Billionaire Steven A Cohen's SAC Capital Advisors Affiliates Settle 2 SEC Insider-Trading Cases For Stunning $615.7 Million

Two affiliates of billionaire Steven A. Cohen's SAC Capital Advisors settled Friday insider-trading cases brought by the U.S. Securities and Exchange Commission for $615.7 million.

In one case concluded Friday, the SEC announced the Stamford, Conn.-based hedge-fund advisory firm CR Intrinsic Investors agreed to pay $601.8 million to settle charges that it participated in an insider-trading scheme involving a clinical trial for an Alzheimer’s drug being jointly developed by two pharmaceutical companies.

The settlement filed with the U.S. District Court for the Southern District of New York is the largest ever in an insider-trading case, requiring CR Intrinsic to pay $274,972,541.00 as disgorgement, $274,972,541.00 as a penalty, and $51,802,381.22 as prejudgment interest. It is subject to the approval of District Judge Victor Marrero.

“The historic monetary sanctions against CR Intrinsic and its affiliates are sharp warning that the SEC will hold hedge-fund advisory firms and their funds accountable when employees break the law to benefit the firm,” George S. Canellos, acting director of the SEC’s Division of Enforcement, said in a statement.

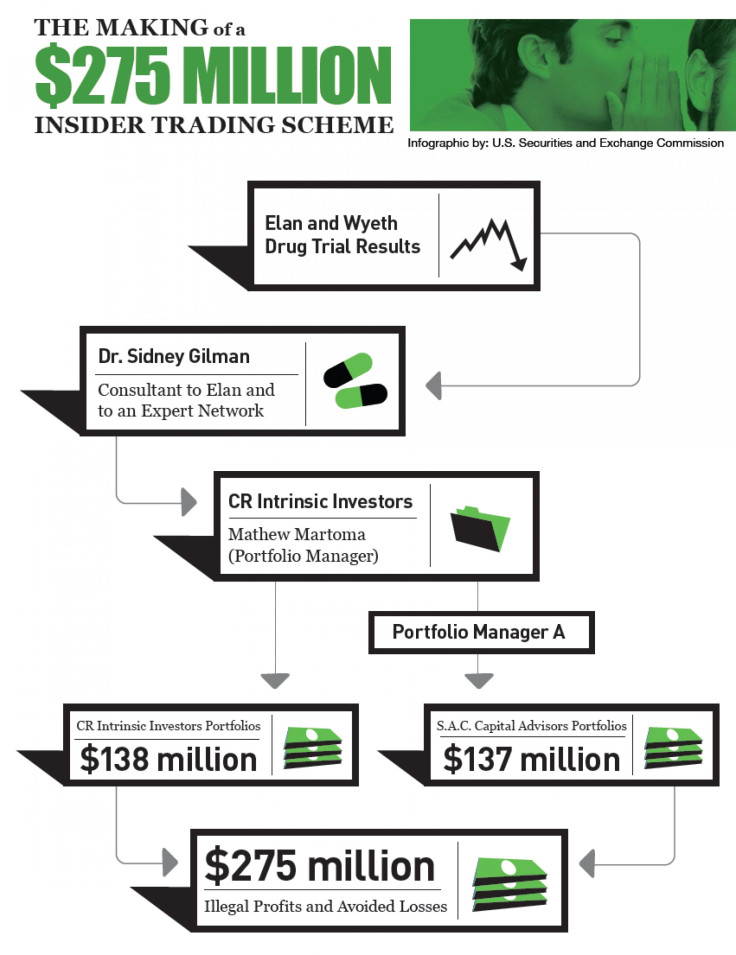

The SEC had charged CR Intrinsic with insider trading last November, alleging that Mathew Martoma, one of its portfolio managers, illegally obtained confidential details about the clinical trial from Dr. Sidney Gilman, who was chosen by the pharmaceutical companies -- the Elan Corp. (NYSE:ELN) and Wyeth, now a unit of Pfizer Inc. (NYSE:PFE) -- to present the final trial results to the public. (The infographic prepared by the SEC accompanying this article illustrates this purported flow of confidential information.)

