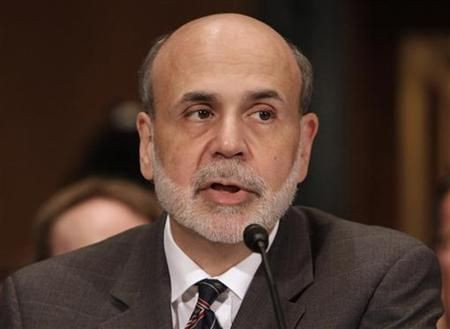

Bernanke Pressures Congress to Save Economy

With the economy slowing and the markets crashing, Federal Reserve Chairman Ben Bernanke put the burden squarely on Congress to act.

In a scheduled testimony before the Joint Economic Committee of Congress, Bernanke said monetary policy, which he and his committee control in the U.S., can only do so much.

“It is not a panacea for the problems currently faced by the U.S. economy,” he said.

Instead, it takes the actions of all policymakers, including those who control the “critically” important fiscal policy, namely Congress and President Obama.

Bernanke told them to accomplish two goals: lowering the long-term budget deficit while supporting the near-term economic recovery.

“These first two objectives are certainly not incompatible, as putting in place a credible plan for reducing future deficits over the longer term does not preclude attending to the implications of fiscal choices for the recovery in the near term,” he said.

The Federal Reserve, on its part, has done plenty to support the economy.

It has lowered interest rates to near zero (and promised to keep it that way until at least mid-2013), rolled out two rounds of balance sheet-expanding quantitative easing, and most recently extended the maturity of its balance sheet.

However, Bernanke noted the Fed’s willingness to do more to support the economy and markets, most likely by expanding again the size of its balance sheet.

“The Committee will continue to closely monitor economic developments and is prepared to take further action as appropriate to promote a stronger economic recovery in a context of price stability,” he said.

© Copyright IBTimes 2024. All rights reserved.