Brutal First Half Of '22 On Track To Shave $8 Trillion Off S&P 500

Steep losses in stocks and bonds, dizzying market swings and a Federal Reserve intent on curbing the worst inflation in more than forty years have been among the hallmarks of U.S. markets in the first half of 2022.

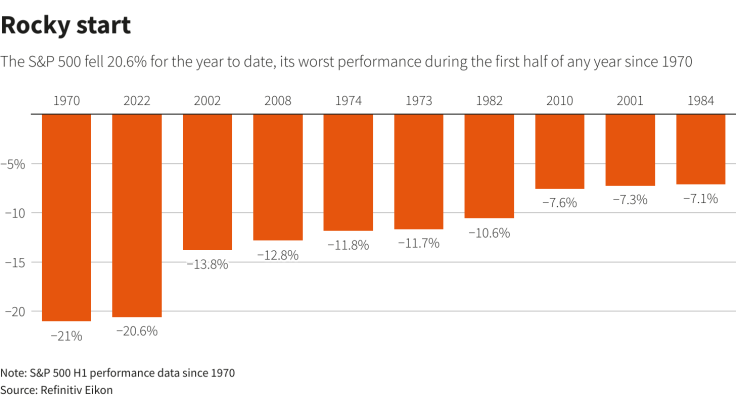

As of Wednesday, the S&P 500 is on track to close the initial six months of 2022 with a 20% loss, shedding some $8.2 trillion in market value as the index heads for its steepest first-half decline since 1970.

The index earlier this month confirmed the common definition of a bear market by closing down over 20% from its January record peak.

Bonds have fared little better, with the ICE BofA Treasury Index down nearly 10% this year, on pace for its worst year in the index's history going back to 1997.

For now, investors see little respite from the gyrations that have pummeled markets over the last several months amid worries that the Fed's fight against inflation will further dry up risk appetite while potentially throwing the U.S. economy into recession.

The coming month will bring a fresh round of corporate earnings, the latest inflation data and culminate in a Fed meeting, leaving plenty of opportunities for markets to build on a nascent rally in stocks that began in mid-June or seek out fresh lows.

GRAPHIC: Rocky start

Soaring inflation forced the Fed to quickly raise rates in the first half of the year, throwing into reverse the easy monetary policy that helped the S&P 500 more than double from its March 2020 lows.

The index's slide has pummeled many of the high-growth shares that prospered in recent years. One high profile casualty has been Cathie Wood's ARK Innovation ETF, which holds post-pandemic favorites such as Zoom Video Communications, Teladoc Health Inc and Roku Inc, is down 57% year-to-date.

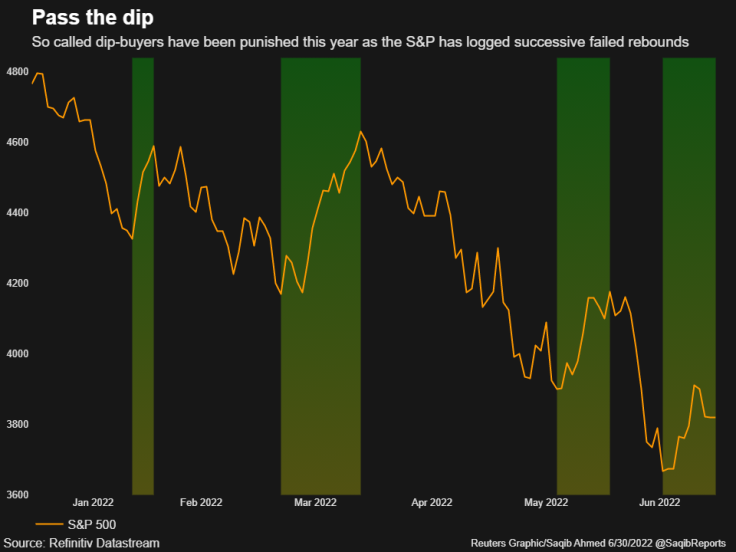

The tumble in equities has also severely tested the popular strategy of buying stocks on weakness, which rewarded investors for the better part of the last decade but has floundered this year amid the S&P's decline. The benchmark index has seen three rebounds of at least 6% this year that have reversed to fall below its prior low point. The latest bounce has the index up about 3% since its mid-June low.