The SEC’s complaint against CR Intrinsic, Martoma and Gilman alleged that during phone calls arranged by a New York-based expert network firm that had engaged Gilman as a medical consultant, he tipped Martoma with safety data and eventually details about negative results in the trial about two weeks before they were made public in July 2008. It also alleged that Martoma and CR Intrinsic then caused several hedge funds to quickly sell more than $960 million worth of Elan and Wyeth securities.

In an amended complaint filed Friday, the SEC added SAC Capital Advisors and four hedge funds managed by CR Intrinsic and SAC Capital as relief defendants because they each had ill-gotten gains from the insider-trading scheme. These ill-gotten gains included not only profits made but also losses avoided, the SEC indicated.

If the judge OKs the settlement, it would resolve the SEC’s charges against CR Intrinsic and the relief defendants relating to the trades in the securities of Elan and Wyeth made between July 21 and July 30 in 2008. The settling parties neither admit nor deny the charges.

Meanwhile, the SEC said the settlement does not resolve the charges against Martoma, whose case continues in litigation. The court previously entered a consent judgment against Gilman requiring him to pay disgorgement and prejudgment interest, while permanently enjoining him from further violations of the anti-fraud provisions of the federal securities laws.

In the other case concluded Friday, the SEC announced the New York-based hedge-fund advisory firm Sigma Capital Management agreed to pay $13.9 million to settle charges that it participated in insider trading based on nonpublic information obtained through one of its analysts about the quarterly earnings of Dell Inc. (NASDAQ:DELL) and the Nvidia Corp. (NASDAQ:NVDA).

The settlement filed with the U.S. District Court for the Southern District of New York would require Sigma Capital to pay $6,425,000.00 as disgorgement, $6,425,000.00 as a penalty, and $1,094,161.92 as prejudgment interest. It also is subject to the approval of the court.

The SEC said that this case was based on its ongoing investigation into expert networks and the trading activities of hedge funds. It began last year with charges against several hedge-fund managers and analysts, including Jon Horvath, a former analyst at Sigma Capital who admitted liability in a separate settlement this month.

In a complaint filed Friday with the court, the SEC additionally charged Sigma Capital in the insider-trading scheme and named two affiliated hedge funds -- Sigma Capital Associates and SAC Select Fund -- as relief defendants that unjustly benefited from Sigma Capital’s violations. SAC Select Fund is an affiliate of SAC Capital Advisors.

The SEC’s complaint alleged that Horvath provided Sigma Capital portfolio managers with nonpublic details about quarterly earnings at Dell and Nvidia after he learned them via a group of hedge-fund analysts with whom he regularly communicated. Based on the confidential information, Sigma Capital purportedly traded Dell and Nvidia securities in advance of earnings announcements in 2008 and 2009 to secure gains of $6.425 million in either profits made or losses avoided by its hedge-fund affiliates.

“Sigma Capital’s violations of the securities laws were blatant and recurring,” Sanjay Wadhwa, senior associate director of the SEC’s New York Regional Office, said in a statement. “The firm obtained key quarterly earnings information before it was public and exploited an unfair edge over the rest of the market to reap millions of dollars in unlawful gains.”

If the court OKs the settlement, it would permanently enjoin Sigma Capital from future violations of the anti-fraud provisions of the federal securities laws. Sigma Capital is neither admitting nor denying the charges.

Meanwhile, the Associated Press quoted Stamford, Conn.-based SAC Capital Advisors as saying in a statement Friday: “This settlement is a substantial step toward resolving all outstanding regulatory matters and allows the firm to move forward with confidence. We are committed to continuing to maintain a first-rate compliance effort woven into the fabric of the firm.”

Although the announced settlements on Friday may indeed represent substantial steps toward resolving all outstanding regulatory matters, the complaint filed Friday in the Sigma Capital case indicates more federal investigations may be in store for either SAC Capital Advisors or its affiliates, as Bloomberg News reported.

However, none of these matters has involved Cohen personally.

“Steve Cohen has not been charged with any wrongdoing and has done nothing,” said Jonathan Gasthalter, a SAC Capital Advisors representative quoted by Bloomberg.

Cohen, 56, was ranked No. 6 on Forbes' list of “Richest American Hedge Fund Managers” last year with a net worth of $8.8 billion, which, apropos of nothing, is about 14.29 times $615.7 million.

© Copyright IBTimes 2024. All rights reserved.