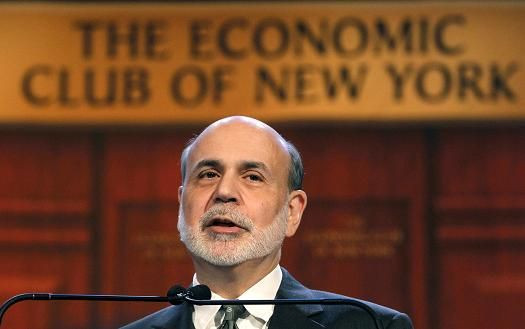

Bernanke Challenges Lawmakers To Address Nation's Fiscal Problem

Federal Reserve Chairman Ben Bernanke used a wide-ranging policy speech Tuesday to challenge federal lawmakers to get serious about the nation's "urgent" fiscal challenges, and he offered support for a two-step approach to solving the coming tax hikes and government spending cuts.

Speaking to a gathering of the Economic Club of New York that was meeting in a massive Marriott Marquis hotel conference room that he jokingly referred to as "intimate," Bernanke said, "We will do our best to provide support to the economy," but he added that policymakers needed to take the baton from his institution since “the ability of the Fed to offset headwinds is not infinite."

Bernanke did not exactly come out swinging, and he dedicated the first half of his speech to explaining how the Federal Reserve had “spent a good deal of effort attempting to understand the reasons why the economic recovery has not been stronger."

"The pace of recovery has been slower than the FOMC (Federal Open Market Committee) participants and many others had hoped or anticipated when I spoke here about three years ago,” Bernanke said.

He then proceeded to go over most of the explanations the Fed has provided in the past for that phenomenon, including a slower depressed housing market, overly tight banking standards and the effect on household finances of budget cuts at the local and state level.

Bernanke also suggested that the U.S. economy’s potential growth rate might have taken a hit as a result of the financial crisis, explaining that “slower growth of potential output would help explain why the unemployment rate has declined in the face of relatively modest output gains we have seen during the recovery.”

But the real fireworks came in the second half of his speech, when Bernanke delivered what amounts to his clearest criticism so far of U.S. policymakers' efforts to resolve federal fiscal issues. Bernanke spoke of “two daunting challenges” of avoiding “the so-called fiscal cliff” and then tackling the “urgent issue of longer-run fiscal sustainability.” These challenges, he said, must be addressed in a step-wise fashion, “one step by the start of the new year and the other no later than the spring.”

The two-step approach makes sense, Bernanke explained, since “preventing a sudden and severe contraction in fiscal policy early next year will support the transition of the economy back to full employment; a stronger economy will in turn reduce the deficit and contribute to achieving long-term fiscal sustainability.”

Near the end of his speech and in the question-and-answer session that followed, the Fed head particularly focused on how “uncertainty,” while hardly quantifiable, was the main thing policymakers should try to avoid.

Continuing to push off difficult policy choices will only prolong and intensify these uncertainties,” Bernanke said, asking Congress “to deliver a reasonable solution with a minimum of uncertainty and delay.”

Bernanke even suggested at one point that any kind of forceful deal would be better than no deal at all.

"We'll see what kind of deal comes out," Bernanke said in response to a question, from Harvard University economist Martin Feldstein, about what would happen if negotiations to avoid the fiscal cliff still end up causing deep tax increases.

"You're correct that even if some extreme scenarios are avoided, some plausible scenarios involve relatively contractionary policy. It’s up to Congress and the President to figure out how they want to make the trade-off.”

Asked specifically about uncertainty by another club member, he noted that “thirty years ago, when I was an economics grad student, I wrote my dissertation on how uncertainty affects investment spending … and I concluded it was not a good thing.”

To laughter from the audience, Bernanke concluded: “And they gave me a Ph.D. for that.”

© Copyright IBTimes 2025. All rights reserved.