GRAPHIC: Pass the dip

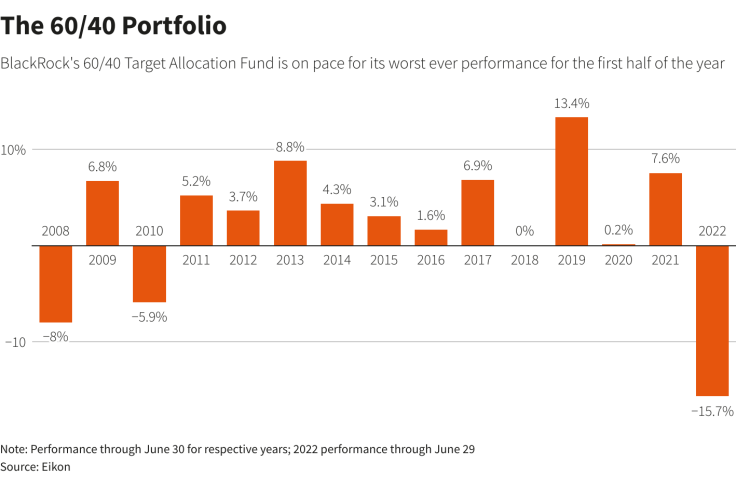

Another popular approach that has suffered this year is the so-called 60/40 portfolio, where investors count on a blend of stocks and bonds to protect against market declines, with equities rising amid economic optimism and bonds strengthening during turbulent times.

GRAPHIC: The 60/40 Portfolio

That strategy has gone awry in 2022 as expectations of a hawkish Fed weighed on both asset classes. The BlackRock 60/40 Target Allocation fund is down 16% since the start of the year, its worst performance since it launched in 2006.

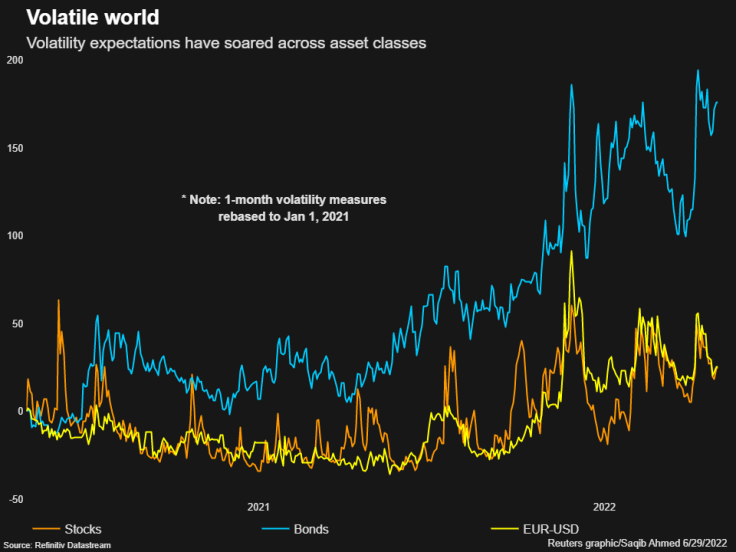

GRAPHIC: Volatile work

The first half of the year saw volatility return to global financial markets in spectacular fashion, with stocks, bonds and currencies all jolted by central bank moves as well as surging geopolitical tensions.

But while the Cboe Volatility Index, or "Wall Street fear gauge," has remained elevated through the year to date, it has failed to close higher than the 37, the average level that marked past market bottoms. That has led some investors to fret that the selling might not be done.

Few believe the wild swings in markets will subside until there is evidence that inflation is cooling, allowing the Fed to slow or halt its monetary policy tightening. For now, warnings of a looming recession have grown louder on Wall Street, as the effects of higher rates seep into the economy.

GRAPHIC: Nasty surprise

The Citigroup U.S. Economic Surprise Index, which tracks where a core set of economic data series has been coming in relative to expectations, shows incoming data missing estimates by the largest margin in about two years.

© Copyright Thomson Reuters 2024. All rights reserved.