China NPC 2014: Shifting Rhetoric On Property Market

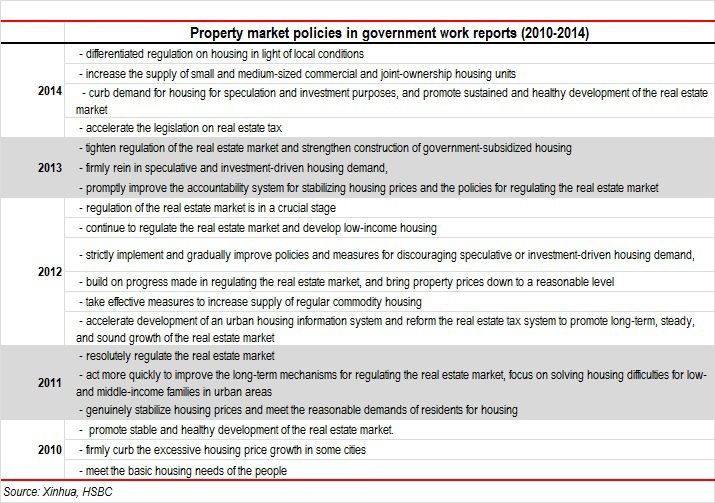

In a notable shift in Beijing's rhetoric on the property market in the 2014 Government Work Report, China’s top leaders are emphasizing the need to adopt differentiated property market regulations rather than a “one-fit-for-all” policy.

“Nation-wide property market tightening policies are likely off the table,” said HSBC economists Qu Hongbin and Sun Junwei in a research note published Monday. “Instead, cities seeing a property price surge are likely to introduce additional local control measures.”

In his first government work report delivered to the National People’s Congress (NPC), Premier Li Keqiang dropped the sentences of “tightening regulation of the real estate market” and “improving the accountability system of stabilizing property prices.” Instead, he reiterated the need for adopting “differentiated regulation on housing in light of local conditions” and “increase the supply of small and medium-sized commercial and joint-ownership housing units.”

In the cities seeing rapid property prices increase -- mostly the top-tier cities and some second-tier cities -- local authorities are likely to strengthen regulations on property markets to curb speculative and investment demand. According to HSBC, this means the current housing purchasing bans and tighter mortgage standards are likely to be kept in place or even ramped up.

For the lower-tier cities seeing slower property price increases and relatively high inventory pressures, there is little need to further strengthen property market tightening policies.

Property prices in China’s 70 biggest cities soared again at the start of 2014, but the pace of acceleration cooled slightly for the first time in 14 months.

New home prices rose 9.6 percent in January from the year-ago period, compared with the 9.9 percent on-year increase in December, according to the latest data available. Prices rose in 69 of 70 Chinese cities on an annual basis.

Prices in Shanghai were up an annual 17.5 percent, compared with 18.2 percent in December, while Beijing prices climbed 14.7 percent in January from a year earlier, versus 16 percent in the month before.

Chinese property tycoon Xu Jiayin said recently that arbitrary charges and duplicate administrative approvals are the real culprits behind the unsustainably high property prices.

Premier Li also called for acceleration in housing supply and property tax legislation.

China will begin to build more than 7 million units of government-subsidized housing, 4.7 million of which will be in rundown urban areas. By the end of this year, 4.8 million units should be completed. Meanwhile, land supply will be increased, especially for the small and medium-sized housing market.

A nation-wide property tax is also needed to rebalance the real estate sector.

The real problem with China’s Ghost towns – acres of empty high-rise apartments and vacant shopping malls – is the lack of property tax. Currently, there is no holding cost for owning a property in China, which incentivizes speculative buying.

Speculators are scooping up apartments and letting them sit empty, while runaway prices in many cities have made purchasing an apartment unaffordable for homebuyers.

A nation-wide housing information registration system led by Ministry of Land and Resources will help improve property regulation and pave the way for a property tax.

The property tax is also an important part of municipal finance reform.

Land sale is a crucial source of local government revenue, but there will come a time when local governments run out of land to sell.

Financing burden for infrastructure has fallen on regional governments, causing them to accumulate a large pile of debt, which is seen as the Chinese economy’s ticking time bomb. China's National Audit Office said in late December that local government obligations hit 17.9 trillion yuan ($3 trillion) by the end of June 2013 -- a dramatic increase from the 10.7 trillion yuan figure reported in 2010.

The legislation of property tax and the nation-wide housing information registration system will probably take several quarters to be fully implemented, HSBC economists noted.

“Some cities may see a trial of property tax customized according to local conditions, but the property tax's national-roll out is still in the distant future, not least because of the technical issues to establish a nation-wide property ownership information system,” they said.

© Copyright IBTimes 2024. All rights reserved.