Bond Yields Jump, Euro Rallies On Prospect Of Bigger ECB Rate Hikes

Euro zone bond yields jumped and the euro rallied on Tuesday on news that the European Central Bank would discuss this week whether to raise rates faster than expected, while equity markets turned positive after a shaky start to the day.

The euro jumped 1.1% to $1.08149, on course for its best day since May, after Reuters reported that ECB policymakers are considering raising interest rates by a bigger-than-expected 50 basis points at their meeting on Thursday.

Euro zone government bond yields also shot higher. Germany's two-year bond yield, sensitive to near-term rate expectations, climbed around 10 bps to its highest in over two weeks at around 0.64%..

In equity markets, the broader Euro STOXX 600 turned positive after earlier falling as much as 0.6%. Leading the charge was French power giant EDF, which surged 15% on nationalisation plans.

"Right now it's cautious mode. It's not necessarily plain defence and really being short markets," said Olivier Marciot, senior portfolio manager at Unigestion.

"Really little exposures all over the place, and waiting for some sort of clearer direction to deploy risk."

The MSCI world equity index, which tracks shares in 50 countries, eked its way into positive territory, and was last up 0.1%.

Wall Street futures gauges pointed to gains of almost 1%. U.S. equity markets had closed lower on Monday, impacted by reports Apple plans to slow hiring and spending growth next year.

The dollar's retreat from last week's two-decade peak, continued, with the greenback hovering just above a one-week low touched on Monday.

The dollar index, which gauges the unit against six counterparts, was down 0.9% at 106.52, on course for its biggest daily loss in a month and well back from the high of 109.29 last week, a level not seen since September 2002.

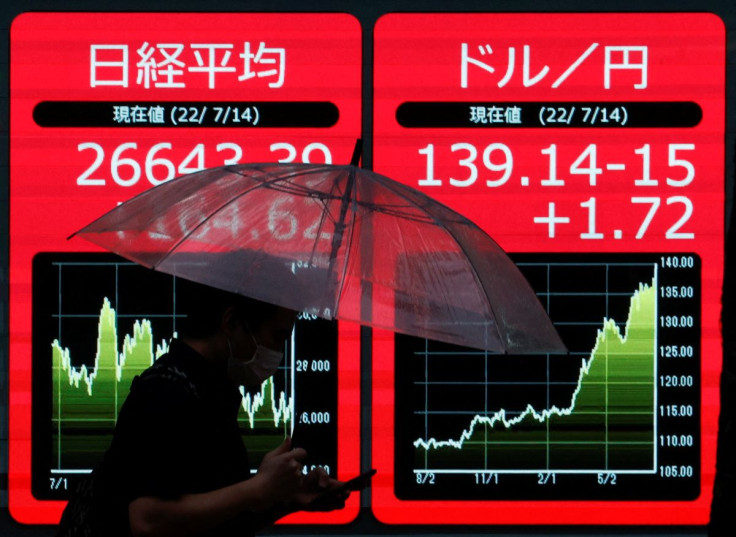

Earlier, MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.2%.

TAMING INFLATION

How central banks try to tame inflation was central to traders' thinking. The Bank of Japan also meets on Thursday, though little change is expected from the ultra dovish BOJ.

Markets are expecting a large 75 basis point interest rate hike at the U.S. Federal Reserve's meeting next week, away from a flirtation with the chance of an enormous 100 basis point rise.

"It's a bit like 'paint by numbers' at the moment, you've got a picture to fill in, but we don't have all the colours yet," said Kerry Craig, global market strategist at JPMorgan Asset Management.

"There are a couple of things missing (such as) the direction of the labour market and unemployment rate in the U.S., and whether central banks will step back and say 'that's the peak in inflation and we don't need to be as hawkish', or 'we're going to be really aggressive'."

Commodities were also at the fore.

Russia's Gazprom has told customers in Europe it cannot guarantee gas supplies because of "extraordinary" circumstances, according to a letter seen by Reuters, upping the ante in an economic tit-for-tat with the West over Moscow's invasion of Ukraine.

Oil prices fell, with Brent crude down 1.4% at $104.88 a barrel, while U.S. crude dropped 1.5% to $101.12.

© Copyright Thomson Reuters 2024. All rights reserved.