China Expected To Clock Weakest Growth In 30 Years: AFP Poll

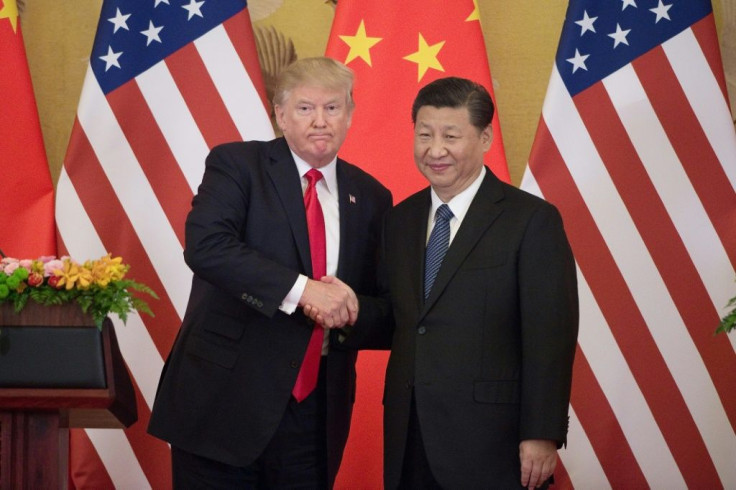

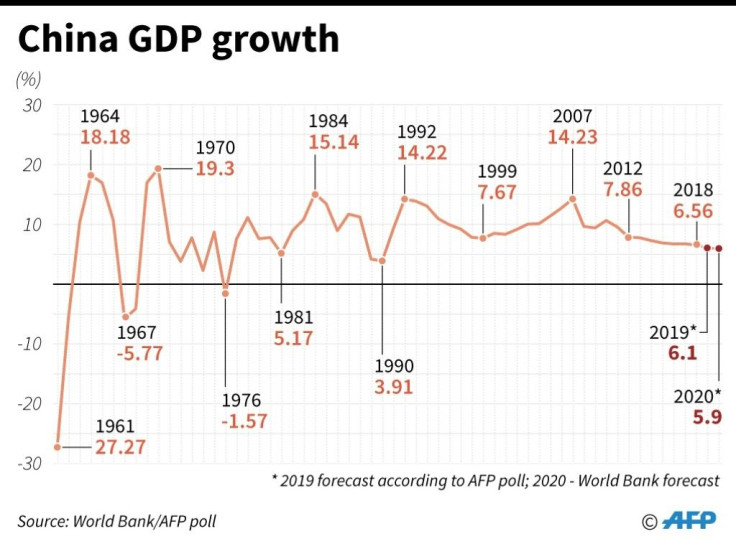

China's economy grew at its slowest rate in three decades in 2019, according to an AFP poll of economists, after a year marked by weaker domestic demand and a bruising trade war with the United States.

The survey of analysts at 14 institutions predicted that the world's second-largest economy would clock 6.1 percent gross domestic product (GDP) growth for the full year.

The figure is a clear drop from the 6.6 per cent growth achieved in 2018 -- which was the slowest pace since 1990 -- but remains within Beijing's official target of 6.0-6.5 percent.

Analysts are forecasting six percent growth for the last three months of the year, the same as the previous quarter, with the official figure to be released Friday alongside the annual GDP result.

Oxford Economics senior economist Tommy Wu said that although GDP figures are set to hit a record low for recent decades, it was not unusual to see growth tapering off in economies undergoing restructuring and moving towards services and higher-value industries.

"It's natural to see the Chinese economy's growth rate slow over time, converging to something more sustainable over the long run," he said.

Wu said that apart from the US-China trade war, which weighed on manufacturing and exports over the year, government stimulus measures had also taken a toll.

He said authorities had focused on encouraging demand with tax cuts, which were "not as effective when it comes to boosting the economy, compared with other means such as infrastructure spending".

Analysts from the China International Capital Corporation wrote in a recent note that better trade demand and stronger domestic infrastructure investment growth would drive China's recovery.

The Beijing-based investment bank's analysts said they expect economic momentum to continue after a strong rebound in industrial production growth in November.

There are other positive signs on the horizon as well, Wu said, citing the US-China "phase one" trade deal due to be signed on January 15.

A recent JP Morgan report said a recovery in trade is likely to help growth in 2020 -- although this also depends on further progress in the trade talks and how quickly fiscal support can step up to support infrastructure investment.

ANZ senior China economist Betty Wang warned trade tensions could still escalate and impact next year's growth, telling AFP that enforcement issues could create uncertainties.

And China's growth may not have hit the bottom yet, according to Nomura analysts, given challenges such as worsening fiscal conditions, a cooling property sector and weakening exports.

Customs data released Tuesday showed Chinese exports grew 0.5 percent in 2019, while its imports fell 2.8 percent.

The data also showed that the trade surplus between China and the US, a major source of anger in the White House, narrowed 8.5 pecent last year to around $295.8 billion.

On Tuesday, spokesman for the customs administration Zou Zhiwu said a rise in imports from the US is not likely to hit those from other countries.

But Julian Evans-Pritchard of Capital Economics said Chinese import growth may not improve much more owing to "headwinds to domestic demand", and that a step-up in US imports will probably come at the expense of those from elsewhere.

Nomura's Wang Lisheng told AFP that despite the ongoing trade talks, China's export growth is likely to remain under pressure in coming quarters, given existing US tariffs on and global economic headwinds.

Beijing may respond with another round of infrastructure stimulus, likely to focus more on large cities in the coastal regions, Nomura analysts said.

The World Bank has forecast China's growth to come in at 5.9 percent this year, against the backdrop of a "fragile" world economic outlook.

Overall global growth is expected to accelerate slightly in 2020.

© Copyright AFP {{Year}}. All rights reserved.