Borrowing To Buy: How Much Do Americans Owe?

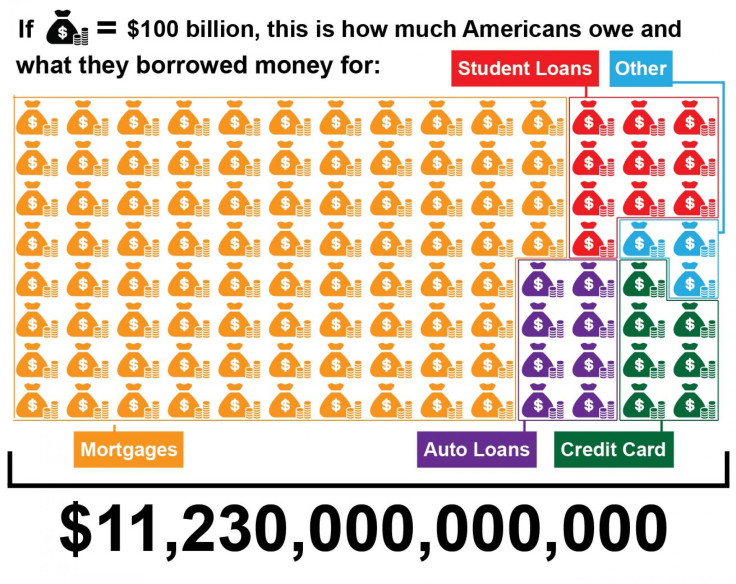

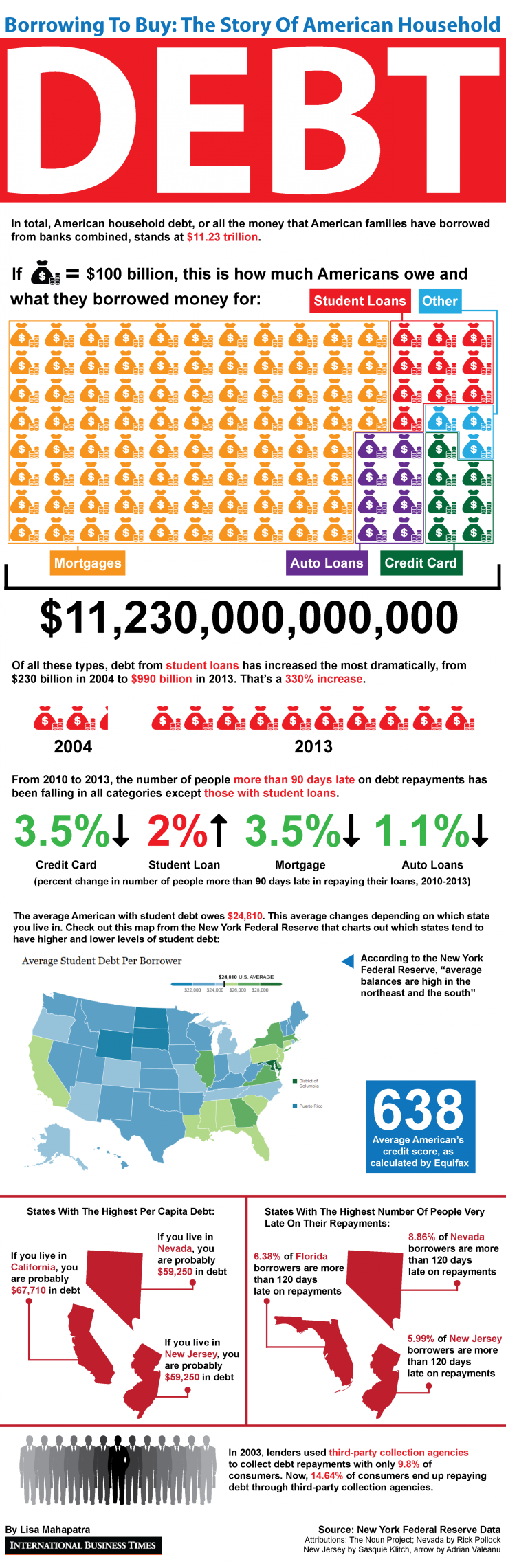

Ever since total outstanding national household debt peaked at $12.68 trillion in the third quarter of 2008, Americans have continued to slowly but steadily chip away at what they owe. In the first quarter of 2013, total household debt in the U.S. declined by $110 billion, or about 1 percent of all the debt that Americans hold, according to the Federal Reserve of New York. With total debt currently at $11.23 trillion, this means that Americans repaid more money than they borrowed in the first three months of this year.

Americans are taking out fewer mortgages but borrowing about the same total amount on their credit cards as they did 2008. However, they are borrowing a lot more today than they did then to pay for higher education. Total American student loan debt was $579 billion in the first quarter of 2008, and now that number has jumped to $986 billion in the first quarter of 2013. The increase looks even more dramatic when compared to the amount of student loan debt Americans held in the same period in 2004: $240 billion, a fraction of what it is now.

Meanwhile, the number of people late on their loan repayments fell in the first quarter of 2013 for every type of debt except student loans. In the first quarter of 2013, 11.2 percent of those with student loans were late on their repayments, a 2 percent increase from the fourth quarter of 2010.

© Copyright IBTimes 2024. All rights reserved.