Bogus Wireless Fees: Study Finds Nebraska, New York And Washington Hit Hardest By Patchwork Of Local And State Taxes And Fees

Here’s why people in New York, Nebraska and Washington are getting soaked for using cell phones.

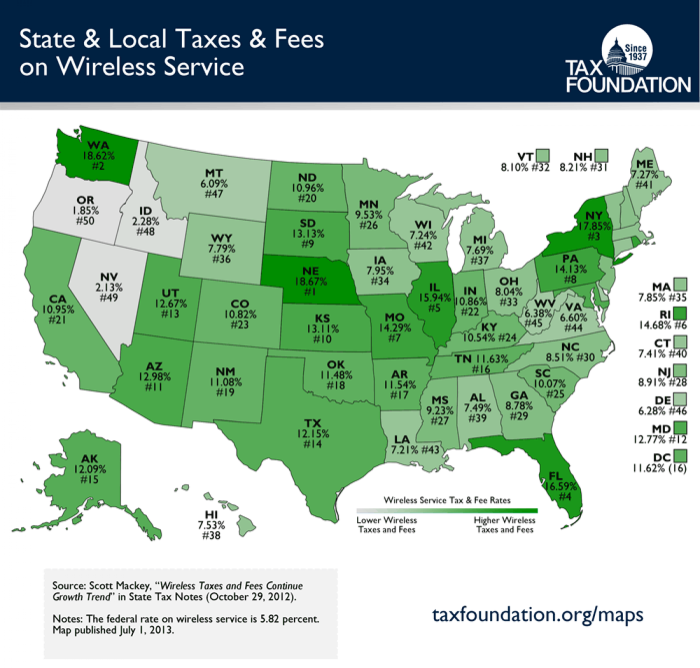

According to a study published by the Tax Foundation earlier in 2013, Nebraska ranks the highest in wireless taxes and fees. Washington state takes second place, and New York ranks third in having the highest wireless tax rates in the country. Nebraska tops the list at 18.67 percent, with Washington and New York following with 18.62 percent and 17.85 percent, respectively.

When combined with federal taxes, the effective wireless tax rate is even higher in those states. If you have a mobile device in Nebraska, your tax and fee bill jumps to 24.49 percent. Washington state residents can expect to pay 24.44 percent. New Yorkers can expect to pay 23.67 percent of their bill in taxes as well, which certainly doesn’t help with the absurdly high rent costs in the city that never sleeps.

The cause for these absurd fees: several local and state fees. New York hits wireless customers with 11 individual fees alone. This patchwork of taxes and fees doesn’t even include that bogus “regulatory recovery fee" that cell phone companies charge, which essentially translates to “a fee just because we can.”

Below is a breakdown of how much you can expect to pay in fees on a $100 wireless bill in New York. The individual tax breakdown for each state is also avaiable here.

On the other end of the spectrum, Oregon, Nevada and Idaho have the least burdensome taxes even after combining with federal taxes at 1.85 percent (7.67 percent), 2.13 percent (7.95 percent) and 2.28 percent (8.10 percent), respectively.

You can take a look at how much of your bill is taxes and fees in your individual state in the graphic below.

What do you think of the study’s findings? Let us know in the comments below.

© Copyright IBTimes 2024. All rights reserved.