Can RIM Ever Recover?

As shares of Research in Motion trade around their 52-week low, it's a good time to consider if thhe company can recover, either under its own steam or perhaps by being acquired.

Over the past year, the maker of the Blackberry has seen its shares plummet 50 percent, with a low of $22.54. This week, market researchers IDC and IHS iSuppli said it remains in fourth place in mobile market share vs. Apple, Samsung and Nokia.

The bad news: the Waterloo, Ontario-based phone-maker saw sequential shipment growth decline nearly 11 percent, while Apple's rose 9 percent and Samsung's 31 percent.

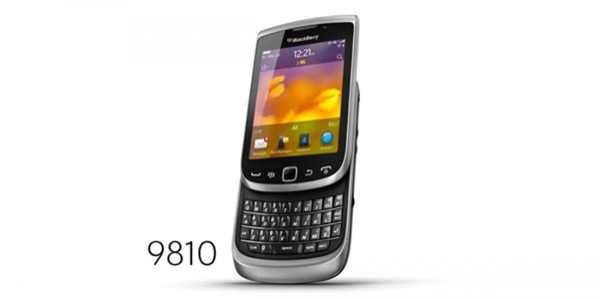

That's probably why RIMM this week announced five new products in its Bold and Torch lines and AT&T confirmed it would start to support them later this month. The new models will finally deploy the new Blackberry 7 operating system, which had been delayed.

While the new smartphones "should keep RIMM in the game," said Wells Fargo analyst Jennifer Fritzche, what outsiders should look for is how the company deploys its next-generation QNX handsets.

Others are not impressed. On Friday, Needham analyst Charlie Wolf boosted his target price for Apple to $540 from $450. Shares of the Cupertino, California company Friday traded around $374, not far off their yearly high of $404. Apple shares are up about 50 percent in the past year --- the same as RIMM's loss.

Analysts have a mean target price for RIMM of $37.06, according to ThomsonFirstCall. One of the more bullish is Jeff Kvall of Barclays, whose price target is 52.

Rather than looking at market share, investors might consider other aspects of RIMM in the smartphone universe.

Besides being cheap, with a market capitalization of only $12.03 billion, compared with Apple's lofty $350 billion, RIMM enjoys a number of advantages.

The RIMM treasury has more than $2.4 billion in cash and investments as well as a highly dedicated professional audience in many of its prime markets in the developed world. But it also has 50 million users alone in Indonesia and many in India. RIMM derives nearly 70 percent of sales from international customers.

As well, the Blackberry is approved by various U.S. government agencies. TheRIMM PlayBook is the only tablet approved for federal agencies as well as Australia; other approvals are pending. The General Services Administration could announce a major order.

Then there are prospective bans of Apple's iPad mentioned by Russia and other governments. And while not likely, a glitch or problem with a product would be an Apple disaster. Nearly 20 years ago, Apple rolled out the Newton.

Both of RIMM's co-CEO founders, Michael Lazarides and James Balsillie, are experienced technology entrepreneurs with top science backgrounds. As a result, RIMM holds thousands of patents for its devices, mobile technology and network management.

Earlier this year, Research in Motion was among the consortium that paid $4.5 billion for patents auctioned by Nortel Networks, along with Apple, Microsoft, EMC, Ericsson and Sony. So the library has grown larger.

On Friday, Alcatel-Lucent said it is interested in selling its patent portfolio for as much as $9 billion. That's further proof that intellectual property is valuable.

Conceivably, a bidder like Apple or AT&T might launch a bid for RIMM, especially at its depressed price. Or the co-CEO might consider going private with cash from private equity or hedge fund investors.

Technology companies that are targets often attract "activist investors" like Carl Icahn, who bought into Motorola and still retains big stakes in its two successor companies, Motorola Mobility and Motorola Systems. He and others helped send companies like Siebel Systems into the hands of Oracle.

A check of the Securities and Exchange Commission Friday showed no filings by new significant investors. But investors ought to check frequently. For now, RIMM's shareholders remain mainly big U.S. and Canadian institutions and mutual funds.

© Copyright IBTimes 2024. All rights reserved.