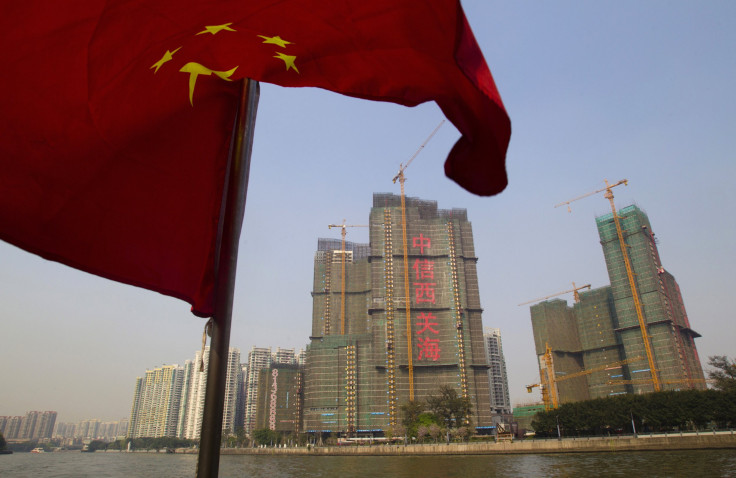

China Mulling Implementing FATCA-Like Law To Reduce Tax Evasion On Mainland; Hong Kong Agreed To Share Tax Information Of US Expats Earlier This Week

China is to looking to formulate a law similar to one in the U.S., which now requires financial institutions worldwide to disclose information on American taxpayers to the U.S. government, South China Morning Post, or SCMP, reported Friday.

China is considering implementing rules on the lines of the Foreign Account Tax Compliance Act, or FATCA, which would make it difficult for wealthy people in China to stash away money in Hong Kong, which is a special administrative region of China and, signed an agreement on Tuesday with the U.S. to share tax information about Americans who work or own assets on the island. Since last September, G-20 summits have discussed measures to tackle tax evasion, and member nations, including China, have decided to exchange tax information automatically by 2015.

"Fatca is only the beginning of what will become a major new compliance obligation for financial institutions. The next major development with respect to Fatca will be the G20's proposal to multilateralise Fatca. China, as a member of the G-20, has endorsed this proposal. China can obtain tax information by joining the G20's approach to Fatca. That is a likely scenario," Richard Weisman, of the Hong Kong office of law firm Baker & McKenzie, said, according to SCMP.

In Asia, only Japan has signed full-fledged intergovernmental deals to be fully FATCA-compliant while Hong Kong said that a deal is in the works, according to The Washington Post.

Hong Kong's decision has drawn criticism from U.S. citizens in Asia, many of whom have reportedly given up their citizenship to escape onerous tax compliance issues in their former country. Meanwhile, many private banks in Hong Kong are also reportedly refusing to provide bank accounts to U.S. citizens and green-card holders, stating that the cost to handle such clients' tax-related paperwork is prohibitively expensive.

"Perhaps they (Hong Kong Banks) are hoping to bargain down their level of compliance. This is going to create a lot of work for US lawyers," Gene Buttrill, of U.S. law firm Jones Day, said, according to SCMP.

© Copyright IBTimes 2024. All rights reserved.