Bitmain Cryptojacked Customers' Mining Devices, Lawsuit Claims

Cryptocurrency mining equipment maker Bitmain received a class action lawsuit in the Northern California district, filed by Bitmain's customer and bitcoin miner, Gor Gevorkyan, who accused the company of cryptojacking its customers' devices.

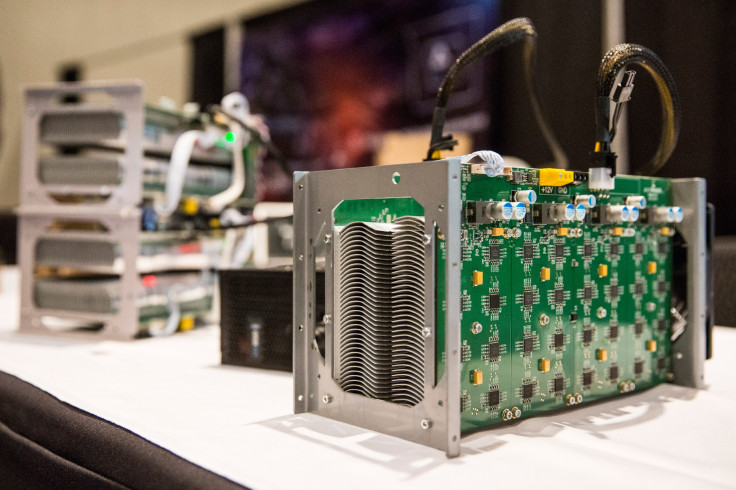

Gevorkyan's lawsuit sought damages of approximately $5 million on behalf of miners everywhere, CCN reported Friday. In his complaint, he alleged that Bitmain — the largest designer of ASIC chips, necessary for bitcoin mining — cryptojacked its customers by utilizing their newly-purchased ASIC devices.

According to CrowdFund Insider, Bitmain allegedly used its customers’ newly-purchased ASIC devices to mine cryptocurrency at full power when those customers were setting up (configuring) their devices. Cryptojacking is a kind of cyberattack where a hacker hijacks a target's processing power in order to mine cryptocurrency on the hacker's behalf.

Bitmain, cofounded by Jihan Wu (involved in the recent bitcoin cash hard fork), also operates BTC.com and Antpool, two of the largest bitcoin mining pools worldwide, that bring together resources of several individual miners, who share their processing power.

“Until approximately 2 years ago, the machines started in low power mode… (and) there was no default account setting to which virtual currency mined during the setup process was directed and transferred," CrowdFund Insider reported Saturday, citing Gevorkyan who is from Los Angeles County.

Gevorkyan also added there was a recent change Bitmain made to its ASIC devices which allowed the devices to start in full power high energy consumption mode instantly and lasted until the setup process completed, without the customer’s account being linked to the device.

“The default account setting on the Bitmain ASIC devices is set to contribute to Bitmain’s own account on its own Antpool server. Bitmain’s ASIC devices are preconfigured to use its customers’ electricity to generate cryptocurrency for the benefit of Bitmain rather than its customers… and lay the substantial costs of operating the ASIC devices at the feet of its customers… (resulting in) out of pocket losses," CrowdFund Insider reported, citing Gevorkyan's claim.

An external Bitmain spokesperson responded to the allegations and told CCN the company did not use customer devices to mine cryptocurrency:

"Bitmain does not use customer devices to mine. Mining for itself has long been a part of Bitmain’s business and it has always been transparent."

Gevorkyan filed the lawsuit based on his experience since January when he started using Bitmain's mining device. Regarding the jurisdiction where he customer filed the complaint, he justified that courts in North California court had jurisdiction over Bitmain because the company had a branch office in Santa Clara, California.

The case filing read that Bitmain made "$3-4 billion in operating profits in 2018”, which, if Gevorkyan’s charges are true, were made up of profits earned from unknowing customers.

Bitmain is also caught up in another court case, one that it filed Nov. 7. The company alleged that an unknown suspect obtained unlawful access to its account on cryptocurrency exchange Binance, and stole 617 bitcoins (which were worth about $5.5 million at the time). At its current price of $3,966 at 4:30 a.m. EST Monday, they were worth about $2.4 million.

The company had also applied to have its shares listed on the Hong Kong Stock Exchange in September, when it revealed its detailed financial statements of the business for the first time, while submitting the IPO prospectus.

Before it filed for the IPO, another allegation in June claimed Bitmain was using its new mining innovations even before making them available to the public, and that it was running a "secret mining operation". However, Wu said at the time: “No, it never happened. We have a small-scale test. We don’t do that. That is not our strategy.”

© Copyright IBTimes 2024. All rights reserved.