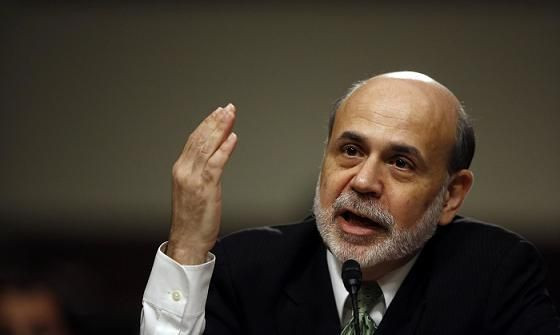

Bernanke Goes After Racial Discrimination In Bank Lending

A day after minutes were released that showed the Fed's continuing concern about getting macro-level economic guidance right, the head of U.S. central bank went back to micro basics, warning against racial discrimination in lending in a speech about the state of the housing market.

"Lower-income and minority communities are often disproportionately affected by problems in the national economy, and the effects of the housing bust have followed that unfortunate pattern," Bernanke said at the Operation HOPE Global Financial Dignity Summit in Atlanta.

Regarding the general state of the housing market, Bernanke said the housing market was still being affected by tight lending standards, though he said this problem was improving as the rest of the economy healed.

"The housing sector is far from being out of the woods," Bernanke said. "Strengthening and broadening the housing recovery remain a critical challenge for policymakers, lenders and community leaders.”

But rather than focusing on the general state of the market, Bernanke’s speech dwelled on the disparities still seen in lending to minorities, highlighting the two main issues minorities face currently.

"One is redlining, in which mortgage lenders discriminate against minority neighborhoods, and the other is pricing discrimination, in which lenders charge minorities higher loan prices than they would to comparable nonminority borrowers," Bernanke said.

"We remain committed to vigorous enforcement of the nation's fair lending laws," he added.

As the nation’s most visible bank regulator since the global financial crisis of 2008, the Federal Reserve has some discretion in guiding banks toward complying with U.S. anti-discrimination laws when lending. Most recent headlines about regulators moving against banks for exhibiting patterns of discrimination have come from the Justice Dept. Over the past year, both Wells Fargo & Co. (NYSE: WFC) and Bank of America Corp. (NYSE: BAC), two of the nation’s largest lenders, have been involved in federal lawsuits alleging racial discrimination in lending.

Many smaller mortgage originators have been sued for targeting minorities when offering subprime loans during the economy’s heyday.

Last month, the American Civil Liberties Union sued Morgan Stanley (NYSE: MWO) for predatory lending practices that targeted minorities, the first time an investment bank was involved in that kind of legal action.

© Copyright IBTimes 2024. All rights reserved.