Cheap Foreign Steel Drives Heavy U.S. Imports In January

Cheap foreign steel, especially from China, has pushed U.S. steel imports up for a recent brief surge and dented confidence among domestic steel producers, the Wall Street Journal reports.

Steel imports are expected to hit 3.2 million tons in January, up 23 percent from a year ago, as price differences between U.S. and Chinese steel rose to $159 per ton. At this time last year, U.S. steel cost $19 less than Chinese steel, according to market analysis firm CRU Group.

“It’s the largest first-quarter import order I’ve seen in the last five years,” one unnamed steel trader told the Wall Street Journal. That trader brokers steel purchases between U.S. buyers and foreign sellers.

The surge in imports could impact confidence in major U.S. steel producers like United States Steel Corp. (NYSE:X), AK Steel Holding Corp. (NYSE:AKS) and ArcelorMittal USA Inc., which all report earnings within the next two weeks.

Price-wise, the average U.S. price for a benchmark hot-rolled coil is $676, up 10 percent from a year ago. That compares with the Chinese benchmark price of $540 per ton. Even with shipping costs factored in, foreign steel can end up being 10 percent cheaper, according to Midland Steel Warehouse Corp.’s Howard Allen.

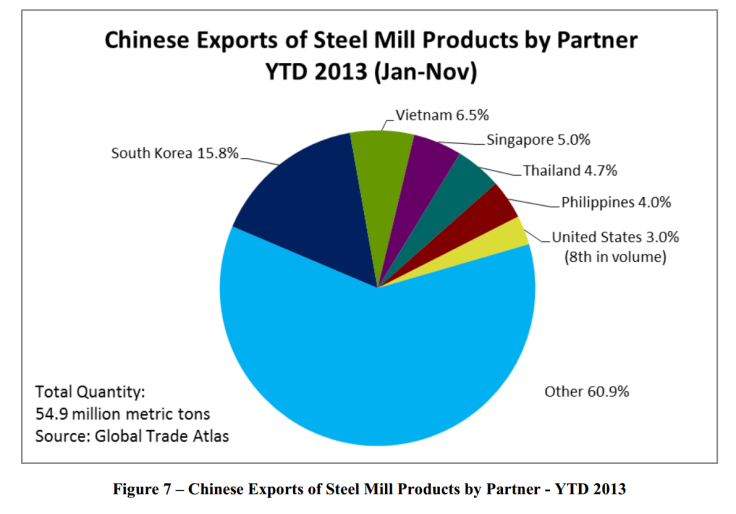

Steel producer CEOs have long complained that foreign countries dump steel at artificially low prices into U.S. markets. They have requested trade tariffs. South Korea, China and Japan are major exporters of steel to the U.S.

U.S. steel shipments have dipped slightly from 2012 levels, according to the American Iron and Steel Institute. U.S. steel imports, for all steel products, were worth $26.6 billion from January 2013 to November 2013, according to U.S. Census Bureau statistics.

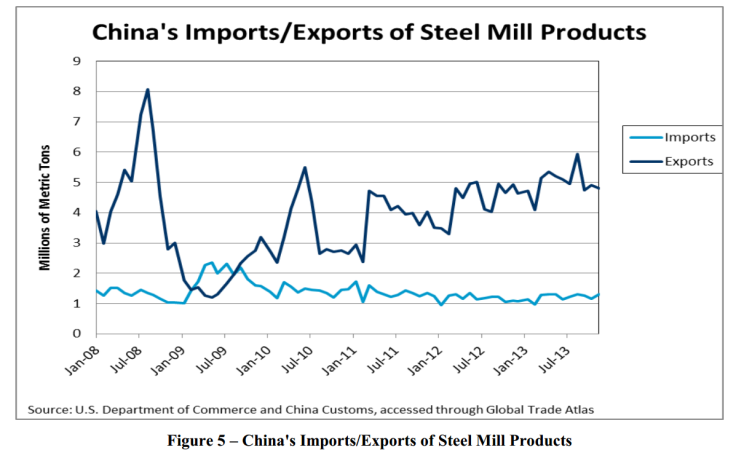

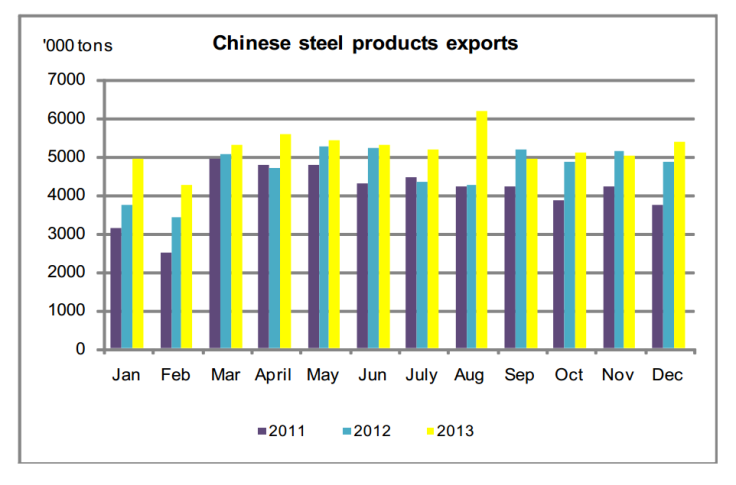

China has a healthy steel surplus, which it ships off to countries including South Korea and Southeast Asian countries, according to the U.S. Department of Commerce. Chinese steel exports rose to 54.9 million tons from January to November 2013, up from 48.7 million tons a year before. In contrast, the U.S. has a steel trade deficit of about 1.5 million metric tons, meaning it imports more than it exports.

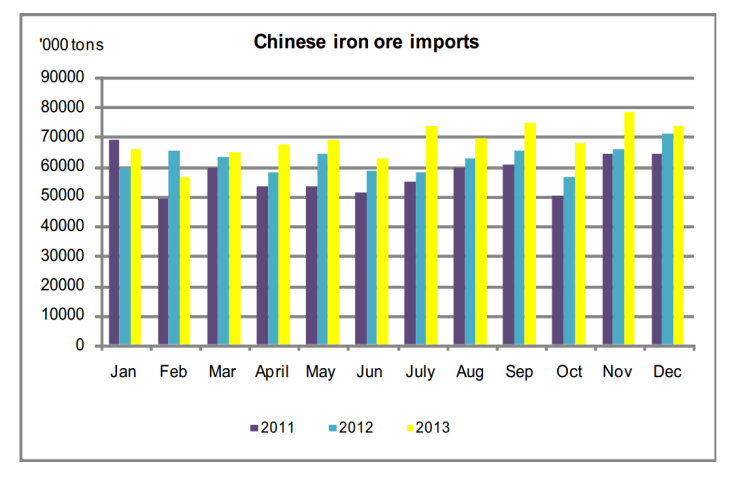

Steel is used in cars, industrial machinery, the energy sector, and construction, among other applications. China has steadily imported more iron ore, steel’s key raw material input, and has exported more steel, in the past three years.

Many analysts expect global and U.S. steel prices to fall this year, driven by global oversupply. Overall U.S. imports for January to November 2013, the latest period covered by official data, fell 4.4 percent from 2012, and averaged 2.4 million tons per month in 2013.

© Copyright IBTimes 2024. All rights reserved.