Bitcoin Is Not A Solid Investment, J.P. Morgan Report Concludes

JPMorgan Chase (NYSE:JPM) thinks investing into bitcoin is an audacious idea. The financial services goliath wants its forex investors to know that bitcoin isn’t all it’s cracked up to be. So much so that the company released a report Tuesday, “The Audacity of Bitcoin,” authored by John Normand, its managing director and head of global FX strategy, highlighting the points that critics of the virtual currency have been making for some time.

The report does a fair job at outlining both the good and the bad of bitcoins. It gives fair weight to the interest in the virtual currency. “Hence the purported appeal of a virtual currency: a medium of exchange, a unit of account and a store of value without the alleged recklessness, capriciousness, siphoning and snooping inherent in traditional systems,” the report states. “Even leaving aside this caricature of bitcoin's underlying philosophy, there is something compelling about the idea.” Normand classifies the caricatures of bitcoin as it being “allegedly only preferred by criminals, libertarians and anarchists.”

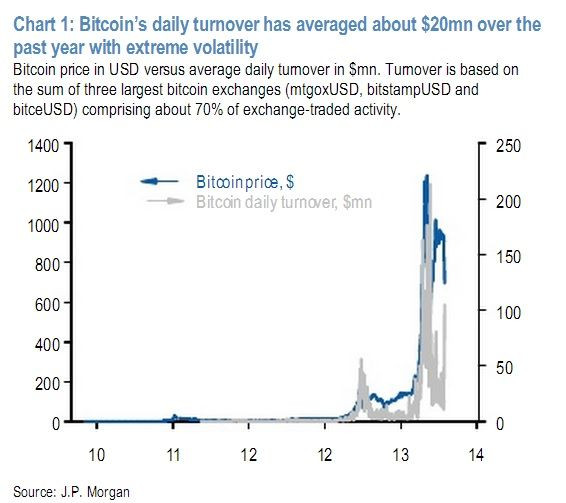

Normand eventually lands on the conclusion that most FX investment companies come to: Bitcoin lacks staying power, and therefore shouldn’t be invested in, because it is not a fiat currency, “or paper and coins with no intrinsic worth whose perceived value stems from government declaration and collective belief.” He cites the extreme volatility that bitcoin has endured in the last year and the daily turnover as reasons to avoid the virtual currency.

But then, Normand casts doubt on his own conclusion, stating, “At the risk of sounding like a Luddite unable to recognize the transformative effects of evolving technologies – similar to the late 1970s prediction that ‘there is no reason for any individual to have a computer in his home’ – bitcoin looks like an innovation worth limiting exposure to.” In this statement, he concedes that he could be wrong. Normand’s assumption, though, is that bitcoin seeks to replace fiat currencies.

According to Emma Lawson, senior currency strategist for the National Australia Bank, bitcoin is in fact more like a payment system that works in tandem with fiat currencies. “But, if enough people believe in it, and use it, it may be here to stay as a payment system,” Lawson stated in a report on bitcoin and the Australian dollar. Normand specifies that the main attraction for bitcoin is the minimal fees that users incur. “Their greatest appeal is the apparent cheapness of peer-to-peer fund transfers,” states Normand, “though it is unclear how economical these transactions truly are when the virtual world interacts with the real world.”

The report concludes that bitcoin’s main investment appeal is the potential for net gains in long-term investing. However, due to the nascent nature of bitcoins, there is no analytical models that can graph a potential future. “The best framework is to consider the behavior of supply-constrained commodities when the market balance tightens due to rising demand,” Normand suggests. “Price trends turn exponential until supply increases (impossible with bitcoin unless network users collectively agree to alter the protocol), or high prices curb demand.” Considering Normand’s bitcoin recipe, wouldn’t a fixed supply with curbed demand create a price equilibrium, or value stability? Isn’t that a good thing for a currency?

© Copyright IBTimes 2024. All rights reserved.