Bursting The Washington Bubble: The Outlook For 2013

Opinion

It’s that time of year again. Time to hold our noses and check the diaper we have all come to know as Obamanomics.

While rightly this review should have been completed closer to the first of the year, there were too many events in the offing that were likely to impact the economy to take a stab at the broad outlines of an economic outlook nearer New Year’s Eve.

But let’s clear the children from the room, because now that Congress and President Barack Obama have agreed to get the tax increase off the table they didn’t dare pass while campaigning, this economic forecast won’t be pretty.

In short, the DC diaper is pretty full and, with a bit more pressure, the bubble it has created could blow in 2013. During the campaign, Obama consulted with his chief economist, talk-show host David Letterman, and promised he wouldn’t try to pay down the deficit “solely on the backs of the middle class.”

Well, promise kept. Not only has Obama raised taxes on everyone, from every income spectrum -- poor, middle class and rich -- he also has made it clear that he won’t make any attempt to pay down the deficit.

In recent negotiations on the debt ceiling, when House Speaker John Boehner brought up the government’s chronic spending problem, the president said he was “tired of hearing you say that.”

“When it comes to federal spending,” Investor’s Business Daily wrote, “Obama is like the alcoholic who says that the only drinking problem he has is when he can't get a drink.”

While Obama’s own bipartisan commission has warned that the country will have to keep borrowing to sustain the current level of spending, even if the economy reverts to historical growth patterns -- which it won’t anytime soon -- Democrats are confidently preparing a new assault on taxpayers.

That’s because Obama is going to spend the increased tax dollars he just got from you and me on more stuff that won’t work, like “climate change” legislation. It will be disguised as a “green jobs” program, of course. But, let’s be honest: Even if Obama instituted a 100 percent tax on fossil fuels, the earth’s temperature is not going to be effected by the tax, even allowing that global warming models are correct, which I don’t.

After all, the models were probably created by economists.

Jobs won’t be growing out of the burgeoning “green” energy industry -- or other government measures -- because we know from past history that new industries aren’t formed at the direction of the government, but rather by demand.

Former President Jimmy Carter put solar panels on the White House at a time when energy spending made up a larger portion of our GDP, and what good did it do? None.

So let’s just agree right now that the best thing the government can do for our economy would be to do no harm; and that Obama at least doesn’t seem inclined to lay off the economy and let it self-mend.

Big government is not the economy’s friend this year.

Taxes, regulations and more intervention will take its toll. And that means slower growth, if any growth at all, as anyone outside of the Wall Street-Washington corridor would admit.

A recent Gallup poll found that business owners are worried about taxes and regulations, while consumer confidence is down as a result of the last tax increase. So prepare for the double whammy of less spending by both businesses and consumers.

One clue of the economy’s downward direction can be gleaned by looking at what economists are saying. The Economist, the flagship franchise for, um, economists, is saying that America’s economy is looking better for 2013.

What that actually means is things are going to be really bad.

“The financial crisis and recession ended more than three years ago!” they wrote. “The housing market is firmly on the mend! Employment is growing! The euro zone, though feeble, is no longer about to collapse! And the threat of home-grown crisis appeared to recede when Republicans in the House forbore to use the threat of default to extract spending cuts!”

In fairness, I added the exclamation points, but you get the idea. Yeah, I laughed too.

Of course, they don’t present any actual data to support the thesis that things are looking up, but what the hay, these are economists we are talking about. What they don’t know, they can make up.

According to an NBCNews report, half of all business economists polled recently “now expect real gross domestic product -- the value of all goods and services produced in the United States -- to grow between 2 and 4 percent in 2013. That's up from 36 percent of respondents who felt the same way three months earlier.”

And just in time, because as the Washington Post reported, economists say they aren’t “driven by ideology,” so we should trust them when they tell us what to expect. Besides some cheap humor aimed at economists and liberal journalists, there is a real point here.

