Calm Before the Storm

Economic data and news flows are light this morning as market participants take stock of the significant moves across asset classes in the past week and position themselves for a data-heavy end-of-week.

Global manufacturing data releases on Thursday and Friday are expected to show weakness outside of the US, while a modest improvement is anticipated in the world's largest economy. The US will also be reporting employment data for the month of May this Friday and this release is seen as a possible catalyst for the Fed's policy-setting meeting on June 20th. If payroll data for the month is significantly below the consensus estimate of +150k, markets will likely take it as strengthening the need for further action by the Fed to support the economy. That outcome could be supportive of growth currencies and equity markets.

Send money globally with No Fee Options with iMoneywire.

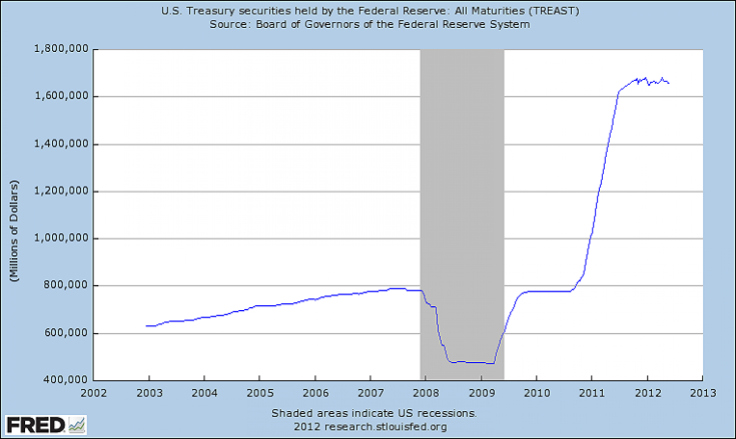

But markets must consider just how much more the Fed and other central banks can do to support an economic landscape littered with bad debt. Consider the two graphs below. They represent all the US government debt and mortgage debt that the Federal Reserve has purchased and held on its balance sheet over the past few years in an effort to support lending and stimulate growth. Can this amount of support continue to rise unabated?

Send money globally with No Fee Options with iMoneywire.