Central Bank Gold Demand Hits 48-Year-High In 2012: World Gold Council

Central banks last year added the most gold to reserves in almost a half century and will likely remain an important force in the gold market in 2013, the World Gold Council said Thursday.

“We think this trend is going to continue,” Marcus Grubb, managing director for investment at the World Gold Council, said by phone from London. “Although you are seeing some improving sentiment around equity markets and some rotation back to risky assets on the hope of better growth this year, especially in the U.S., central banks are still buying gold because they are concerned about quantitative easing and low interest rate policies, which are what are fueling the economic growth.”

Central banks boosted purchases by 29 percent to 145 metric tons in the fourth quarter of 2012, an eighth successive quarter of net buying, the London-based industry group said. In the full year, central bank bought 534.6 tons of the precious metal – the most since 1964.

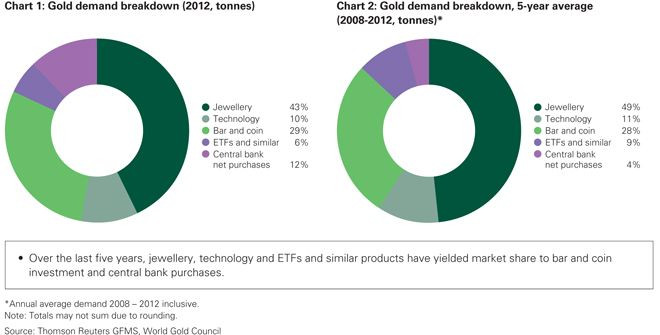

Net purchases by central banks accounted for 12 percent of overall demand in 2012, compared with a 10 percent share in 2011. That’s also higher than the average of a four percent share over the past five years.

Last year, central bank net purchases surpassed certain investment categories of demand. For 2012, total demand for ETFs was 279 tons, while central bank demand was 535 tons.

“Central banks are now buying more gold than ETF investors, which is a very startling result,” Grubb said. “Even though demand for bars and coins was down last year, the bar and coin market worldwide was still 1,259 tons, so central banks would have to really go for it to equal bar and coin demand.”

Until about four years ago, central banks as a whole have been a net seller of gold for 15 years -- about 400 tons to 500 tons a year. Simply put, they were having a negative effect on the bullion’s price. But now, they are buying 500 tons of demand a year.

“One of the reasons gold is where it is today, is because central banks have swung completely from the supply to the demand side in the last four years in a major way,” Grubb said. “A 900-ton swing in a 4,400-ton market.”

The past year saw a number of new joiners added to the list of institutions building their gold reserves; Brazil and Paraguay were two such names, both making significant purchases during the year, according to the World Gold Council. During 2012, Brazil and Paraguay made purchases of 34 tons and 7.5 tons, respectively.

Iraq also joined the ranks of net purchasers of gold, adding 24.1 tons of gold to its reserves between August and November, according to data released by the International Monetary Fund.

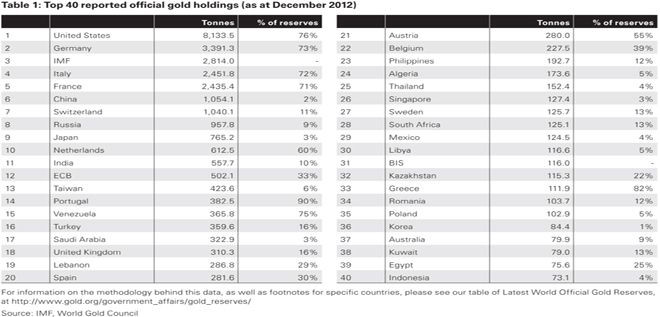

In the Asian region, South Korea and the Philippines were again the dominant figures, adding 30 tons and 33.6 tons, respectively, during the course of the year. The two markets are now in possession of gold reserves totaling 84.4 tons (South Korea) and 192.7 tons (Philippines), according to the council.