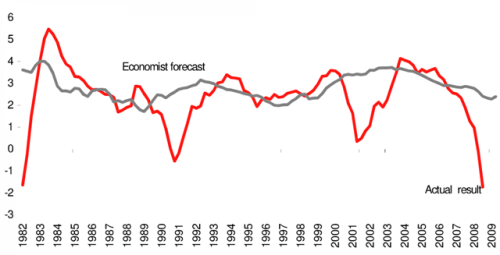

As our own favorite economist, Dan Mitchell of the Cato Institute pointed out, economists have a poor track record at predicting what the economy will do in the future.

“It’s not that economists are totally useless” Mitchell said. “It’s just that they don’t do a very good job when they venture into the field of macroeconomics, as Russ Roberts succinctly explained. And they look especially foolish when they try to engage in forecasting.”

We all look bad at forecasting. But economists look especially bad at it.

The gray line below represents economists' forecast for a fictional land where recessions never happen, and the red line represents teh economy that you and I actually have to live in every day.

But going past some of these more humorous and superficial reasons for economic pessimism, let’s look at some data points.

The VIX

The VIX, also known as the Volatility Index or the Fear Index, is trading near lows of $13.04. That means there isn’t a ton of fear in the market. That is often misunderstood by some people -- even (gasp!) economists -- to mean that things are just swell.

A case in point is The Economist saying that when Obama was elected in 2009, the VIX stood at 46, but “[a]t the start of his second term, by contrast, the Dow hit a five-year high, while a widely followed index of investor fear called the VIX reached a near-six-year low.”

The low on the VIX is not good news, however, with all due respect to economists. Let’s see it in action using The Economist’s own example.

When Obama was inaugurated in 2009 and the VIX was at 46, the Dow was at 8,000 on the way to 6,600. The VIX settled eventually to a high of around 49. Since then, the Dow has added 6,000 points. And the VIX has moved downward.

VIX high means time to buy, VIX low means time to blow.

In other words, when the VIX is this low, it can only go higher, generally speaking, which means something bad is about to happen as the VIX trades near $13. The fact that The Economist, the franchise publication for, um, economists, doesn’t know this, should worry you -- especially if you rely on their optimistic assessments of the economy to make investment decisions. And yes, these are the guys who plan bailouts and QEs and Dodd-Frank and actuarial tables for Social Security and all the other stuff Washington can think up that doesn’t work.

Gas Prices

Gas prices have not helped our economy under Obama either.

Whether you are liberal or conservative you have to agree that the administration isn’t friendly to fossil fuel supply. That may seem incidental, but oil prices don’t go down when a cartel controls those prices, and the largest economy in the world signals that they like high prices. It’s not just the fact that administration officials say high oil prices are desirable, it’s that financial markets find them desirable, too.

While the stock market has been a general beneficiary of the Fed’s printing-press largess, oil markets have loved Federal Reserve Chairman Ben Bernanke as well. Frankly, there are too few places to invest, but the petro markets have been a nice source of reliable returns for investors.

Prices make lows in the winter and then go up in the summer -- generally.

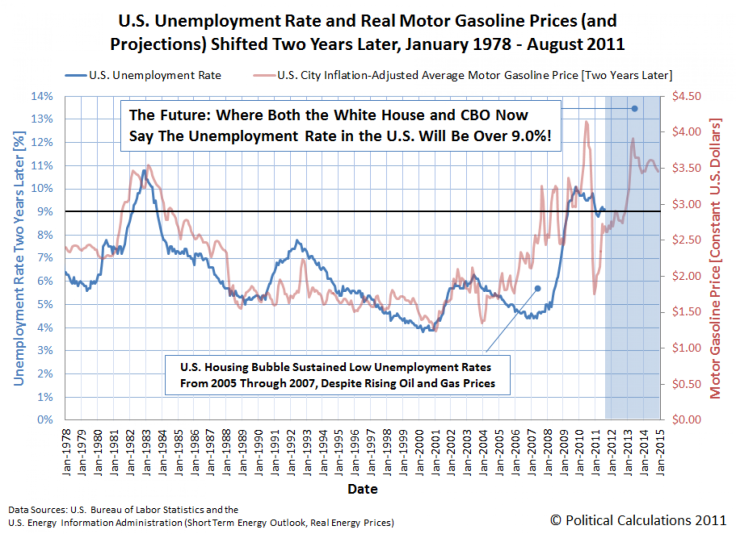

The problem is that, according to our friends at Political Calculations, there seems to be some correlation between high gas prices and high unemployment.

