China May Cut Banks’ Reserve-Requirement Ratios Again, And Soon: Report

Neither China’s economy nor its equity market has behaved well recently, so the People’s Bank of China appears ready to put its monetary-policy pedal to the metal by once again cutting banks’ reserve-requirement ratios, advisers and officials at the central bank told the Wall Street Journal. The contemplated decrease of half a percentage point, or 50 basis points, in these ratios could increase the ability of the country’s banks to lend by 678 billion yuan ($106.2 billion), the Journal reported. The PBOC could announce the loosening of policy within days or weeks, the newspaper said.

There is no guarantee the PBOC will cut reserve-requirement ratios (RRRs) across-the-board, though. When the central bank reduced these RRRs in June, it trimmed them by 50 basis points for some financial institutions and 3 percentage points for others. Accordingly, the amount of liquidity to be provided to the banking system by its next move could be a bit more or a bit less than anticipated at present.

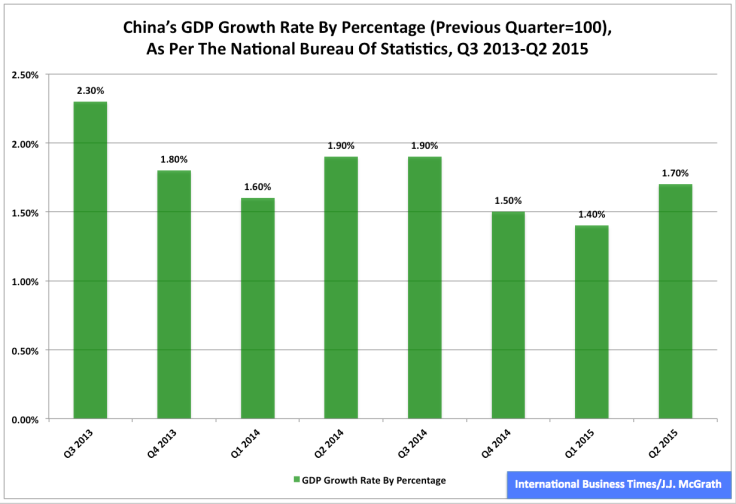

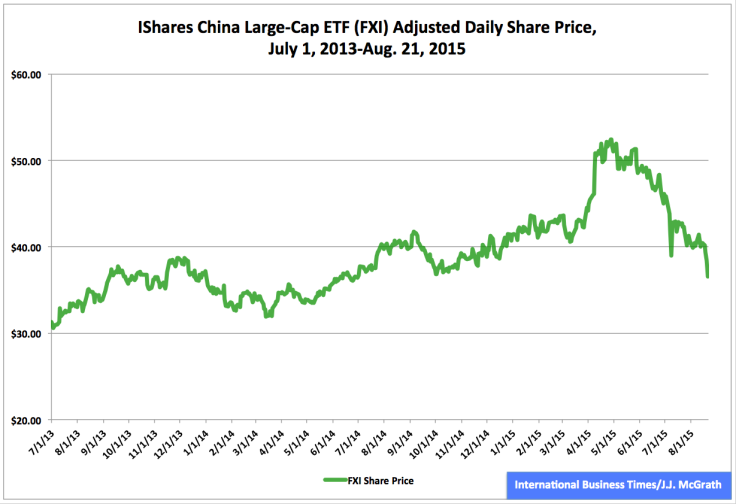

Authorities at the PBOC likely are feeling the pressure to pull on their policy levers because of China’s economic slowdown and the country’s stock-market crash, as indicated in the below charts.

Manipulating reserve-requirement ratios is only one of the ways the PBOC has attempted to stimulate the No. 2 economy in the world during the past year or so. For example, the central bank in June also cut its one-year benchmark deposit and loan interest rates by 25 basis points, setting the former at 2 percent and the latter at 4.85 percent. Most recently, it began devaluing the yuan Aug. 11. As a result, the currency’s market rate has dropped about 4 percent versus the U.S. dollar since then.

Meanwhile, many analysts seem convinced more PBOC action on RRRs is a matter not of if it will cut them but of when it will cut them. “A new round of reserve-requirement reductions is inevitable,” said Zhang Ming, a senior economist at the Chinese Academy of Social Sciences think tank cited by the Wall Street Journal, which also reported that Zhang expects as many as four such cuts between now and the end of the year. Similarly, Reuters quoted economists at Standard Chartered as saying, “We continue to expect a total of 100 basis points of reserve requirement ratio cuts by end-2015, with the first cut likely to take place within the next two weeks.”

© Copyright IBTimes 2024. All rights reserved.