture, housing, or student loans. The risk of loss to the government is generally lower with these organizations since the government shares risk with private entities, and those entities generally have more leeway in which to determine profit through interest rates and other mechanisms.

.@RepBeatty "Are you familiar with OMWI and what it is?"@SecretaryCarson: "With who?"

— CSPAN (@cspan) May 21, 2019

Beatty: "OMWI?"

Carson: "Amway?" pic.twitter.com/5Jqf1sy72t

Porter explained to the secretary that FHA loans had a higher rate of foreclosure rather than going to loss mitigation or non-foreclosure alternatives like short sales and that have less impact on a defaulted borrower’s credit.

“So, I’d like to why we’re having more foreclosures that end in people losing their homes, with stains to their credit, and disruption to their communities and their neighborhoods, at FHA than we are at the GSEs.”

.@RepAOC @AOC asks about One Strike Rule and No-Fault Policy and if Secretary Carson would support moving the policies over to a more holistic/case-by-case review.

— CSPAN (@cspan) May 21, 2019

@SecretaryCasron: "I'm always in favor of more flexibility." pic.twitter.com/7ze07GqZc9

In what seems a counter-intuitive situation, Porter was asking why fully government-insured borrowers were being foreclosed on and losing their homes at higher rates than borrowers in quasi-government programs with shared risk.

© Copyright IBTimes 2024. All rights reserved.