Meanwhile, Russia adhered to its long-term buying program, adding around 75 tons to its reserve holdings throughout the year through the purchase of domestically produced gold. The country’s gold reserves, the seventh largest globally, now approaches 1,000 tons and slightly less than the 10 percent of total reserves.

Speaking during the World Economic Forum in January, Russian Central Bank First Deputy Chairman Alexei Ulyukayev said the central bank would continue to buy gold. "We are buying metal and will continue to pursue this course," Ulyukayev told reporters in Davos. "This is a course of asset diversification in a situation when investing in securities or deposits remains risky."

The increase in money supply could be a potential catalyst for higher inflation in the future, which is positive for gold investment. Previous research by the World Gold Council shows that a one percent change in money supply, six months prior, in the U.S., Europe, India and Turkey tends to increase the price of gold by 0.9 percent, 0.5 percent, 0.7 percent and 0.05 percent, respectively.

Closely linked to the inflation effect is the impact that unconventional monetary policy has on currencies. Given that gold prices are typically denominated in U.S. dollars, the exposure gained from buying or selling gold is influenced by changes in the exchange rate for U.S. dollars. U.S. dollar-based investors typically see a negative correlation between the U.S. dollar and gold.

Central banks in developed economies have deployed monetary easing to ameliorate the impact of the 2008-09 recession.

The Federal Reserve made it plain during its December policy meeting that job creation had become its primary focus, announcing that it planned to continue suppressing interest rates so long as the unemployment rate remained above 6.5 percent. According to the Fed’s economic projections, most of its senior officials did not expect to reach the goal of 6.5 percent unemployment until the end of 2015.

“We think it’s unlikely that the Federal Reserve will end [quantitative easing] before the end of this year,” Grubb said. “It’s going to be very difficult for the Fed to actually hit those targets.”

Last month, the Bank of Japan adopted a two percent inflation target, effectively doubling its previous goal of one percent, and announced “open-ended” purchases of government bonds from next year, in a bold gamble to end two decades of stagnation in the world's third-largest economy.

Britain's central bank said Wednesday that inflation will not fall back to its two percent target until early 2016, but that it was still open to more bond purchases to boost Britain's stagnant economy. The Bank of England has spent 375 billion pounds ($587 billion) on buying government bonds between March 2009 and October 2012. It currently holds just over one-third of conventional gilts.

“In a world of coordinated currency intervention and quantitative easing, central banks of countries with surpluses will diversify into assets like gold, because they are continuing to accumulate currencies that they feel may be depreciating,” Grubb said.

The average weighting of the European and American central banks in gold is between 50 percent and 100 percent. But a developing country’s central bank generally has less than five percent of its reserve portfolio allocated to gold.

“I think there’s a lot of room for that [emerging market central banks increasing their gold holdings] to grow,” Grubb said. “Potentially, you could see average emerging market central bank weightings double to an average of more than 10 percent.”

Aside from central bank buying, the gold price is also supported by strong demand in China.

China used to consume only its own mine production, so it wasn’t importing gold at all until about 2007 and 2008. The country is now importing 400 tons to 500 tons a year.

Consumer demand in China has soared over the past four to five years and even though China is the world’s largest mine producer, with a roughly 14 percent of supply, it’s still not enough.

According to data from the World Gold Council, Chinese demand was flat in 2012 -- but it was flat on the highest number ever recorded.

“China’s now increasing the gold price around the world because it’s pulling in 400 tons to 500 tons a year of foreign gold,” Grubb said.

Bullion gained for a 12th straight year in 2012, the best run in at least nine decades, averaging $1,669 an ounce in the past year.

The SPDR Gold Trust (NYSEARCA: GLD) and iShares Silver Trust (NYSEARCA: SLV) both ended Wednesday’s session in the red. Gold miners (NYSEARCA: GDX) such as Yamana Gold (NYSE:AUY) and Newmont Mining (NYSE:NEM), and Silver names such as First Majestic Silver (NYSE:AG) and Pan American Silver (NASDAQ:PAAS) were mostly down as well.

© Copyright IBTimes 2024. All rights reserved.