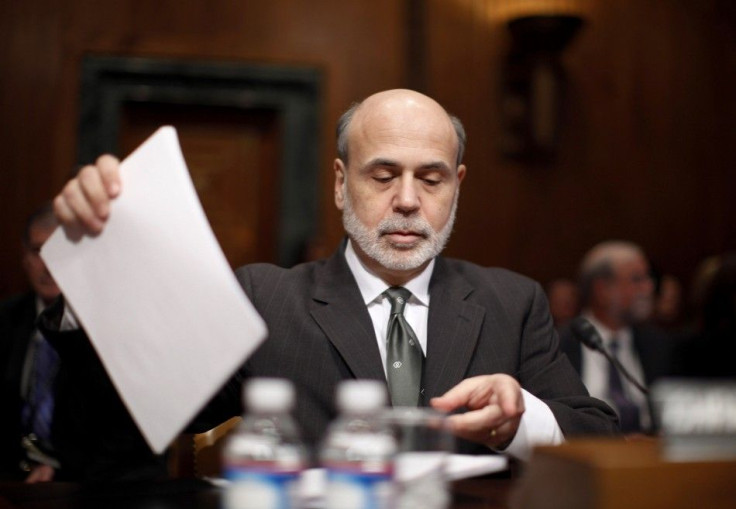

Bernanke Urges Congress to Address Bush Tax Cuts

(Reuters) -- Federal Reserve Chairman Ben Bernanke on Tuesday warned Congress that putting off a decision on the fate of expiring Bush administration tax cuts could unsettle businesses and households, undercutting the U.S. economic recovery.

With presidential and congressional elections looming in November, many analysts think Congress is unlikely to act until the final months of the year. The tax cuts expire on January 1.

Bernanke told the Senate Budget Committee that lawmakers might not enjoy the luxury of waiting.

I don't know exactly when the uncertainty would become a factor, but surely as we get closer to January 1 and Congress has not given a clear road map for how it plans to proceed, that would certainly affect planning, business decisions, household decisions, as they look ahead to the next year, he said.

The Congressional Budget Office has said that if all the Bush tax cuts were allowed to expire, U.S. economic growth would slow to 1.1 percent in 2013, more than a full percentage point below where Fed officials expect it to land this year.

Forecasts released by the Fed last month showed most policymakers at the central bank expect growth next year to come in a 2.8 percent to 3.2 percent range, suggesting they foresee at least some of the tax cuts being extended.

I want to be very clear that I'm in no way stepping back from my strong advocacy of maintaining fiscal stability in the longer term, Bernanke said. But I think there is a concern there that this very sharp change in the fiscal position in a very short time might slow the recovery.

President Barack Obama wants to continue the Bush tax cuts for the middle class while ending them for upper-tier earners.

Republicans oppose any tax hikes, while saying they want to reform the entire tax code and lower top rates. The more radical Republicans backed by the fiscally conservative Tea Party movement want steep spending cuts immediately.

In his testimony, Bernanke coupled his plea that Congress come up with a credible long-term plan to cut U.S. budget deficits, with a caution against any steps that could undercut the still-fragile recovery.

The more you can demonstrate a will and commitment to sustainability over the longer term ... the more flexibility there will be to address near-term concerns relating to the recovery, he said.

Congress must not push the issue off to manana, Bernanke added.

Just simply promising future action risks at least an adverse market reaction, an adverse reaction in terms of confidence and so on, he said.

(Additional reporting by Pedro Nicolaci da Costa; Editing by Tim Ahmann)

© Copyright Thomson Reuters 2024. All rights reserved.