While they say the correlation is far from perfect, “Going by the elevated motor gasoline prices that have come to characterize Barack Obama's years as U.S. President, it appears that the U.S. unemployment rate will skyrocket up to 11 percent early in 2013 if the correlation between gasoline prices and the unemployment rate two years later continues to hold.”

While unemployment may not get as high as 11 percent, it’s troubling that spot oil prices for West Texas Intermediate remain stubbornly high in a sluggish worldwide economy. Because that means the gas prices that have fallen recently are sure to rebound shortly.

We used to be able to count on getting gas price relief as the economy cooled, but with trillions in liquid money looking for a place to park, that’s no longer the case. High prices at the pump mean businesses have less money for labor. We used to know this in our country without someone saying it out loud.

Corporate Dividends

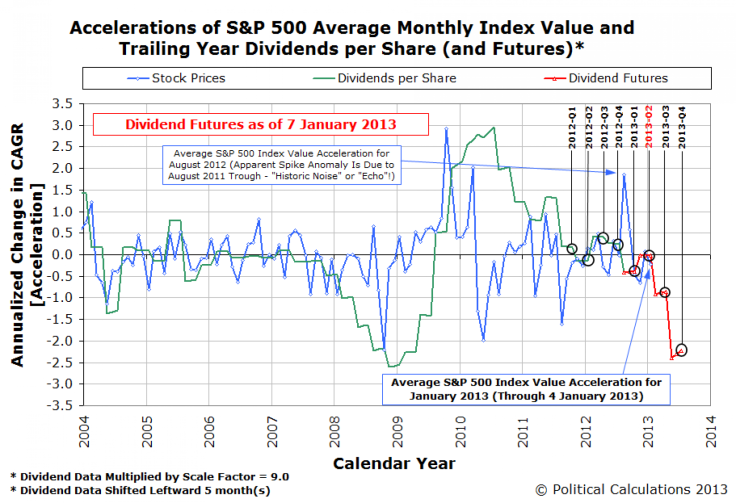

Here, too, I’m a big believer in the work that Political Calculations has done on the predictive power between dividend futures data and the S&P 500. In short, PC uses dividend futures data to calculate with a great degree of accuracy what the S&P 500 will do several quarters out.

And here’s the worrisome part: “In December 2012,” PC wrote, “93 U.S. companies announced that they would be cutting their regular dividends going forward, also a new record. The previous record of 81 companies announcing dividend cuts in a single month was set in March 2009, as the U.S. stock market was hitting bottom during the ‘Great Recession.’”

While it’s uncertain if the cuts are due primarily to changes in tax policy, or the desire by companies to hold on to earnings, the cuts in the number of companies paying dividends is worrying. Clearly as companies accelerated dividend payments in the 4th quarter of 2012, it helped the stock market.

I think the obverse will happen as we move into future quarters.

Forecast

While there has been some de-coupling of Wall Street from GDP over Obama’s term, I don’t see that lasting very much longer. Frankly, Obama doesn’t care anymore about being the “economic” president who cares about trivial things like jobs. Now that he’s been re-elected, he’ll pursue policies regardless of the outcome on Main Street and Wall Street. The results won’t be pretty.

GDP again will come in under 2 percent for 2013, and we will likely see several quarters of contraction. Trust me, I’m not an economist. I’m just foolish enough to forecast like one.

John Ransom is finance editor at Townhall.com and the host of Ransom Notes, a nationally syndicated radio show covering the connection between politics and finance.

© Copyright IBTimes 2024. All rights reserved.